The long term the trend is down….and that is not a bad thing

“Davidson” submits:

I have always looked long term to find common sense in our financial system when events did not make sense short term. With this in mind I provide two charts.

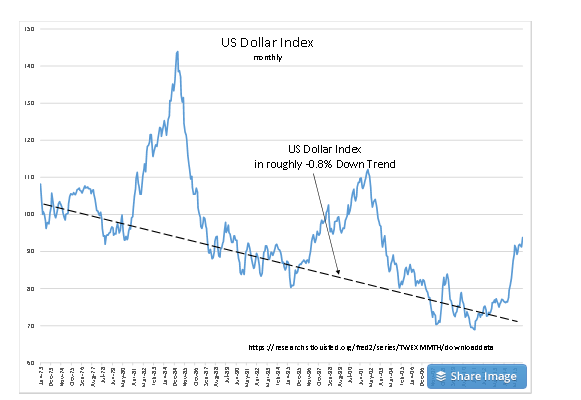

1) The 1st chart represents the US Dollar Index shown as a BLUE LINE plotted monthly from 1973-November 2015 with a DASHED-BLACK TREND LINE.

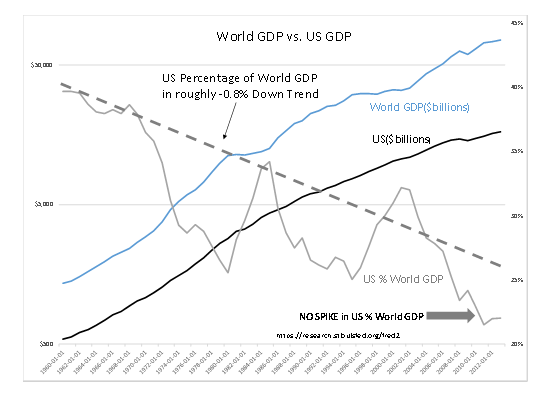

2) The 2nd chart represents the World GDP(BLUE LINE) vs. US GDP (BLACK LINE) plotted annually 1960-2013 with the US Percentage of World GDP shown by the GRAY LINE and a DASHED-GRAY TREND LINE.

In the 1st chart, US Dollar Index, one should have no problem being able to see that vs. other currencies the US Dollar has been in steady decline. That trend by my calculation is a decline of -0.86% annually across the period. It is important to note that this trend line is drawn by hand and ignores the spikes which have occurred periodically. Mathematicians will cringe at not including all the data. But, I counter that using mathematics which would include all the data including the spikes is not only misleading but it misunderstands the basis of the information presented. This data represents human activity globally and how we value trade between countries. Every day we decide a relative value of how much of ‘our work in our currency system’ we are willing to exchange for goods and services for ‘work in other currency systems’. There are periods during which market psychology dominates the long term trend, distorting the data. Hand drawn trends are the only means one has to ignore short term deviations which time shows had no long term impact. This is called Empirical Analysis.

There are many who decry the decline of the US Dollar globally. I disagree. The decline of the US Dollar is a natural result of wealth created in the US being spread globally. The recent rise in the US Dollar is temporary.

In the 2nd chart, World GDP vs. US GDP, GDP is plotted vs. logarithmic left hand scale with the US Percentage of World GDP plotted vs. % right hand scale. This trend line is likewise drawn by hand and ignores the spikes which have occurred from time to time.

1) Note that the trend in World GDP has widened a little from the trend in US GDP since ~1970 and accelerated a little in 2002-see this? 2002 on is in part China!

2) Note that US Percentage of World GDP is also in a similar down trend, a decline of roughly -0.8%-the decline rate is identical within the abilities of analysis.

3) Note carefully that the spikes in US Percentage of World GDP correspond to spikes in the US Dollar Index, spikes occurred in 1985 & 2001.

To see dates the spikes occur to convince yourself that this is true, you can expand charts by clicking-hold down and dragging the chart corner to obtain to a larger view.

There are many who decry the decline of the US Dollar globally. I disagree! The decline of the US Dollar is a natural result of wealth created in the US being spread globally. The US has been in the lead scientifically and technologically since before WWII, but it has certainly been reflected in our innovation since the 1950s. The US has been the source of the majority of all major scientific advances the past 60yrs. The integrated circuit, advances in medicine, scientific study, technology and innovation. This includes the global changing Internet and iPhone. In the past 10yrs the US invented ‘fracking’ which is currently rearranging the energy resource and global political chessboard. And just what do we do with these inventions?

The simple answer is we consume and export our technology everyday. We frequently make what we invent elsewhere in the world. By this process the world benefits and grows from US innovation. The list of books and articles which support understanding this process spans my investment career and the best I can do is to recommend one read the many political and business writings of the past 300yrs. The US has been the innovator since the 1950s because we have a “Free Market”. The rest of the world has shifted towards socialism, Communism and fallen generally into various forms of Command Economies. The US has been an individual choice/business oriented economy since its Founding Fathers signed the Declaration of Independence and then created the US Constitution. I urge all to reread the US Constitution several times each year. I continue to be amazed at how well it has served us. It is the 5th Amendment which states an individual’s rights to invention and property:

“No person shall be…deprived of life, liberty, or property, without due process of law; nor shall private property be taken for public use without just compensation.”

Throughout mankind’s history it has always been the inventiveness of individuals, freely bartered and sold between others in society, which is the basis of the concept of Free Markets. Many decry exporting US technology but it has been the technological export surge begun in the early 1970s which has gradually resulted in growth witnessed outside the US. The recent surge in growth of Emerging Markets is due to US innovators seeking lower cost manufacturing sites elsewhere. China and other Asian countries have made themselves prime beneficiaries of this. Too often, we fail to see that Emerging Exports are due to US innovation. Our desire to benefit from our intellectual property, requires lowering the cost to achieve the greatest distribution with a rapid recovery of research costs and net profit before another innovation supplants our products. In a Free Market existing products must competed within a constant advance of innovation. Inventing and selling goods and services which improve human standards of living means lowering the cost enough to displace existing products. To be successful in foreign markets requires pricing levels which are low enough to be competitive in those economies.

For these reasons many innovations created here need to be manufactured elsewhere and transported. Every time an item is manufactured in a foreign currency and sold in the US makes that currency stronger relative to the US Dollar. Every time a product is sold in a foreign country, some of the proceeds are converted back to US Dollars which come back to the innovator. This makes other currencies more valuable in global trade. It is the success of the Free Market in the US which makes this so. The US does not manufacture the iPhone, PCs, Laptops, servers and Tablets. Companies in the US like Google, Apple and Microsoft are some of the most profitable in the world. Apple with its continued success with the iPhone and other products ports Net Profit margins over 25%. That is huge! Especially when compared to companies which we tend to think of as ‘necessity companies’ like supermarkets which sport Net Profits of 1%-2%. The difference in profits is wholly due to the economic value of the intellectual value which a company brings to society and obviously society’s willingness to pay for it. Apple has intellectual value in the iPhone which supermarkets do not have in what they offer.

Emerging Markets have had great benefit from US innovation. Our technology which may take years of development/evolutionary effort as in the iPhone or modern pharmaceuticals provide instant benefits in undeveloped societies when they are made locally affordable. While the US spent decades and decades developing and evolving a communication system beginning with the telegraph and emerging more recently as the Internet, Emerging Market countries effectively get this overnight when costs fall. There are always entrepreneurs waiting to install cell towers and sell phones as technology prices are driven down by Free Market forces. Every time another country comes on line, the their currency sees greater demand vs. US Dollar. Why then, have we had the recent spike in the US Dollar?

In my opinion, the current US Dollar strength is a temporary spike which is likely to be short lived. I stated in previous notes that much of our significant market volatility comes from Hedge Funds seeking short term returns. Hedge Funds began to dominate short term market pricing beginning in 1995 which was the beginning of the ‘Internet Bubble’. The SP500 for the 1st time had a significant deviation from its Intrinsic Value Index peaking at 100% over-valuation in 2000. The SP500 did this for the 2nd time in 2007 with the ‘Sub-Prime Bubble’ at a 55% over-valuation. Then during the subsequent correction the market lows of March 2009, Hedge Funds without the curb of the ‘Up Tick Rule’ drove the SP500 to 65% of the Intrinsic Value Index. The markets since 1995 have seen an enormous increase in volatility due to Hedge Funds.

Subsequent Fed actions led a significant number of Hedge Funds to make bets that the US Dollar would collapse with hyper-inflation. We know that they made these bets because they told every one! They did this because many believe in Milton Friedman’s observation that too much money always leads to inflation. But, I recently demonstrated that it is not the quantity of money, but the nature of government spending which is the driver of inflation. Hedge Funds began to see their bets against the US Dollar to unravel in early 2014. Russia’s takeover of Crimea and effort to take control of eastern Ukraine which caused the US Dollar to rise in value. Hedge Fund bets for a weaker US Dollar included being long oil and short the 10yr Treasury and other US government maturities. Not only did Russia’s actions force the value of the US Dollar higher, but the lack of hyper-inflation during economic recovery forced the wholesale reversal of this particular inflation bet. Hedge Funds were forced to reverse their inflationary bets very quickly.

The reversal of the hyper-inflation bet forced oil down from $100BBL range to $40BBL, forced the US Dollar from mid-70s to mid-90s and forced the 10yr Treasury from 3% at the beginning of 2014 to 1.65% early 2015. This was an out-and-out panic! The reason I attribute this activity to Hedge Funds and not to economics comes from the action of the US Percentage of World GDP. The lack of a spike in the US Percentage of World GDP trend which accompanied other US Dollar spikes shows that the current US Dollar strength does not have an economic basis-see where I marked NO SPIKE US % World GDP.

In my opinion 2014-2015 was a bad hyper-inflation bet by Hedge Funds which wend bad for them and forced them to reverse. History supports the expectation that the trends do not support such strength in the US Dollar vs. global currencies. We have not seen any diminution to speak of in global trade and the flood of immigrants should convince us all that humanity has not lost its strong desire for improvements in standards of living. I expect to see the US Dollar return to its long term trend and oil prices ($USO) ($OIL) to rise along with a substantial rise in 10yr Treasury rates.