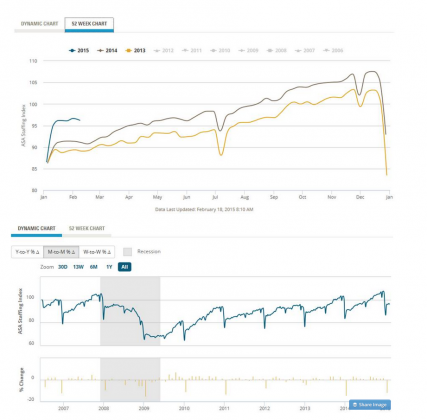

Remembering there is a ~4-6mos lag in this data what we are seeing that as we head through spring and into early summer we will see employment trends continue to improve. The index has correctly predicted what we have seen in employment over the past several year and early indications in 2015 are that things may be getting ready to accelerate.

“Davidson” submits:

The ASA Staffing Index was reported at 96.22. This level is 6% higher than last year at this point in the year. 2015, 2014 and 2013 data are shown together in the top chart while the historical data is shown in th bottom chart. This weekly indicator of labor demand continues to hit all time highs vs. prior seasonal highs and is a good indicator of trends in the monthly employment data by 9mos-12mos. Link:

As a measure of economic activity, general market psychology and eventual direction of equities, this is one of my favorite indicators. Remember, it is recommended that investors not resort to short term trading to capture temporary equity price changes. It is a much better approach to identify qualified portfolio managers and individual corp CEOs, build a portfolio and hold thru short term volatility till the broad measures signal that significant price excesses have been reached. Building to excess may take 5yrs-10yrs+. But, once excess pricing is identified, the prudent decision is to liquidate Higher Risk/Lower Reward and favor Higher Reward/Lower Risk.

We just restructured portfolios to reduce risk and this coincided with significant dips in Natural Resources and Intl LgCap. Both of these asset classes have already shown some recovery in market psychology. I expect as the global economy continues to expand that they should continue higher. Employment trends in the US have a good correlation to global economic activity.

All continues to look very good and we should see higher equity prices the next several years ($SPY) and lower bond prices ($TLT).