“Davidson” submits:

There is so much pessimism that it feels like one could spiral down a hole and never recover. Reality is opposite!. What we are experiencing is an incredible negative ‘group-think’ based on broad economic misperception.

I run GDP, Wage Growth and Productivity corrected for inflation and where necessary Govt Spending. Low inflation and falling US military spending are part of GDP and if not corrected are misleading. Without correction, we get distorted views.

With the proper corrections, there is much to like about our economy which is operating in line with historical levels. There are many issues with what the Fed has done incorrectly but as a Free Market we are finding our way through it as long as the Fed does not raise rates with their misperceptions of the economy.

The equity markets respond to profits long term. Even with the periods of extreme pessimism, it has been economic activity which has eventually forced market psychology to be more optimistic.

————————–

“U.S. Worker Productivity Hasn’t Been This Bad Since 1993”

May 4, 2016 — 12:01 AM EDT http://www.bloomberg.com/news/articles/2016-05-04/u-s-worker-productivity-hasn-t-been-this-bad-since-1993-chart

I encourage you to view the link to this Bloomberg article.

This point of view is typical of the pessimism we have experienced since 2009 as markets crawl higher. I often look at the headline of the moment and find that consensus headlines are well off the mark. The major issue is people do not use Real GDP and they do not correct it for government spending. Inflation has been much higher in the past and this makes it appear that the current economy is slow when wages and prices(production) are not adjusted for inflation. The same is true for government spending which has varied over time. The past few years Government Expenditure & investment has fallen in real terms as military spending has declined. In order to get to a better history to compare today’s economy with that of the past, I subtracted Real Government Exp&Inv. From Real GDP to look at US workforce productivity which so many seem to view negatively in today’s pessimistic climate.

There is concern that the US workforce is somehow losing its productivity. There has been a slowing over time, but not nearly the decline many claim. It is all how one looks at the data. We count Government Expenditure & Investment as part of GDP. All government spending derives from the Private Economy through taxes or government borrowing. In my opinion it is better to look at what is left of the Real GDP once Govt Exp&Inv has been extracted.

In recent notes showed that inflation adjusted wage growth is no different than what we have seen in past economic cycles. Wages have always grown at a faster pace than inflation long term. The Real Private Economy growing at ~3% is likewise in line with historical norms. The Real Private Economy is the source of profits which supports stock prices, not the actions of the Fed. If there is no earnings growth, then stock prices do not attract investors, i.e. the market will not rise without earnings. The consensus perception is that we currently have historically low economic activity and even negative wage growth. They believe markets have risen purely because the Fed has kept rates low. In my opinion, careful examination of available data does not support this assertion.

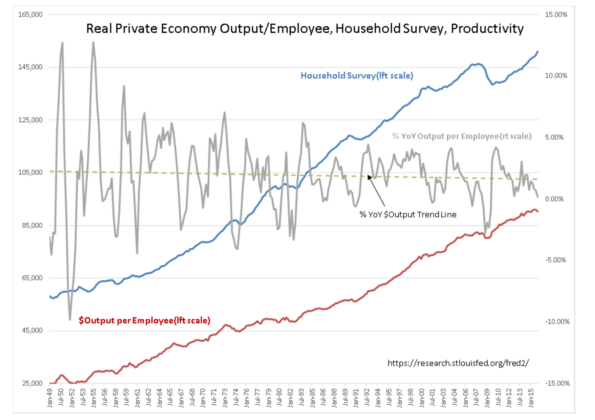

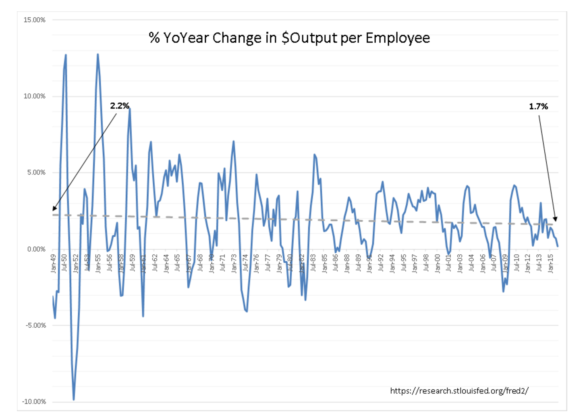

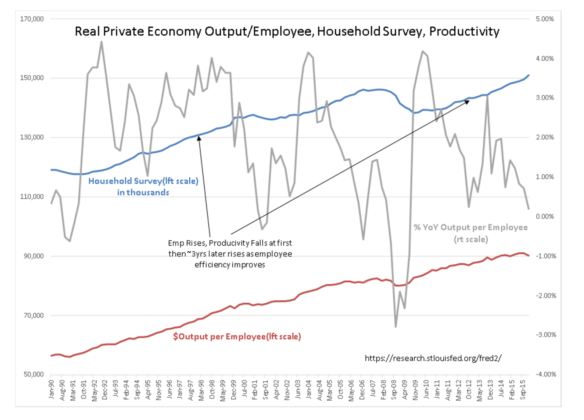

The Household Survey is used to produce Output per Employee. The 1st chart is from 1948 to present shows the Household Survey, the Output per Employeecreated by dividing the Real Private Economy(not shown) by the Household Survey and Productivity as the % YoY Output per Employee. The distortions of inflationand changes in government spending have been eliminated from the Nominal data. The % YoY Output Trend Line reveals how Productivity has tracked as our economy has grown. The 2nd chart is the % YoY Output per Employee by itself. The 3rd chart is from Jan 1990 and leaves out the trend line which makes it easier to see the impact that new hiring has on % YoY Output per Employee.

1) 1st chart shows the history from Jan 1948 using Household Employment as the measure of total employment(includes self-employed which other measures do not).

2) 2nd chart shows the % YoY Output per Employee by itself with Jan 1948 regression beginning at ~2.2% ending Jan 2016 at ~1.7%

3) 3rd cart shows Jan 1990- Jan 2016 in which one can see that a rise in hiring first causes a lag in productivity which then rises ~3yrs later.

There are several take-aways from these charts:

1) US % YoY Output per Employee has slowed somewhat over time. This is likely do the US economy growing from $1,4Tril(chained 2009 dollars) to ~$14Tril(chained 2009 dollars). Importantly, Productivity expectations discussed in the media based on unadjusted GDP historical data in the range of 3%-4% are unrealistically high. They have never averaged those levels. The long term trend appears to remain intact

2) Near term % YoY Output per Employee rises and falls with businesses making delayed changes to employment levels in relationship to economic activity. When the economy corrects % YoY Output per Employee slumps and employment drops in response. YoY Output per Employee falls in a delayed response to economic contraction because employers are slow to layoff valuable employees. As the economy recovers, % YoY Output per Employee surges as employers are initially reluctant to raise employment till their confidence improves that economic improvements are likely to be sustained. Later in the cycle, as new employees are added, % YoY Output per Employee slumps again only rising ~3yrs later as their skills improve and they become more productive.

3) Note that % YoY Output per Employee just slumped in response to the July 2014 acceleration in the Household Survey which can be seen in the 1st and 3rd charts

Based on history and the recent hiring surge from July 2014, we should see a surge in % YoY Output per Employee shortly if our economic expansion continues. Other economic indicators strongly suggest that economic expansion very likely. It is the Private Economy which drives equity prices long term(in my opinion) and the current trend appears healthy and without excess.

In my opinion, there lately has been considerable confusion and misreading of economic trends. investors should favor equity over debt and ignore current market volatility.