“Davidson” submits:

It is useful to think of and to analyze markets much like a novel being written in real time. Markets are a ‘Human System’. If we attempt to influence markets in a direction we believe to be beneficial, we often get unexpected outcomes. Long-term markets correct to long-term fundamental trends. This is the action of Free Markets. If you know the long-term fundamentals, you can see when markets shift too far in one direction. While one cannot precisely forecast what will trigger a return to the fundamental trend, nevertheless one use the return-to-trend as an investment opportunity.

One aspect of current markets is that increasingly Momentum Investors have taken short-term control of prices with the use of leverage and derivatives(derivatives are leverage on steroids). They bet on inflation themes and do so in currency, debt and commodity markets because these are the only markets large enough which permit deploying the levered $3Trillion they have to invest. One can visualize this in markets over the long-term. We see this specifically in the Trade Weighted US$ Index Major Currency which has had quite a ride since 2009.

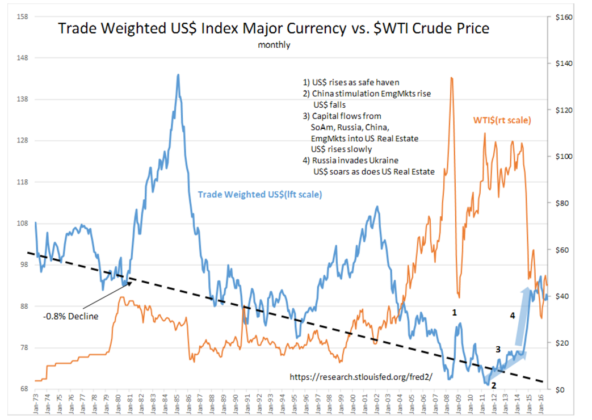

Whenever the US$ changes value against global currencies, everything priced in US$ are repriced accordingly. The relationship to $WTI oil prices(and all US$ priced assets) is negatively correlated. If the US$ is higher, then oil and commodities will be priced lower in US$ terms.

In Trade Weighted US$ Index Major Currency vs. $WTI Crude Price ($OIL) ($USO) the US$ has a long-term declining trend of -0.8% which represents the fact that rising trade with Emerging Market countries causes their currencies to rise in value vs the US$. Short-term events can result in currency flows which counter this trend. We saw this 1) during the 2009 market correction when investors shifted capital to the US as a safe haven, especially US treasuries. Then when China announced economic simulation amounting to 5.8% of its GDP in 2009-2010, 2) US$ fell as Emerging Markets rose sharply as capital shifted out of US$ denominated assets. As Emerging Markets peaked in 2011 3) the US$ again began to see a steady rise as global capital flowed into participate in the US Real Estate recovery. Then, suddenly, 4) Russia invaded Ukraine and the US$ soared. Oil and commodities responded negatively.

The US$ has had previous spikes, in the early 1980s and the late 1990s, which were due to US GDP growing at a faster pace than global economies. As a result, capital flowed to US$ priced assets. The current rise in the US$ is not a result of US GDP economic divergence. Global data indicates that most economies are expanding roughly in line with historical trends. Current US$ strength has every indication that it was the reversal of mistaken inflation expectations of Momentum Investors during 2010-2014.

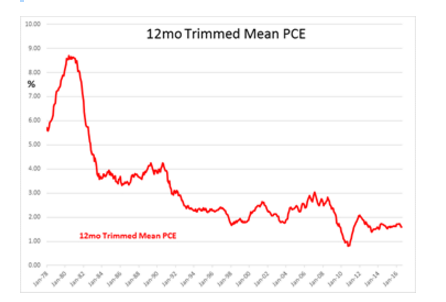

The story goes like this. During 2010-2014 Momentum Investors were encouraged by Fed officials to expect inflation. From the 1960s the business/investment community has accepted Milton Friedman’s observation that:

“Inflation is always and everywhere a monetary phenomenon.”— Milton Friedman, 1963

Inflation did initially rise from 0.82% in 2010 to just over 2.0% by the end of 2011, but then it has since fallen to 1.6% as shown by the 12mo Trimmed Mean PCE from the Dallas Fed. The largest inflation influence is government spending. The US made substantial reductions in military spending beginning July 2009. It is likely that the well documented global US military withdrawal resulted in capital seeking a safe haven flowing into the US and other Western countries driving real estate prices to historically high levels.

The US Fed made many statements that its goal was to re-inflate the US economy as a means of dealing with the asset deflation. The Fed initiated a series of QE actions. M2 soared. Momentum Investors countered that excess money would create massive inflation. During 2010-2014 Momentum Investors shorted the US$, went long oil and commodities and shorted US treasuries. They even revealed that they had bought farm land(to benefit from food inflation) and almond farms as assets which would protect them from the ‘hyper-inflation’ they anticipated. The problem with these trades lies in the fact that since they were initiated, inflation became weaker not stronger. Meanwhile, 3) capital flowed from EmgMkts causing the US$ to strengthen. Then in 2014 Russia invaded the Ukraine and what was a flood of capital into the US became a dam burst as investors’ fears of world instability rose even more. The US$ began to rise even more. Momentum Investors found themselves on the losing end of a highly crowded trade. They reversed! The 4) US$ soared! Other Momentum Investors jumped on this new trend because it was the only course of action. All this capital pushed the US$ ~40%+ higher than its long-term 0.8% decline trend. Today, inflation sits at 1.6% having been recently revised lower.

The ‘elephant in the room’ is that US$ cannot stay 40% above trend. Previous US$ spikes were due to the US GDP growing faster than global economies. This is not the current situation supporting the excessive level of the US$. That the strong US$ is not supported by economic fundamentals means that there is not much holding it at current levels. Market forces will gradually bring it back to its long-term fundamental trend. How and when this occurs is the investment opportunity ahead.

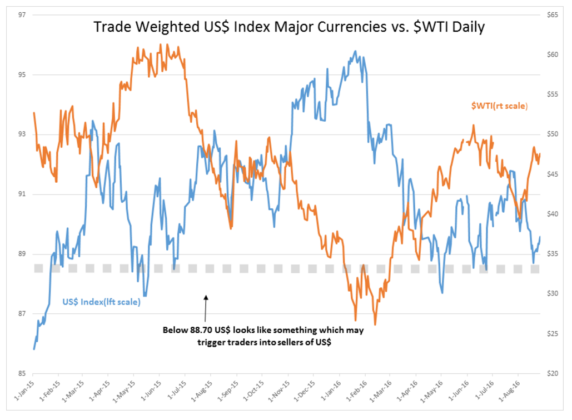

Even if one cannot precisely forecast the timing of the US$ normalizing back to trend, patient investors can benefit. One can get an idea the level at which Momentum Investors may turn the other direction by looking at the daily chart from Jan 2015-Aug 2016. Trying to think like a price-trend follower, it appears that 88.70 is a level that could trigger some to reverse course on a stronger US$. I am not a trader and do not know precisely at what level will trigger Momentum Investors to reverse course. 88.70 for the Trade Weighted US$ Index Major Currency certainly looks interesting.

Commodities, Intl Equities and US$ are inversely correlated. When the US$ begins its normalization towards its long-term trend, commodities and Intl Equities should rise. In my opinion, portfolios should favor US infrastructure issues, issues related to Natural Resources and Intl LgCap Equities. Should the US$ weaken as expected, investors should avoid fixed income exposures as rates should rise sharply. Since REITs are also priced at historical levels, they should be similarly avoided.

Market volatility is to be expected.