“Davidson” submits:

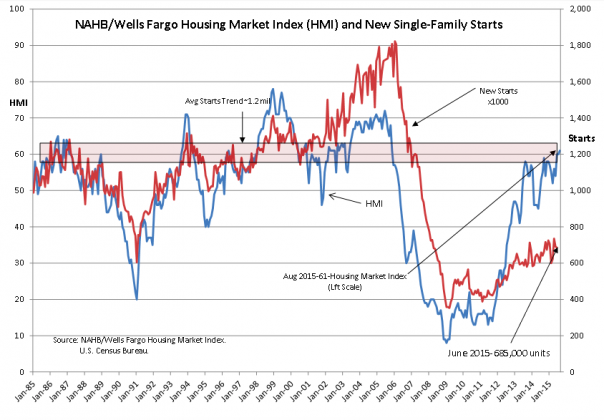

The National Assoc. Of Home Builders Housing Market Index (HMI) nudged to 61 in the current report. Although sentiment reports like the Purchasing Managers Index and Michigan Consumer Confidence (and a number of others) have poor correlation to economic activity long term, this report which represents home builder sentiment is one of the very few which have held up over time as quite helpful in forecasting the direction of its sector. The current level of 61 is an all-time high for this cycle and can be interpreted as positive for an expanding single-family housing market.

Single-family housing activity is particularly important in signaling general economic trends. It not only represents additional Residential Construction Employment which is how many uneducated individuals enter the job markets and gain new skills (this is how the Middle Class grows), but it also reflects whether credit issuance is expanding or contracting. The HMI rising to 61 is a clear signal that credit issuance to individuals is expanding. We have already seen this reflected in the Mortgage Credit Availability Index jump to 125.5 in July 2015.

Equity markets rise as credit issuance expands ($SPY). Looser credit is welcomed at this point in the economic cycle and is the lubrication which flows throughout our economy. The United States is still the tide which lifts the global market place in spite of many claiming China or Emerging Markets to have assumed this role. The United States is the leader in standard of living improvement. We have the greatest global consumption per citizen and we are also the most inventive and productive of technology. The growth so many tout in Emerging Markets has occurred because the US first invented new technologies and then manufactured some of them in Emerging Markets for reimport back to the US.

The following relationship holds in my opinion:

Rising HMI = Expanding US Economy = Expanding Global Economy = Higher Global Equity Markets

We remain globally connected with the US still the only Free Market the primary global driver. This is so even with self-inflicted wounds, self-condemnation and outside terrorist, command & socialist economic pressures. There continue many very good reasons to be positive and expect global growth in my opinion.