“Davidson” submits:

As a Value Investor I look at all times to determine if economic fundamentals justify market prices. Most investors think that prices alone carry all the information necessary for understanding economics as if prices were a form of ‘short-hand’. Comparison of economic data and market psychology reveals that fundamentals and price soften differ. Such is the case with the current thinking of the US$, oil and International Equities in my opinion. One sees these relationships by examining the data long-term.

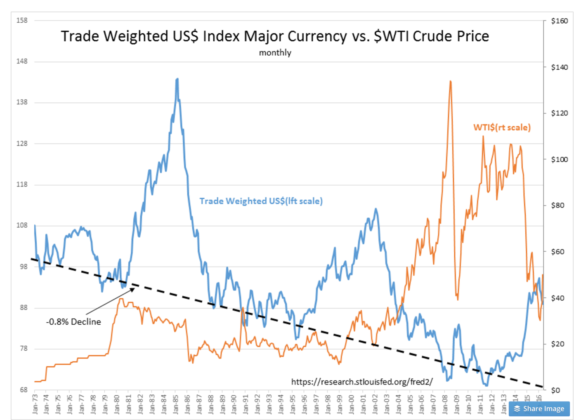

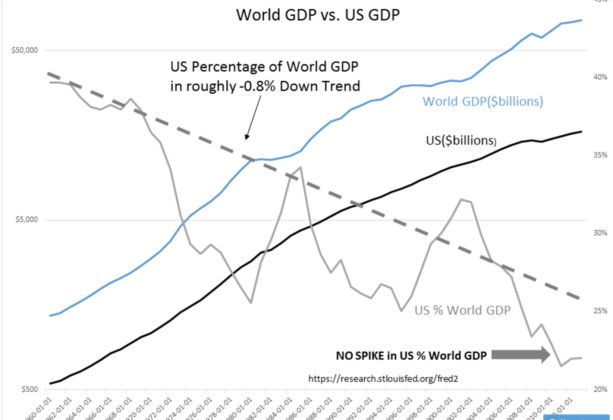

The US$ varies in its relationship with global currencies. Many believe that a strong US$ is good for the US. Data tell us the opposite. It is a relationship controlled by Free Markets. Over time, the US$ has gradually weakened. This is explained by comparing the two charts World GDP vs. US GDP and Trade Weighted US$ Index Major Currencies vs. $WTI Crude Price.

The prominent feature connecting these charts is that the -0.8% decline of the US share of World GDP matches the identical decline of the US$ relative to major trading currencies. Adam Smith first observed in “The Wealth of Nations”, 1776, that when one country enters trade with another, it is to improve its own standard of living. The financially stronger, more advanced country as measured by the standard of living seeks cheaper sources of goods and services to advance its own standards of living once native sourcing has grown too expensive. In the process of establishing trade, the stronger country transfers manufacturing to the lower-cost less-strong countries which raises the GDP growth of the latter while it slows the GDP growth of the former. Over time the GDP % of the country with the strongest standard of living relative to World GDP drifts lower. Both countries experience standard of living improvements. Simultaneously, if trading partners maintain currency growth at the same pace as their respective GDPs, the relative currency strength of the stronger country declines as trading activity causes its new trade partner currencies to rise in importance. This is the long-term pattern reflected in these two charts.

Usually investment activity tracks the direction of global trade. Not always. Both charts show that there have been two periods, the mid-1980s and the late 1990s during which US GDP grew faster and gained share of World GDP. These periods were accompanied by an influx of investment capital seeking higher rates of return and the US$ surged in both instances. Currency relationships are established by Free Markets in global trade and investment capital which can vary in the short-term. Eventually the long-term relationships in GDP and currency pricing return to trends determined by Free Markets.

Naturally, the country’s currency with the highest contributions to improvements in the global standard of living being one-half of the trade transactions, becomes a benchmark currency for trade. Today, this means commodities are priced in US$. There is somewhat an inverse relationship between $WTI and US$ in Trade Weighted US$ Index Major Currencies $WTI Crude Price. This relationship appears more correlated since the late 1990s than in the prior period. This is a feature of the recent and rising influence of Momentum Investors on market prices. Lately, every twitch in price comes with some interpretation of broad economic importance. The actual currency and trade relationships can only be interpreted over the long periods in which they occur. One cannot take a single day’s volatility or even a month of activity and come to any broad conclusion whatsoever. One cannot make a mountain from a molehill. The data does not permit it. Yet, this is done everyday by price trend followers.

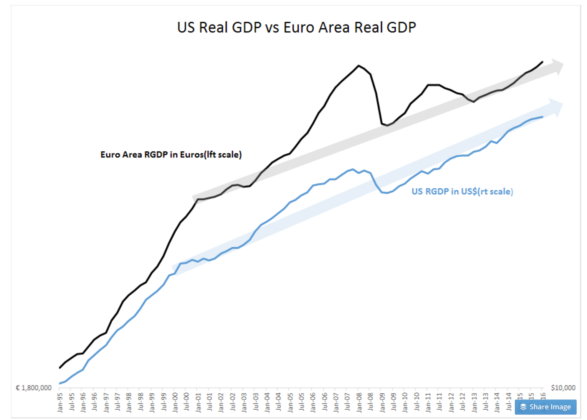

Lately, many have interpreted global growth as slow with Europe falling back into recession or threatening to do so. In an earlier note, the US Private GDP was shown to be growing at historical levels and not at the ultra-slow growth currently perceived. This misperception arises because analysts have missed the impact of declining Government Expenditure&Investment which has occurred with the current administration. It appears that Europe Zone GDP suffers from its own negative interpretation.

The chart US Real GDP vs. Real Euro Zone GDP (19 countries)provides a relative view in local currencies of economic activity. The data is not adjusted for government spending. We hear frequently that Euro Central Bankers need to do more to stimulate the Euro economy. Like a number of calls by those who perceive the US economy to be slow, the belief that lower long-term lending rates are required. Even the most casual observer cannot miss that Real Euro Zone GDP is growing at a pace, while less than the 1990s, is at the same rate since 2000. Not only does the Real Euro Zone GDP not provide any support for pessimism, the recent rise above trend indicates an acceleration in expansion. The disparity between market psychology and fundamentals has been widening. If one revisits the top chart, World GDP vs. US GDP and Trade Weighted US$ Index Major Currencies $WTI Crude Price, one can see that there has been NO SPIKE in US % World GDP. US economic activity is not at this point in time out-pacing global economic activity. The widely accepted interpretation that the US is growing slowly while the world is not at all is not supported by fundamentals. Globally, economies are expanding at the same relative pace historically. It is in this disparity of market sentiment vs. fundamentals where Value Investors find opportunity.

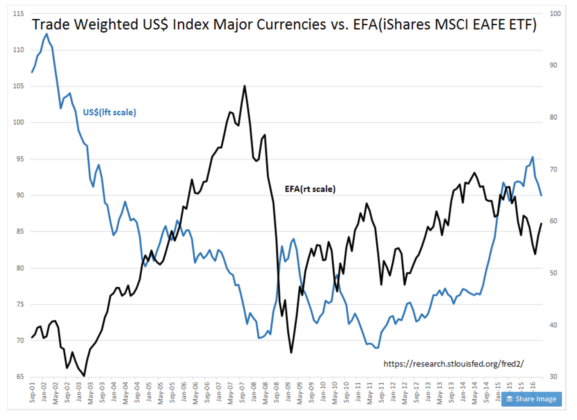

To US Value Investors the opportunity appears significant in Intl Equities. Especially LgCap Intl Equities! This can be seen when one compares the charts Trade Weighted US$ Index Major Currencies vs. EFA(iShares MSCI EAFE ETF) and US Real GDP vs. Real Euro Zone GDP. The EFA, which is the iShare of LgCap Intl issues, is priced inUS$. When the US$ is stronger the EFA appears weaker. For Momentum Investors who believe price tends reflect economic trends the Euro Zone appears to have slumped into recession as the US$ gained strength from 2014. Fundamentals show that this commonly held belief is a gross misperception.

Much of the wild market swings in equities, bonds and currencies we have witnessed since the mid-1990s can be attributed to shifts in Momentum Investor psychology. Momentum Investors, whose trading is based on the belief that price trends provide optimum economic information, control significant levels of capital, over $3Trillion at the last measure. In a world of ~$80Trillion, trading $3Trillion levered through derivatives has considerable impact on market pricing. Recent measures place oil market derivatives as having a notional value 17x larger than the value of the available commodity. One can get an appreciation of the influence non-economic parties can have on market prices by this measure. They do not know for the most part if prices are being driven by their own activity or something else. They believe at all times prices reflect fundamentals of supply/demand. What they see are potential directional gains and additional capital is committed. Value Investors see price as market psychology.

Value Investors by nature seek to understand price in relationship to fundamentals. A much lower price relative to long-term fundamentals is investible with a margin of safety. A much higher price relative to fundamentals is something to avoid. There are few fundamental short-sellers. Jim Chanos is one of those few. Most Value Investors know that market psychology is impossible to judge with any degree of uncertainty and do not short over-priced issues.

In today’s market, the US$ is over-priced relative to long-term global trade fundamentals. This has resulted in market misperceptions in which Value Investors find opportunity. The extreme strength in the US$ comes from previous misperceptions of Momentum Investors detailed in earlier notes. As the US$ returns towards its long-term trend, there should be decent investment gains available in those companies related to infrastructure, commodities and Intl Equities among other opportunities.