This is much to do about nothing. The UK was never “really that into” the EU which is why they’ve kept their currency the whole time. One cannot escape the feeling this was due to happen at some point. The UK views itself as Europe’s leader, how long did we expect them to take orders from Brussels? Markets are getting up in a tizzy because that is what they do when there is uncertainty.

Think about this though. If the stock you own primarily does business in the US, are their operations going to be hurt by this? Will Apple ($AAPL) sell fewer iPhones? Are people going to do fewer Google ($GOOG) searches? Are people going to buy less Under Armour ($UA)? Of course not. Now their stock prices may suffer in the short term but this just gives long term investors a better entry point to pick up more share on the cheap.

“Davidson” submits:

Cramer mouthing off on Brexit that European Union was to prevent WWIII-off base as usual.

The EU was formed to lower economic costs trading between nations. The costs of every country having its own border guards, currencies, banking and etc was seen as hurting economic progress. A substantial savings resulted from open borders. This eventually led to the Euro currency which lowered currency exchange costs by up to 2% on each exchange transaction, huge savings when the same capital can change hands 10x.

Whenever one thinks of the calls for countries exiting the EU, one needs to think what is the economic cost. For the UK to exit at this point one has to weigh the economics of dealing with rules from Brussels and demands of open border policies. UK uses the Euro, but has maintained the Pound as well. Economically, the UK did not trust the socialist spending of EU after Thatcher shifted the UK towards capitalism in the 1980s.

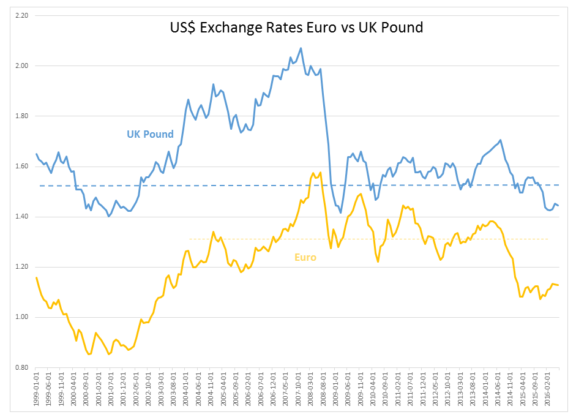

The UK never found a benefit from using the Euro vs the Pound and did not shift to the Euro. The UK Pound has held ~$1.55 better than the shifts in the Euro. The Euro, as a new currency, took a while to become established in global trade. Now that it has been priced by global trade, it is likely we will see it return to the low ~$1.30 range near term(next couple of years). The recent shift in the Trade Weighted US$ Index has had less impact on the UK Pound and more on the Euro.

I do not think the UK sees any value to using the Euro at the moment. Brexit is more important for the EU than it is for the UK in my opinion. Either way it is not likely to hurt either country if the UK exits. Perhaps Brussels will be forced to rethink the policies they self-impose on members and be less top-down control.