Employment is beginning to pick up steam and construction employment has only marginally kicked it. when it does (it will, we need homes for people) these numbers are really gonna get going .

“Davidson” submits:

I have mentioned this before: The concept of it being Politically Correct to be pessimistic in the face of good economic news so that one cannot be accused of having ignored some suffering somewhere in the economy, in the country or even in the world.

It is days like today when we have extensions of economic indicators to levels at which one could expect market psychology to fall more into the optimistic-hopeful camp but, instead people move entirely in the opposite direction which convince me that there seems to be an unusual phenomenon occurring which favors pessimism. I often witness an expression of optimism being countered on CNBC with a “But, you are ignoring…(plug in the name of some group visibly suffering at the moment). The individual who expressed the optimism clearly has a “Gotch-Ya!” moment. This is pervasive!

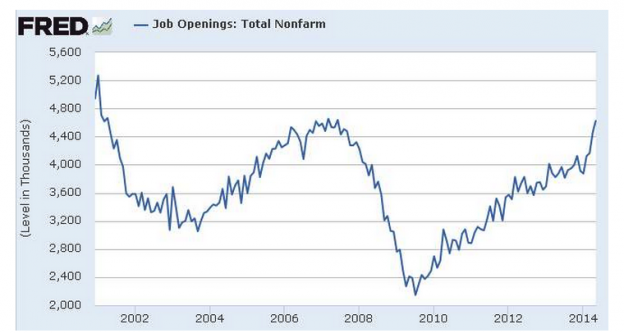

Today’s report of Job Openings was greeted with calls that this is a market top and a long over due correction was in the works. They said the economy remains weak at best. Few are being hired! Etc, etc, etc….

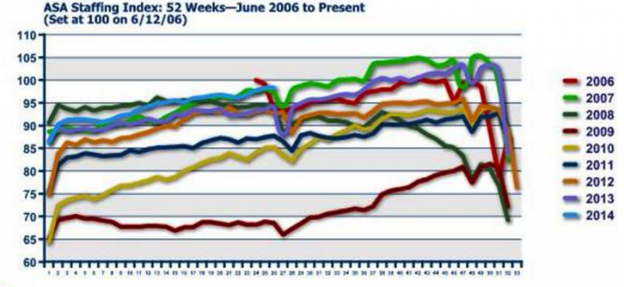

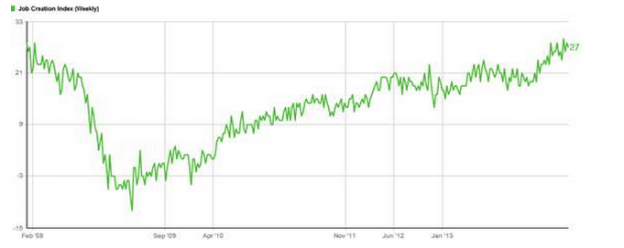

I am amazed at how poorly we are training people to think, to take actual data and formulate basic truths. Current economic trends like Job Openings, the ASA Staffing Index and the Gallup Job Creation Index (see below) are at or near record highs-see their charts below. These employment related indicators are not alone with record levels. Our economy is growing, employment is expanding, individual standards of living are increasing, there is more money to spend and people are spending it. This adds up to companies growing and their stock prices being worth more today than they were last year, last month, even more than yesterday.

For some, this will turn out to be an investment period of a life time. We are roughly in the middle of the cycle and have roughly 5yrs-7yrs before the economy peaks. The change in market psychology from current pessimism to one typical of a bull market is still ahead of us. Since market prices are mostly due to market psychology, predicting how high and when it will occur is impossible to predict. But, I think the market peak when it does finally occur will likely be well, well above present levels.

All the economic data tells us we have a decent economy with the only sector not performing back to historical levels being Residential and Commercial Construction. This unusual weakness I attribute to the Fed’s action to keep mortgage rates low which has stifled bank lending in a very tight regulatory climate.

But, we are seeing economic recovery just the same albeit a slower pace. Recent employment reports suggest an acceleration is occurring.

It is my very strong recommendation that investors avoid fixed income and be 100% committed to the equity markets. The greatest risk in the current environment resides in fixed income as rates rise. Stocks remain the least risky asset class today with 10yr Treasury rates at 2.6%.