“Davidson’ submits:

For generations nearly everyone viewed every security and market move as being related to economics. Even today if a security shifts in price, there will likely be someone, somewhere who says the ‘market knows’ something or other as an explanation. The belief that ‘no one can know’ what drives markets is based on the perception that markets run on some hidden mechanism of information exchange which is not available to normal mortals. Only ‘those-in-the-know’ who have access to significant wealth are believed to have the ‘right connections’ and access to the ‘right information’.

Having studied the very good investors over the years, Warren Buffett, Ben Graham, Seth Klarman, George Soros, Wilbur Ross, Hetty Green, JP Morgan, JD Rockefeller and etc., one comes away with the general sense that these individuals visualized investing in terms of large investment cycles. They were not traders, but certainly knew how to judge value long term and take advantage of any short term price decline which they thought would bring a sound long term capital return. These investors were and are legends in their own times. For those who did not know how to develop a long term investment mentality, these investors carry a magical connotation, “Guru”. “Guru” continues to be used to describe those few who seem to be able to see though the ‘fog of information’ which causes the majority of investors to lose their direction and rely instead on Technical Analysis. The many believe that no mortal soul can ever divine the markets and fall back on the belief that the ‘market knows’ and Technical Analysis is the result. Unless one is using something fundamental with Technical Analysis, Technical Analysis has by itself has a very poor history of benefiting investors. This brings us to the Wells Fargo/NAHB HMI ($XHB) index released today.

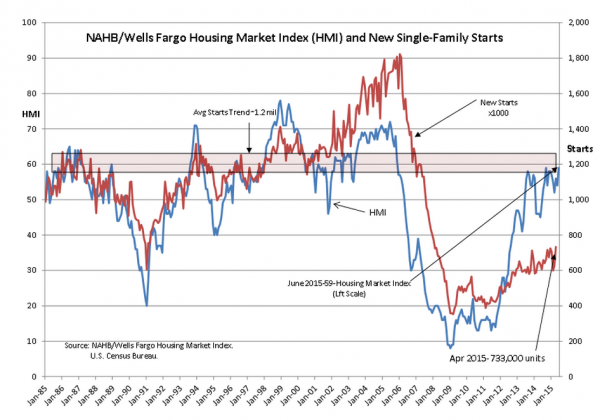

What gives “Gurus” their edge is a focus on long term fundamental trends. One of these trends is the Wells Fargo NAHB HMI(Housing Market Index). Wells Fargo bought the rights to naming this index several years ago. The HMI has been around since 1985 as shown in the chart below. Only by looking long term can we come to understand that there exists a relationship between the HMI and New Single-Family Starts. I can see this relationship today because I have a computer, access to the Internet and the data is freely available from multiple sources. The differences between “Gurus” and what I am doing is that they could do all of this in their heads. Because, “Gurus” do this type of analysis through their daily reading and ability to retain and analyze this information long term, makes what they do seem so incredible and outside our sphere of comprehension. But, this does not have to be the case.

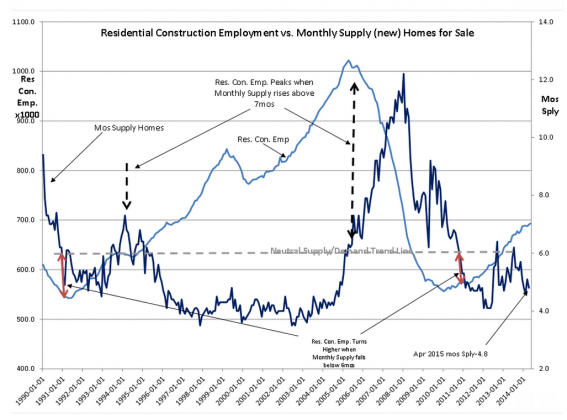

What one needs to do is to identify the significant relationships between various economic indicators and follow with locating at what levels some meaningful investment trend ensues. For Residential Construction what matters is the trend of the HMI, the historical level of New Single-Family Starts and its benchmark(shown in the top chart) and the Monthly Supply of New Homes for Sale, its historical benchmark and the trend of Residential Construction Employment(shown in the bottom chart). If you are a “Guru”, you track this information in your head. For “Gurus”, no computers needed. Buffett says, “My brain is a computer!” For the rest of us, computers are a big help as long as we use them properly and we are not led astray by trying to become too rich too quickly. Desiring overnight wealth through identification of “some-get-rich-quick-trend” is pure self-deception. There is no such thing as a quick economic trend!

There is no such thing as a quick economic trend!

Sorry to say this, but economic trends by the nature of being dependent on the desires, needs and related choices of billions of individuals do not produce overnight successes, ever! Economic trends on which one can invest take years to shape with each economic cycle having its own nuances. As in our current Single-Family housing cycle, the recovery has been slower than in past recoveries. I attribute this to the Fed’s keeping mortgage rates low which has prevented banks from lending to new home buyers at the same pace as in past recoveries. Nonetheless, today’s NAHB HMI release at 59 continues the favorable trend begun in 2011. Next week we will have the Monthly Supply of New Homes for Sale. I expect this trend to continue.

If rates rise as expected, we should see arise in housing activity and US GDP. Equities ($SPY) have always moved higher with expansion in housing activity.