I’m not 100% in agreement with Davidson here but he has been right so often, I post for your digestion. I’m not sure rental housing is in a bubble that collapses but rather froth that flatlines. The rental market has risen because of an increasing population that cannot purchase. Assuming the traditional percentages come to pass, I think the rental market just flatlines while SF housing accelerates. The population is still increasing and people still need homes. Any change will be gradual over a number of years so a rental collapse I am doubtful of.

All that being said more homeowners is far better than renters. Home ownership builds equity while rents are simply a wealth transfer from renters to the owners of the assets.

“Davidson” submits:

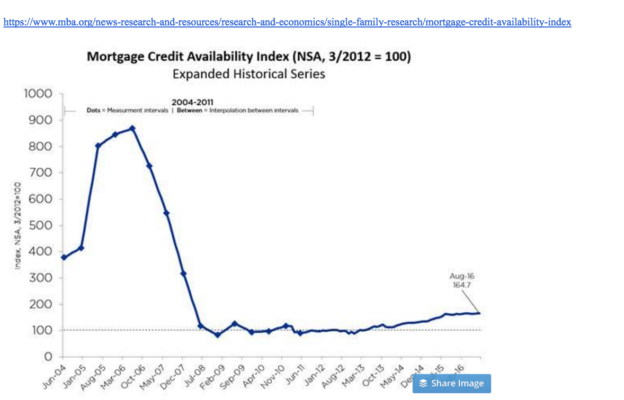

There has been a bubble forming in Multi-Family (Rental) real estate since 2009 and the introduction of Dodd-Frank. Bank regulation has tamped down mtg lending to such an extent that new home buyers are unable to get approval for mortgages. This has forced them into the rental market which has driven rents to record levels, especially in urban areas. The impact on new residential construction has been fairly dramatic.

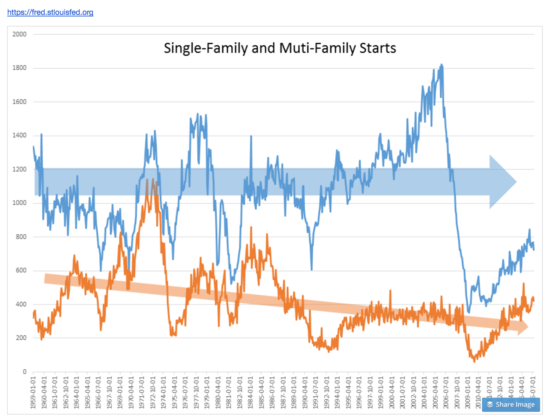

The history of Single-Family and Multi-Family Starts from 1959 reveals that Single-Family Starts has held in the 1.15Mil to 1.2Mil range while Multi-Family Starts has been in steady decline. Single-Family ownership has long been desired by families and has long been promoted by government as beneficial for responsible citizenship. Recent regulations in response has reversed this long-term trend.

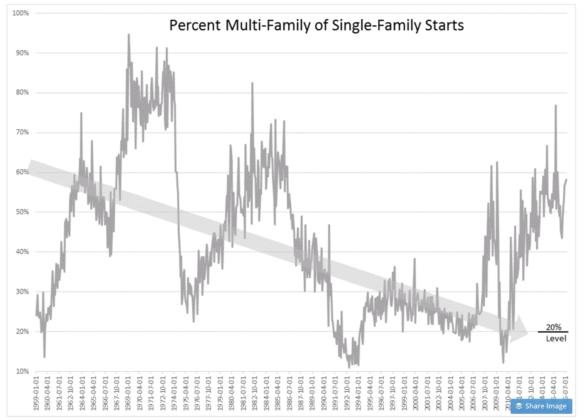

If one views Multi-Family Starts as a percentage of Single-Family Starts, both long-term and recent changes become apparent. Long-term the Percent Multi-Family of Single-Family Starts has been in decline as society has favored the standard of living Single-Family homes provide. Multi-Family Starts have declined from being more than 50% in the early 1960s to ~20% in 2005. Many anecdotal stories and the relatively new Mortgage Credit Availability Index(MCAI) indicate that there is considerable difficulty for new college graduates without significant savings in obtaining mortgage financing due to enhanced regulations which resulted from the Sub-Prime Crisis of 2008-2009.

Since 2009, mortgage lending has been about one-third the level of the most recent comparable economic expansion period(2004-2005). Correspondingly, new home-buyers have been forced into the Multi-Family rental market causing a rapid over-building of units. Eventually Free Markets will normalize mortgage lending and the Multi-Family/Single-Family will return towards its historical trend. With Multi-Family starts at 50% today, the correction back to the 20% level will likely prove difficult for landlords.

Summary:

The rental market is over-built due to recent regulatory changes. This sector will suffer when markets normalize.