People who claim the employment situation is bad simply just aren’t looking at the data. When we worry about the 300k level of 1st time claims it is odd. When we compare that number with the # of jobless claims in the year 2000, when there were 35MM fewer people living in our nation, something is amiss. There is no perspective on that number simply by itself. We needs to put it in perspective with population, employment levels etc, then it actually means something. Be very aware of those who just take a raw number and place it into historical context without adjusting for other factors.

“Davidson” submits:

We do talk ourselves into market declines, but have never talked ourselves into a recession.

With the last couple of monthly employment reports (2 months ago being weaker than expected and this month much better than expected but not believed to be significant), the media and many forecasters seem to have slipped deeper into the pessimistic camp on our economic direction. Nothing could be further from the truth!

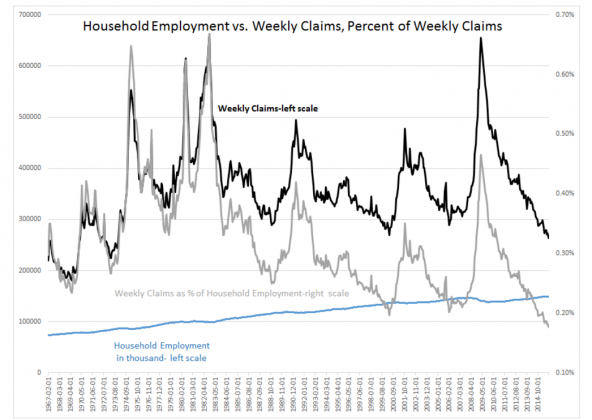

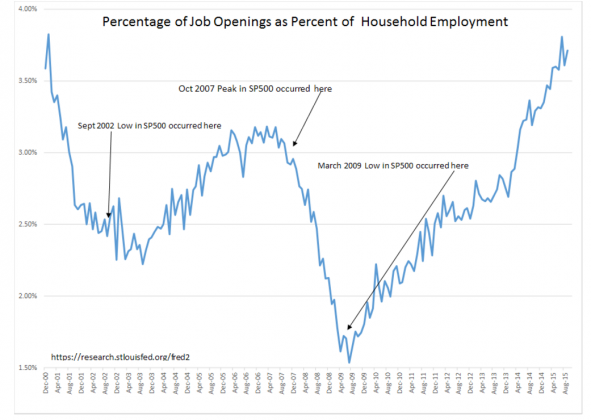

Two views not much used are presented in the charts below. The first represents Household Employment(LIGHT BLUE LINE) vs. the Weekly Unemployment Claims(BLACK LINE) and the Percent of Weekly Claims of Household Employment(LIGHT GRAY LINE). The second chart represents Job Openings as a Percentage of Household Employment(LIGHT BLUE LINE).

1) When Jobless Claims as a percentage of Household Employment is at record lows since 1967 & dropping, then the employment trend is positive

2) When Job Openings as a Percentage of Household Employment is rising, then the employment trend is positive.

Together, these indicators reflect a strongly positive trend in economic activity. One could go purely on employment trends in judging economic direction, but all other economic trends are also strongly positive as well.

We seem to have entered a period in which the consensus is focused mostly on what is perceived as negative information ignoring the positive information altogether. Bad news is bad while good news is ignored! It is a funny situation in which to be an advisor. In this environment any positive advice stands out starkly isolated in a media stream of negativity. This is what it means to be non-consensus and a Value Investor.

There is nothing about the current economic trend which is negative except for the fact that it is slower than past economic cycles. In my opinion this is due to increased bank regulations coupled with the Fed’s Operation Twist which in keeping mtg rates low has created a tight credit condition. Just the same, economic activity has reached impressive levels and any widening in credit spreads are likely to result in additional acceleration.

With the onslaught of pessimism the past couple of weeks, I almost feel I should apologize for being optimistic. But, I won’t! The economy is far better than the media portrays. Equities should do well the next couple of years once pessimists turn optimistic.