“Davidson” submits:

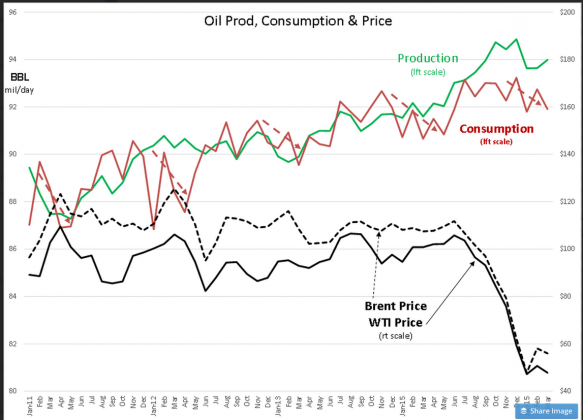

EIA(US Energy Information Administration) reported global oil ($USO) Consumption/Production figures. Previous consumption values were adjusted lower while production values were adjusted higher so that today’s report shows a 2million BBL day excess production vs. consumption vs. ½ million just 4mos ago. The data collection for this series began in 2011, a relatively short term period for economic data analysis. There have been a number of calls that lower oil prices mean a slower global economy and there are algorithms which factor lower oil prices into forecasts of lower equity prices.

Today we have a number of analysts calling for $20BBL-$30BBL oil lasting for decades while some indicate a recovery in price to $80BBL-$90BBL in 6mos-12mos. Oil is quite sensitive to not only Supply/Demand but to market psychology as well. There are also seasonal consumption variations as what we north of the equator call northern climates which have a refining spring pause to switch over from winter fuels to summer fuels. Production backs up and is the reason the US has enough storage capacity at Cushing, OK to handle the build in crude storage till refiners can accept it after the change over. The EIA Oil Prod, Consumption & Price chart reflects the seasonal consumption in by dips early each year in this data as shown by the RED DASHED ARROWS. After May of each year Consumption tends to catch up with Production. It important to point out that In 2012 we had a “Peak Oil” panic (everyone but for those producing oil believed we were rapidly running out of oil) which drove oil prices over $140BBL even as Production exceeded Consumption by more than 3milion BBLs a day in some of the monthly reports at the time. Such is market psychology that it can greatly exceed any rational expectation due to Supply/Demand. Only a relative handful of analysts have explained the seasonal change over impact on consumption. Only if you have listened to the media carefully do you grasp these snippets of fact.

Only if you have been listening carefully do you come to understand that global oil Consumption slumps temporarily every spring.

Normally oil prices do not slump as much as we experienced recently, not even with the known winter fuel/summer fuel change over. But, this time we had a considerable bet on ‘hyperinflation’ tied to Central Banker liquidity actions to stimulate our economy. With inflation remaining under 2%(1.6% at last report) those betting on an exaggerated rise in inflation were forced to reverse this trade. Oil falling while the US$ and 10yr Treasury prices rose(falling 10yr Treas rates) were what we experienced.

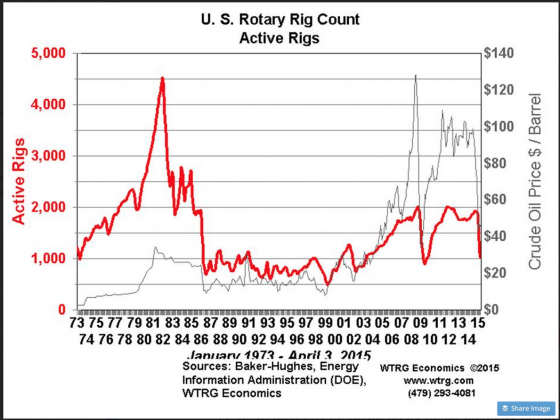

But, lower prices than could be justified by cost of production forced the rig count to collapse-see U.S. Rotary Rig Count Active Rigs chart below. The Baker Hughes reported number of rigs working weekly is represented by the SOLID RED LINE. The rig count falls very quickly with oil prices then recovers much more slowly than it fell. Oil prices do not show much sensitivity to Consumption/Production. But, prices which are set in the futures market are highly sensitive to market psychology and speculative trading. Our recent price collapse was due to the reversal of a highly speculative hyperinflation bet in my opinion.

1) I expect to see an increase in global consumption after May 2015 which appears in line with the historical record.

2) I expect to see a much more rapid price rise than a rise in the rig count which appears in line with the historical record. I guess that $90BBL oil price works for many corporations and countries.

3) I expect to see the US$-EURO relationship return to balance with the rise in oil prices-I guess that this is likely to be back to the $1.30+/EURO range.

4) Calls for oil at $20BBL-$30BBL for decades do not make sense as no company would make a profit at this range and they would simply stop selling/finding oil till prices rise. Rig counts tell this story!

5) Lower oil prices today do not correlate with rising employment indicators. Oil is out of sync with global economies. More market psychology than Supply/Demand!

Energy prices should rise roughly back to where they were last summer. Some will consider this inflationary and there is likely to be a lot of chatter about it. I do not expect inflation to be much of an issue till the Fed lets the 10yr Treasury rates rise which will stimulate home lending* and building and accelerate spending on construction related raw materials.

*(actually we need the spread between T-Bills and 10yr Treas rates to rise which would make mtg lending more profitable)