“Davidson” submits:

There are many claims and many perspectives on investment returns. Actuaries for the last 20yrs estimated returns for retirement accounts at levels over 8%. There many who think that they should be able to capture 20%+ in returns long term. The history of the SP500 tells of a far more complex history and provides a basis for more realistic thinking.

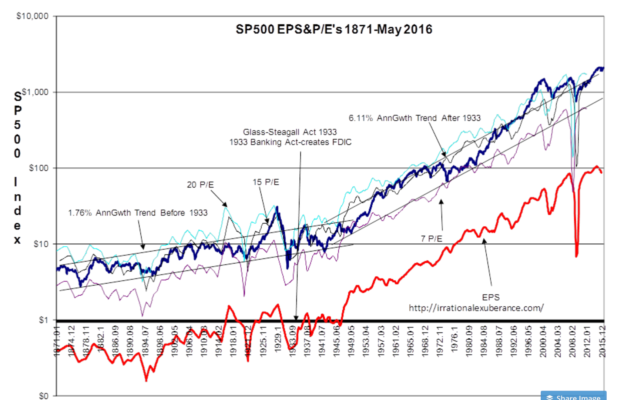

Even with the factual evidence of the SP500 EPS & P/E’s 1871-May 2016 chart, many will have difficulty accepting the data presented. Consensus opinion is firmly rooted on the SP500 Index price movement as the most viable measure of returns and predicting future returns. Most investors use recent history to judge future expectations. Human perception is colored heavily by recent experience. This is called “The Recency Effect”. There are two types of investors pricing stocks in the markets. Long-term, Value Investors price stocks and bonds on fundamentals and contextual analysis. Short-term, Momentum Investors price stocks and bonds on expectations and recent price movement. In my opinion, Momentum Investors dominate the perceptions and the media. Momentum Investors likewise dominate short-term market trading with their view that price trends control and reveal all one needs to know of economic activity. Once one compares Value Investor vs. Momentum Investor styles long-term, it becomes apparent that it is Value Investors who actually set market lows during recessions and set long-term market pricing. Momentum Investors simply key-off Value Investor buying during recession lows and then continue to invest with news headlines and media stories till economic expansion runs its course. The actual percentages of Value Investors relative to Momentum Investors is not knowable. It is my guesstimate from market experience that Value Investors represent a relatively low percentage. Understanding how this small group of investors invest in markets, I call “The 1% Solution”

The long-term perspective reveals that SP500 Index has grown ~6.1% in line with long-term earnings. Value Investors perform contextual analysis to determine at what price they find long-term value in markets. The period 1965-1982 was a period of SP500 underperformance relative to earnings. Rising inflation caused Value Investors to contract P/E levels. (Inflation causes P/E levels to fall-real earnings are not worth as much). Momentum Investor price-trend-followers called this period ‘stagflation’, i.e. slow growth-high inflation. If one examines the EPS for the period, it can be seen that EPS growth remained on its historical trend. Overall economic activity continued at its historical pace, but the P/E fell from the late 1960s 20 level to 7-8 range in the mid-1970s to early 1980s. With high inflation, Value Investor contextual analysis made them only willing to support stocks at lower levels. Momentum Investors have historically conflated stock market and stock performance with economic performance. The relationship is more complex. Value Investors recognize this through their focus on fundamentals.

Once inflation abated, Value Investors expanded P/E levels 1982-1998. There were many claims from Momentum Investors at this time that we had entered a ‘new era’ and many believed the crop of newly minted Internet related companies justified expectations of continued high growth. The SP500 with new Internet additions soared over 35 P/E in 2000. We had the ‘Internet Bubble’. Value Investors spoke openly that markets were in a bubble at the time, but were shouted down by the consensus. There were a number who said that Warren Buffett’s investment style and Value Investing in general was out of step with the ‘New Economy’. The passage of time shows that this was not so! Momentum Investors’ perception and expectations had become heavily influenced through “The Recency Effect”. Using prices rather than fundamentals leads to actuarial assumptions shifting to a highly unrealistic 8%+. Many pension plans continue to use unrealistic actuarial expectations as do investors and advisors.

From the SP500 EPS & P/E’s 1871-May 2016 chart, it appears we may be near a market top, but Value Investors today indicate this is not the case in their experience. Explaining why Value Investors are likely to be right requires contextual analysis which many do mentally. Warren Buffett’s now famous saying, “My brain is a computer” explains why this is so. It is very difficult for Value Investors who blend information from hundreds of sources which amount to hundreds pages of investment information they digest each day to explain simply their investment outlook. You can get some of the details of this by reviewing notes from the past several months. I summarize the key issues.

Summary of Contextual Analysis:

1) All key broad indicators of economic activity continue in rising trends.

2) The US$ which rose on the back of a reversal of a failed-investor-inflation trade caused significant slowing in natural resource and industrial sectors. The dip in recent EPS reflects this effect. The reversal of the US$ back to its long-term trend should just as significantly improve the business sectors which were hurt 2014-2015. My expectation is for continued economic expansion as the US$ normalizes.

3) The SP500 Value Investor Index indicates little in SP500 excess valuation.

4) Currently pessimism is high. Markets and economic activity has never peaked with pessimism, only with optimism.

Momentum Investors have called for a market peak simply because they believe that after 7yrs of economic expansion, “We are due!”. Neither prices nor time-in-trend have anything to do with economic activity. The current economic cycle is coupled with a great increase in banking regulation and elsewhere. Underperformance in housing is a result. Single-Family Starts have underperformed to such an extent that we remain at 1991 recession levels. There have been rule changes. The economic context has changed. Simultaneously, based on Fed commentary Momentum Investor expectations for high inflation with acceleration of the Money Supply(M2) have been thwarted by the rapid slow down in Government Expenditure&Investment. Inflation has remained below 2% as a result. The Momentum Investor short-term expectation for high inflation required significant reversal which forced the US$ well above its long-term global trade determined trend. The US$ will normalize over time as it always has. As this occurs, the economic damage of US$ strength will be reversed. My estimate is that this will occur in the current cycle and boost US and global economic activity for several years.

Note: Even though there is a history of market and economic performance, if we change the rules, future performance can change from the past. The evidence for this can be seen in the implementation of FDIC in 1933-see chart. FDIC was a landmark rule change which protected low-risk savers and their savings from the ravages of speculators. FDIC is responsible for our modern stock market performance from 1933 in my opinion. While contextual analysis indicates we still have several years of economic expansion ahead, but it does not indicate how high investors will be willing to drive market prices. One can predict higher prices simply because history supports that at some point investors become far less pessimistic that they are today. When investors turn optimistic, stock prices rise, but one cannot predict what or when that price rise is likely to occur.

Our goal as investors is to stay the course till we see signs of economic excess which should also be accompanied with higher levels of investor optimism. We have just been through 2yrs, 2014-2015, of US$ strengthening without the US economy being stronger vs. other global economies. The SP500 has stalled as a result of US$ strengthening. Economic activity has continued unabated everywhere. I suspect that once the US$ weakens enough, we will have a sudden realization that equities justify higher price levels. I estimate several years of economic expansion are still ahead of us. At the moment, holding LgCap Domestic and International equities as well as having some exposure to Natural Resource issues appears to offer the better Reward/Risk relationship.

Be patient. Several years of economic expansion appear to be ahead of us. I expect investors to shake off the current pessimism and shift equity markets higher. Investment success relies in having realistic expectations and being grounded to fundamentals.

(At some point several years from now, the economic data should indicate that an economic correction is likely. I will then recommend an appropriate shift in strategy. But, not today!!)