It is interesting that the market dipped below this and shot right back up to it….

“Davidson” submits:

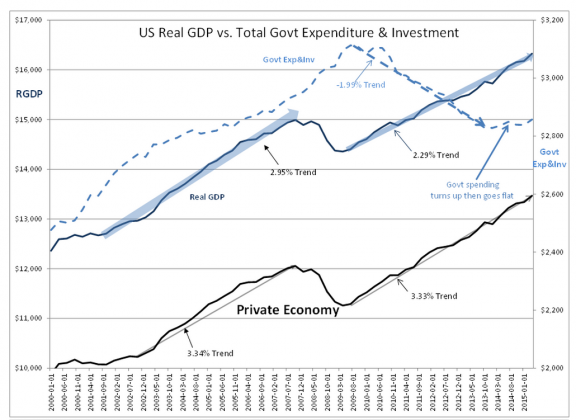

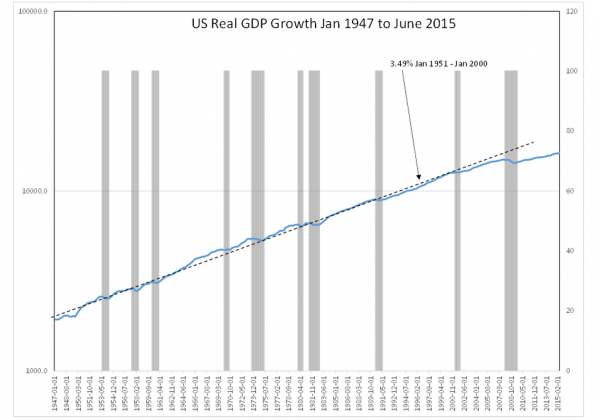

The Real GDP 2Q15 was revised higher Thursday to 3.7% from 2.3% with our long term avg being ~3.5%-see the charts at the bottom. Both Government spending and the Private Economy had a rise with government spending being the bulk of the rise-see chart. The Private Economy remains on trend at ~3.3% much in line with the last recovery’s trend. The perceived slowness of Real GDP can be seen as due to a ~2% annual decline in government spending since April 2009 which appears to have turned flat April 2013. The reason equities are higher on a perceived slower growth in Real GDP is that the Private Economy growth is in fact growing ~45% higher than Real GDP along the recent historical trend.

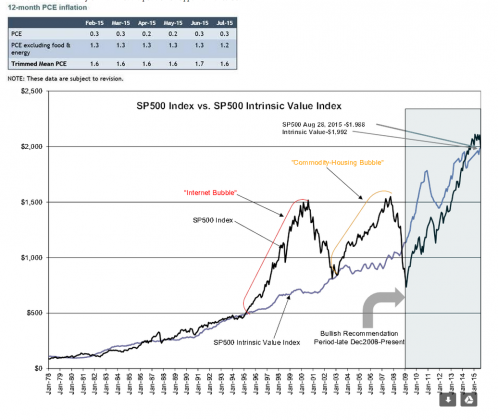

The Dallas Fed reported the July 2015 12mo Trimmed Mean PCE at 1.6%-see their table below. This is the inflation measure used to calculate the SP500 Intrinsic Value Index ($SPY) which has risen to $1,992 while the recent decline in the markets brings the SP500 slightly below this level this morning at $1,988. Somewhat like clockwork noted Value Investors have let the world know that they are finding good buys at current levels. The recent correction in prices impacted to a greater extent the Momentum issues, i.e. those which have been favored by Momentum Investor trend followers. The SP500 at this point in time is showing little speculation as compared to 4mos ago.

In my opinion equities have moved higher the past 6yrs+ on steady growth similar to our most recent economic recovery, i.e. a little over 3% Real growth. It is the decline in government spending which seems to have confused many market observers who have not separated out the Private Economy from the total Real GDP as shown below. The decline in government sending hides the Private Economy unless one breaks out the these components and makes the comparison. At some point I expect investors to become suddenly ‘surprised’ by how well we are actually doing and equity prices should rise. The Fed seems to be missing the Private Equity growth as well. It is my hope that the Fed does not try to more ‘QE’ as called for by some prominent investors. It is my opinion that QE has tightened credit issuance not expanded it and is the reason homebuilding has been so sluggish.

Summary:

1) Equities are rising on the Private Economy which is growing ~45% higher than Real GDP. No wonder equity markets which are based on the Private Economy are where they are.

2) Private Economy Growth vs. Real GDP Growth = 3.33/2.29 = 145% or 45% higher than Real GDP.

3) Equities should continue to rise based on current economic trends.

4) Markets have corrected the speculation which was present 4mos ago.

Only time will tell what the Fed does, but I am also of the opinion that equities are the place to be, not long term fixed income. If investors become more positive on equities as we have done in every economic expansion since history has recorded prices, then I expect much higher equity prices, much higher rates and a much improved housing market with significant increases in employment.