“Davidson” submits

This is a difficult topic to tackle. The current belief is that either oil price rises or excess money supply create inflation. The former comes from the 1970’s OPEC price hikes and the latter comes from those who follow Milton Friedman who said in the 1960s that “Inflationis always and everywhere a monetary phenomenon.”

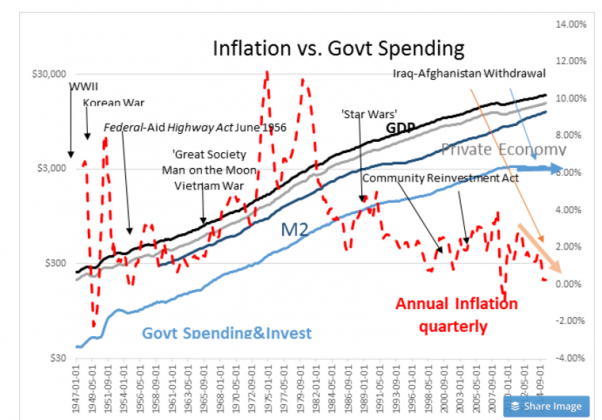

Both of these are difficult to counter because inflation’s causes remain a mystery to all. Economists with historical experience can point to Germany and similar countries of the 1920s printing money to pay for government programs. This certainly was inflationary and resulted in hyper-inflation In recent history Argentina and Venezuela are good examples. The US inflation in the 1970s came from the combination of the Vietnam War, NASA “Man on the Moon” and “Great Society” spending which not only essentially printed money to fund government agenda but government directed this spending which included overpaying for goods and services. This became incorporated into a general price rise for all. The oil price rise in the 1970s if one reads the reports at the time was a response by OPEC nations buying inflated Western goods without any increase in oil prices. OPEC was formed to compensate for this. The US created OPEC as a result of our inflationary government spending.

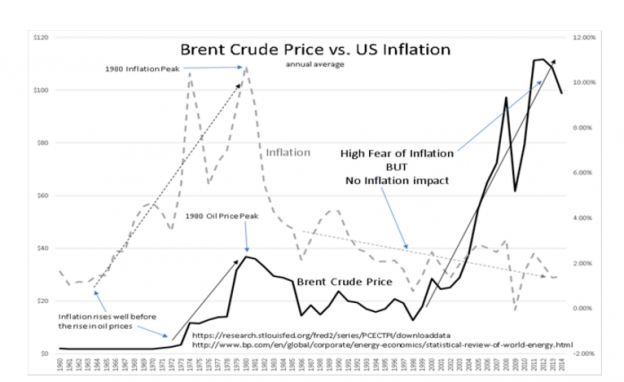

That oil is not responsible for inflation as prices rise or deflation as prices fall can be seen for the first time only in recent history. See my chart sent 11/9/2015. There is zero impact on inflation from the oil price rise beginning in 2001. Oil, copper, gold and etc have come to be the go-to investments when investors fear inflation but the correlation is after the fact and not the economic reason for inflation. Mostly raw material price changes are absorbed in consumer products in order to keep products competitive in the Free Market.

That it is mostly government spending on programs not just transfer payments which create inflation is revealed only recently as well. The long term chart shows inflation spikes from 1947 associated with war and identifiable government programs. Inflation spikes as spending ramps higher and falls as government spending declines. M2, the Money Supply measure, has a similar pattern except not the last 8yrs. This is the first time in US economic history where M2 has soared but inflation has fallen. What has occurred is that US Govt transfer payments have risen while military spending has dropped fairly substantially as the US exited Iraq and Afghanistan.

Milton Friedman was wrong. Inflation is directly connected to US government spending, not simply a monetary phenomenon.

Even though government runs an extensive capital transfer program with Medicare, Social Security and now Affordable Care(Obamacare), transfer payments go to individuals who are careful to get the best value for this income. Free Markets are inherently deflationary. Things cost less, have higher quality or generally deliver greater value to consumers in a Free Market or consumers will not buy them . For most items, including food, gasoline and everything else in between people seek out the lowest cost/highest value. History is obvious with goods costing less and less over time. Mark Perry routinely blogs about this.

For corporations to succeed in Free Markets, they must offer consumers a good value for the cost AND make a profit. Profit is the measure of the intellectual value(improvement in the consumer’s standard of living) added to the product above the costs to produce it. Apple carries 25% Net Income Margins, Microsoft carries 40%+ while Walmart has 2%-3% and supermarkets are 1%-2%. The less intellectual value, the less the positive impact on the consumer’s standard of living, generally the lower the profit. It is the willingness of the consumer to pay which sets the profit. What the product does for the consumer, how the product enhances the consumers standard of living determines the profit margin in a competitive Free Market with multiple offerings. Competitive markets are deflationary because consumers insist on getting value in the current transaction over and above the previous transaction.

Government spending however carries different value metrics. Governments want outcomes, often those outcomes have no measurable metrics beyond it has to appear that government is acting. This is especially so with social spending where outcomes are often claimed without documentation. It is not unheard of for the political party in power to favor political supporters with lucrative profits. “Bridges to Nowhere!” type of project is not unusual for government. Spending which produces no standard of living enhancement for society is inflationary. That government spending is inflationary should not be a surprise. It has been long known to be so even when a societal benefit does accrue. But, mostly spending occurs so that politicians can show they have done something for their electorate and be reelected.

Recent economic history leads me to conclude that inflation comes from government spending where there is no intellectual value(improvement in standard of living) to society. If government spending were only geared towards enhancing society’s standard of living, then the normal condition of a Free Market would appear somewhat deflationary.