Gotta love it….as I’ve said before oil ($OIL) ($USO) is the only thing I know of that can go from glut to shortage in the blink of an eye… It was just February the IEA told us the world was “drowning in oil” and foretold and “endless glut”. It was as if US rig counts collapsing would have no effect on US production which had been the cause of the excess oil supply. Well, it has dropped, it has had an effect and now prices are rising and we are talking about shortages. If only we had some historical data on oil and rig counts to go by…oh yeah, there is a plethora of it .

WTI Crude Oil Spot Price data by YCharts

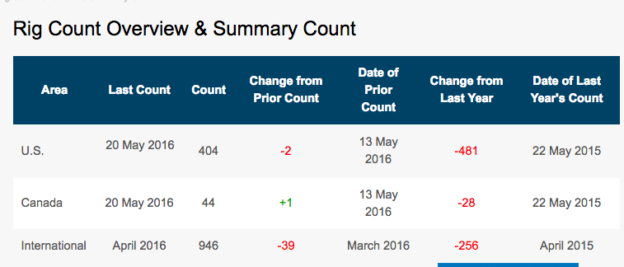

Rig counts continue to fall both in the US and internationally. :

From the WSJ:

OPEC’s ability to ease the pain of an oil-supply shock is slipping.

For half a century, the Organization of the Petroleum Exporting Countries has buffered global crude markets, curtailing production to ease oil gluts and boosting output to prevent shortages.

Now, as it heads into a June 2 meeting to discuss how to stabilize world oil markets, the cartel has neither the political consensus to cut output nor the technical capability to significantly raise production.

Since last year, OPEC members haven’t been able to agree on supply cuts to stem a glut that drove prices down by more than 50% since 2014. Instead they kept pumping full blast. The result: With recent supply outages sending the oil price back up, the cartel has little flexibility to boost production.

This year, OPEC’s spare pumping capacity—the amount it can bring online within 30 days and sustain for at least 90—will be at its lowest level since 2008, the U.S. Energy Information Administration estimates. It said OPEC spare capacity will decline more than 22% in the current quarter compared with the previous quarter.