Today I was wandering through my daily reading when I came across Gary Shilling’s $10 oil prediction. This of course reminded me of Shillings prediction of 2012 the US was already in a recession and deleveraging would take another 5-7 years….both spectacularly wrong. The point here is that Mr. Shilling is prone to rather draconian predictions on a host of topics and readers should be cognizant of that when reading him. In fact, one should take into account most predictions that either positive or negative in the extreme.

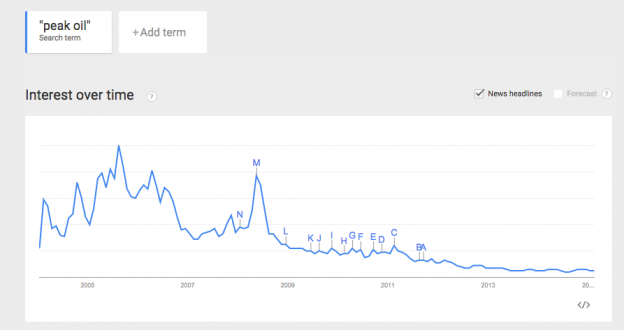

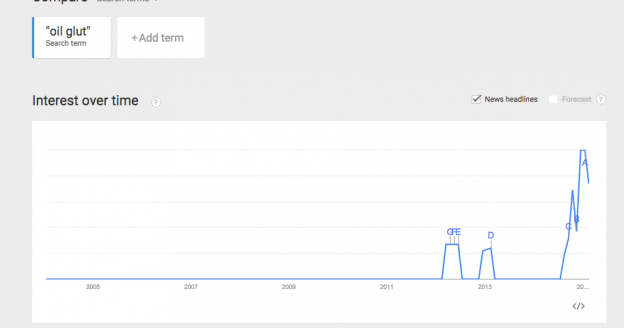

Think back to 2007-’08 when oil ran up to $140/barrel. Then “peak oil”” was the rage just as “oil glut” is now.

What happens in times like this is that just saying “oil is going to ~$40 they ought to rebound like it historically does” quite frankly, while accurate is really pretty boring. If you run a website based on pageviews, that just ain’t gonna get it done kids. But, coming up with some draconian predictions either way, well, that will get some people heading over there for a look and sell those ads….

The point here isn’t to pick on Mr. Shilling. Pick any of the drastic predictions you’ve seen over the last 2 decades and I think you’ll find the same thing. Every now and then someone will nail it. If you think about, the odds of chance dictate if enough large outlier predictions are made, eventually a few of them hit. Those folks find instant fame and them the rush is on from everyone to predict even more extreme scenarios. The problem with that is that the overwhelming majority of them will be wrong, very wrong.

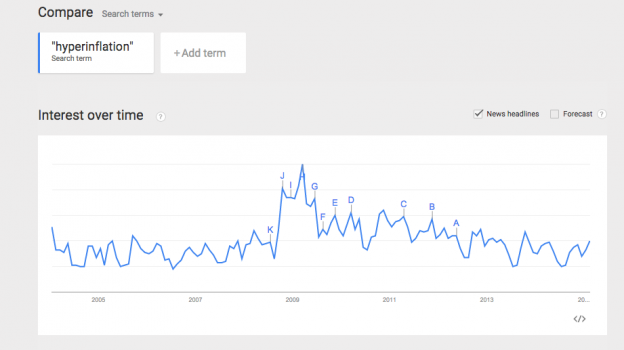

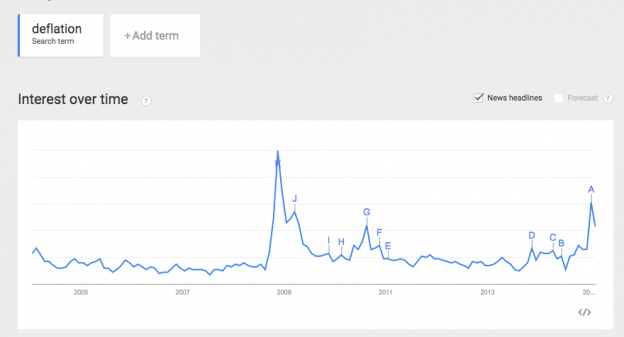

What is interesting is when we get counter extremes. Back in the financial crisis the Fed was both going to cause hyperinflation and deflation at the same time. That would have been quite the feat!!

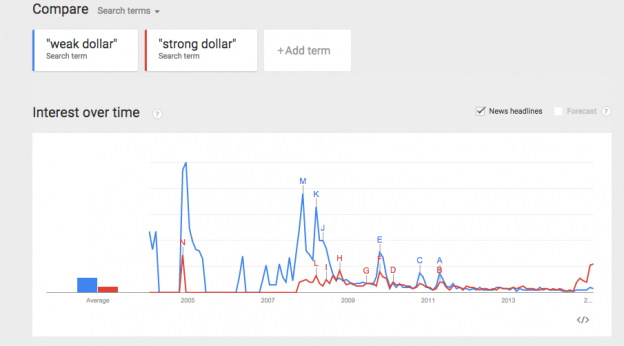

In 2008-’09 we were consumed with the negative effects of a “weak dollar” and now we are getting consumed with the potential negative effects of a “strong dollar”.

People tend to let price dictate their perspective of everything. The problem with that is that price action over the short term is a purely emotional function of the market. Because of that, prices will swing wildly and more often than not disconnect from the fundamentals of the asset they represent. Removing yourself from that emotional equation, is a huge advantage for investors as they can more easily see reality and act accordingly.

The greatest gift great investors have isn’t some mythical ability to analyze a company better than the rest of us, it is their ability to remove emotions from their decisions.

Buffett from the 1987 Berkshire letter:

Ben Graham, my friend and teacher, long ago described the mental attitude toward market fluctuations that I believe to be most conducive to investment success. He said that you should imagine market quotations as coming from a remarkably accommodating fellow named Mr. Market who is your partner in a private business. Without fail, Mr. Market appears daily and names a price at which he will either buy your interest or sell you his. Even though the business that the two of you own may have economic characteristics that are stable, Mr. Market's quotations will be anything but. For, sad to say, the poor fellow has incurable emotional problems. At times he feels euphoric and can see only the favorable factors affecting the business. When in that mood, he names a very high buy-sell price because he fears that you will snap up his interest and rob him of imminent gains. At other times he is depressed and can see nothing but trouble ahead for both the business and the world. On these occasions he will name a very low price, since he is terrified that you will unload your interest on him. Mr. Market has another endearing characteristic: He doesn't mind being ignored. If his quotation is uninteresting to you today, he will be back with a new one tomorrow. Transactions are strictly at your option. Under these conditions, the more manic- depressive his behavior, the better for you. But, like Cinderella at the ball, you must heed one warning or everything will turn into pumpkins and mice: Mr. Market is there to serve you, not to guide you. It is his pocketbook, not his wisdom, that you will find useful. If he shows up some day in a particularly foolish mood, you are free to either ignore him or to take advantage of him, but it will be disastrous if you fall under his influence. Indeed, if you aren't certain that you understand and can value your business far better than Mr. Market, you don't belong in the game. As they say in poker, "If you've been in the game 30 minutes and you don't know who the patsy is, you're the patsy."