“Davidson” submits:

My call of 18mos ago that the US$ would reverse once this Momentum Trade had run its course was based on understanding Free Markets. One cannot time these things, but one can understand then qualitatively.

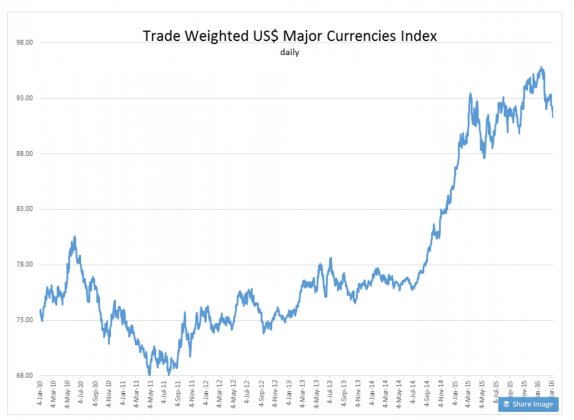

Many losses in energy related and Intl issues will be reversed by the current weakening in the US$. The Trade Weighted US$ economic trend places it moving back to ~68. We saw Momentum Investor panic ensue when Russia invaded Ukraine and they were forced to buy-in their short US$ positions which included oil. Net/net we saw US$ rise rapidly and oil prices collapse causing many to now reverse earlier bets into a new position that was based on the belief that the ‘End-of-the-World’ was at hand. Substantial panic selling occurred ending in Jan 2016! The US$ Index hit 96 on Jan 25th 2016.

But, this recent bout of market psychology was wrong and now they have to reverse the strong US$ and weaker oil bets. This is what we are seeing today.

Markets have always been forced towards economic reality even if market psychology has been insanely misdirected as it has been since mid-2014.

Oil is rising in response as a commodity trade. The underlying Supply/Demand balances do not change very quickly.

Predicting market psychology is not something which can be done even as many claim to do. What can be done is to see the differences between what people say and what is actually happening economically. Big discrepancies provide investment opportunities. Recent fears of recession did not have economic support. The current period continues to offer those with a value approach opportunities if they are willing. At worst, one can now expect a substantial recovery in positions which had been traded down by the market.

My positive stance continues. I have doubled down on issues which took the biggest hits and added those I had always wanted but the timing was not right.