“Davidson” submits:

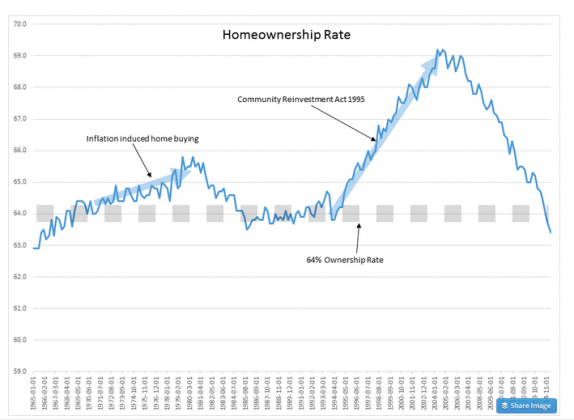

US Homeownership rate at 63.4% has finally reached what can be said to be the historical norm 63%-64% range. The chart below reflects two government induced periods of excess home buying. The first was a result of government induced inflation in the 1970s from ‘The Great Society’ agenda while the second came directly from purposely trying to raise homeownership to over 70%. The belief in creating the recent housing bubble was that homeownership would bring the poor into the broader economy which had failed to occur in previous government attempts to accomplish this. Each attempt of societal manipulation came from liberal/progressive side of the political spectrum, the self-titled ‘Intellectual Elite’.

There have been three such government attempts since the 1913. The first under Pres. Woodrow Wilson ended in the Great Depression. It took about ~16yrs from start to finish. The second, The Great Society, began in 1965 and created the ‘Great Inflation’ of the 1970s to early 1980s. The Great Inflation ended when Fed Chairman Paul Volcker forced short term rates over 18% to end an inflationary spending psychology which pushed homeownership nearly to 66%. This period lasted 16yrs-17yrs. The last, ‘The Sub-Prime Housing Bubble’, specifically engineered by government, pushed homeownership over 69% before market forces caused a correction. This last bout of government largess lasted about 12yrs-13yrs. When one adds a careful reading of our financial/political history, one comes to the conclusion that ~64% plus or minus is a natural rate for the US economy as we are currently structured. The chart helps to see this.

It is interesting to note that it takes about 15yrs of misdirected government policy before all comes tumbling down and normalization sets in. By then, the party which initiated the policy has escaped the blame and the other party can be saddled with it. This is what occurred with the Great Depression with Herbert Hoover being saddled forever by political and economic pundits with a financial collapse actually caused by political rivals. The Intellectual Elite blame Business even now. George Bush was saddled with the financial collapse initiated by Bill Clinton and Obama claims to be saddled with Bush’s mess. History repeats for those who do not study it closely enough.

Today’s news of homeownership reaching a ‘new low’ not seen since 1967 is well out of context. Context tells us that we have simply normalized the excesses of our recent past.