“Davidson” submits

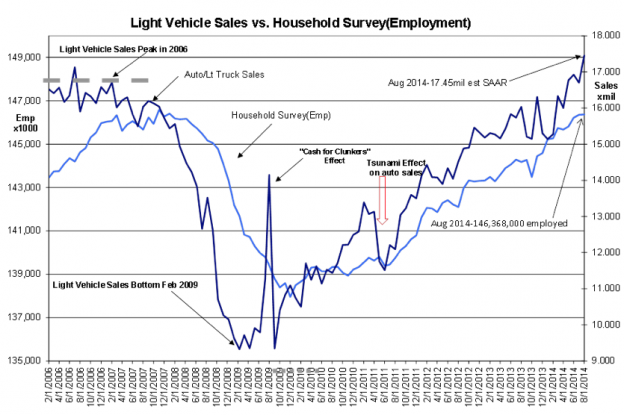

This week we saw 2 primary indicators of the many which reflect economic activity report monthly statistics in line with uptrends since Spring 2009, i.e. Household Employment and Light Vehicle Sales-see chart below. These are statistical counts which mean that numbers can be adjusted in later reports and also they are approximations. One can never ‘count’ all the individuals employed at any point in time nor can we actually ‘count’ all the vehicles sold. What we do is to create a process which captures the ‘best’ even though not perfect information at a point in time with methods we have determined over our history of doing this which represent reliably the economic data we are monitoring. What we miss in one report, we make up with following reports and occasional revisions as we continue to improve our data tracking. And importantly, it is important to not place all one’s emphasis on one indicator. If the trend is there, it will be present in all economic indicators associated with it. An important trend will never be present in one indicator but absent from the others.

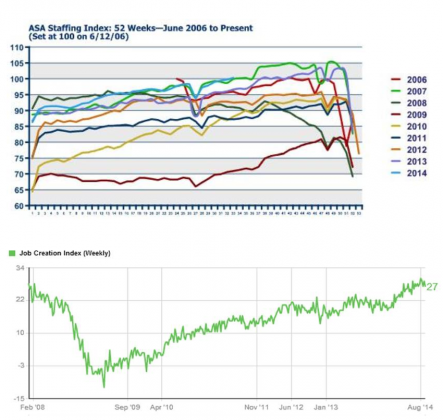

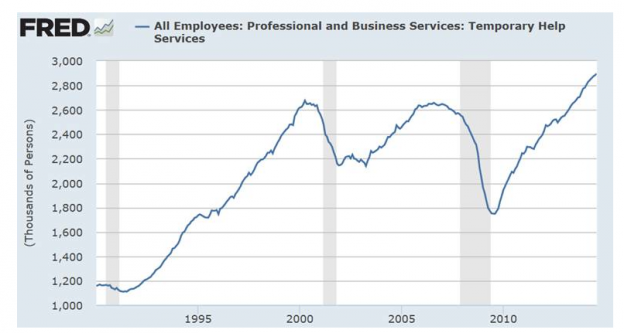

Likewise, the ASA Staffing Index, the Gallup Job Creation Index and the Bureau of Labor’s Temporary Help Index shown below each reflect steady uptrends since 2009 even though one month to another may not follow evenly. It is the 4mo-6mo trend of each indicator which is important not a single month’s report on which one must focus.Please note: Temp Help is a leading indicator of full employment as many companies offer a 6mo-12mo trial period to new employees before making them permanent.

Some will complain that this week’s reports are ‘awful’, but I think this comes from having to get some media face time and following the consensus which so many do. You know by now that if we had followed the crowd, we still would not be invested in equities due to the fear which continues to remain in the minds of many pundits. But, we have chosen to follow the facts not the emotions!

The economic data continues to progress positively. Being invested in equities and not being invested in all but selected fixed income is prudent in my opinion in spite of the potential month-over-month volatility of stocks. I still see potential for a substantial rise in equities for the next 5yrs-7yrs as home building and commercial construction work through their cycles which are in early stages historically.