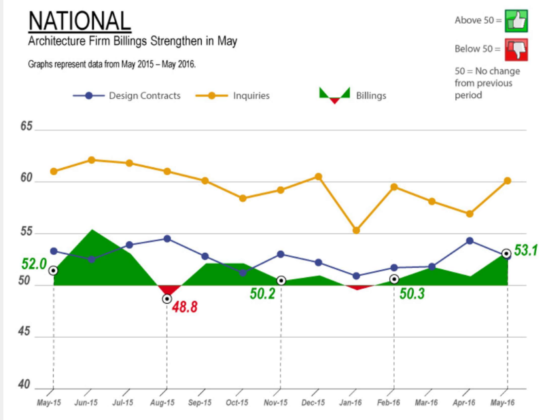

I’ll add to Davidson’s data points here saying the ABI is as the highest level in over a year:

“Davidson” submits

‘BREXIT’ does not change basic economics. There has been a recovery underway globally and this will continue. Every country is connected through global trade. It is the US which has been the global economic driver since the 1950s with our invention, innovation, advances in standard of living and of course our consumption. US consumers now make up ~70% of US GDP according to reports. Clearly we remain in a decent uptrend even with considerable continuous fretting and fears that an unexpected slowing is just around the corner every month since early in the recovery 2009. I sent the note below only a few days ago. It speaks volumes that no one seems to see the economic recovery that has been in place since March 2009. It speaks volumes about the consensus misperception of fundamentals supporting higher equity markets. Two additional charts have been added at the bottom.

It is worth reviewing the economic trends reflected in these charts.

High fear of financial collapse! Major investors saying “Get out!”, ‘Brexit’ forecasts dire for European economy! In the US, top investors say Fed has lost control and the economy or something will spiral out of control. These are only a few of the current basket of concerns. And then there is our current Presidential election fare and the terrorist attack in Orlando.

In reality, this week’s concerns have not been much different than what we have seen since the current economic recovery began in 2009. The only means we have to determine if it is market psychology and high profile events which control our economy or economic fundamentals is to review our history. That look back makes it clear that it is economic fundamentals, not geopolitical events, not market psychology which are the long-term drivers of markets. It is the direction of economic activity which eventually drives market psychology towards optimism. It has been my experience, that pessimism is the rule for most of a recovery till we eventually shift towards optimism. We are then optimistic for several years and remain so even 6mos beyond the inception point of economic correction. Market psychology lags economic activity. It is called “The Recency Effect”, i.e recent experience colors our expectation.

Economic Fundamentals Drive Market Psychology…Market Psychology Drives Market Prices

Today’s markets are different than the past. A major influence is the media’s explanation for every wiggle in prices as having economic causality. Our focus has been too short term. In the morning the media can say prices rose/fell because of one thing and in the afternoon provide an entirely different explanation. The next day we hear yet another explanation. The facts are that economic trends do not shift daily, weekly or even monthly. It takes about 6 months before we can tell if a new trend has formed or the existing trend has deviated from its previous pattern. Yet, not only the media, but analysts and even the Federal Reserve appears to view economic trends as having the ability to change direction frequently. Economic trends have never changed direction as frequently as advertised. Economic up-trends develop over multiple months and hold-to-trend for years once in place. Economic corrections are relatively short-lived. Corrections last about 18mos if permitted to follow their natural progression.

The current investment environment is one of pessimism. Perhaps, we should hope that this continues. Our economy meanwhile continues to expand.

We have record highs in employment which show signs of recent acceleration:

Record employment produces record Real Personal Income:

Record Real Personal Income results in record Real Retail and Food Svc Sales:

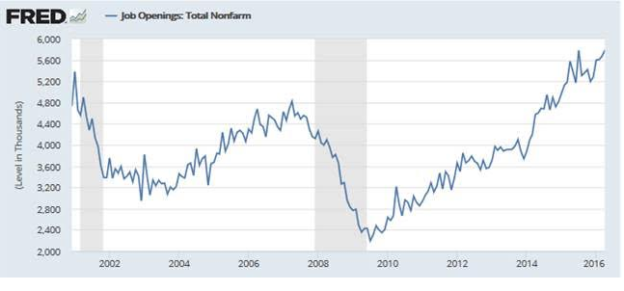

And, it appears that an early indicator of economic expansion, Job Openings has hit record highs:

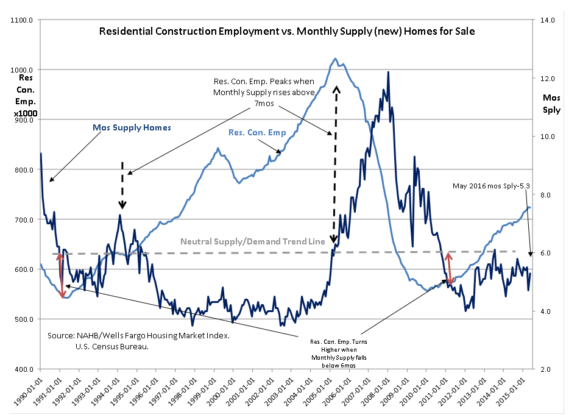

Meanwhile, the US Housing sector is operating at 1990 recession levels(see the New Single-Family Starts chart) with no excess whatsoever. US Housing has been a past prime area of excess spending and excess borrowing which has led to corrections..

Economic activity is measurable and understandable. We have never gone into economic correction without weakness in employment and retail sales trends. In my experience there is no such thing as a ‘Black Swan’. Economic activity does not suddenly turn into a correction. Corrections have never occurred without a prolonged observable period of economic excess followed by a period of preliminary weakness. Current economic data supports ignoring current fears because, as so often in the past, there are no signs of economic excess or weakness.

My analysis reveals that we average about 3% in our Real Private Economy. Our Real Private Economy is the source of taxes for government spending. Growing the Real Private Economy in excess of 3% means we will eventually have a period of growth below 3%. The greater the period of excess the sharper the correction. We have no excess today with the Real Private Economy operating at ~3%.

The long-term Real Private Economy growth rate is part of the ‘Natural Rate’ Knut Wicksell identified in 1898. Adding our current inflation rate of 1.8%(12mo Trimmed Mean PCE) gives us ~4.8% as today’s ‘Natural Rate’. This is roughly the level 10yr Treasury rates should trade. The 10yr Treasury near ~1.6% today is why I remain extremely cautious on fixed income.

While the world frets and then frets some more, economic activity has continue to expand. Eventually, investors have never failed to turn more optimistic and remain so for several years. It is this period of optimism from which excess economic activity derives. It should be readily apparent that while economic activity continues to expand, optimism and economic excess is not part of the current equation. It could said that “Excess pessimism does not produce excess economic activity!” There is no economic correction on the horizon. This does not mean that we could not have a dip in market prices at any point in time for other reasons. Dips should not matter for long-term investors. I anticipate taking action only once economic fundamentals indicate a correction is likely.

While world frets, investors should remain positive. LgCap Domestic and International as well as Natural Resource equities have the higher Reward-lower Risk characteristics in my analysis.

Market corollary:

Highest market optimism occurs at major tops: Highest market pessimism occurs at major lows.

Those who know value, buy when markets are low.

Two Added charts

Economic information flow is continuous. It is impossible to present it as often as some would like to see it. In my work I see the separate reports as part of the larger picture reflecting the broad trend of economic activity. When I see sudden currency changes, as we saw the strength in the US$ 2014-2015 without any change in global economic activity, I know to interpret it as a Momentum Investor event and not an economic trend. The response to ‘BREXIT’ today is likewise a short-term Momentum Trader based currency event and not a long-term economic event in my opinion. ‘BREXIT” does not change the economics of Great Britain or the general Supply/Demand to support its population’s desire to advance their standard of living.

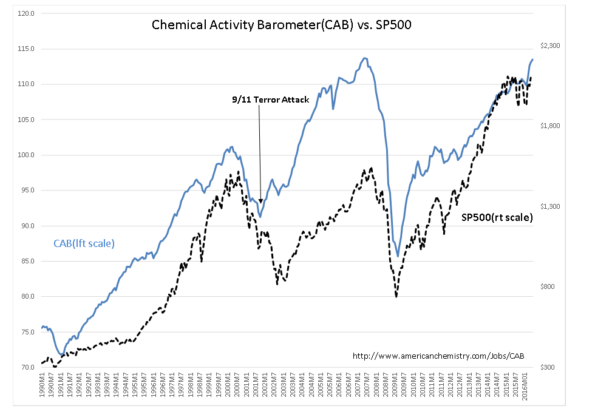

The current economic uptrend is reflected in this week’s reports of the CAB(Chemical Activity Barometer) and Residential Construction Employment vs. Monthly Supply (new) Homes for Sale. New highs this cycle for Residential Construction Employment and a record high for the CAB.

These trends match the positive trends in the other indicators. These trends have been in place in the face of so many calls for another recession and market collapse that this level of market misperception defies belief.

James Grant of “Grant’s Interest Rate Observer” has a good observation:

James Grant said on CNBC this morning that “Great Britain just went on sale”…“This is how Value guys get rich!”