“Davidson” submits:

Analyzing economic activity is like reading a novel being written in real time. The best stories have major plots and multiple sub-plots. Economies like stories include personalities driven by the desire to do good and those whose interests are strictly for personal gain. Mostly what is appears in the media is what is trending at the moment. What is heard is what momentarily gets enough attention to attract a passing mention. The short term focus is a particular data point as having been better or worse than expected. This difference is supposed to forecast our future. For a few moments it captures attention. A few days later another data point is equally promoted often forecasting a different future. Economic reality is far different.

Economic activity evolves slowly, over years. There is no rule that economic expansion has a time limit. It is not about points in time or a report being different than expected upsetting our view of the future. The truth in any data point lays in how those points form a trend. The truth lays in how a specific trend describes human activity in a particular part of the economy. The overall truth lays in how the multiple economic trends combine to tell us with reference to our past how various parts of the economy are performing today. The whole is comprised of many parts. The media rush to get to the next story is not designed to bring the whole picture to our attention. As investors, we have to do this for ourselves. To invest throughout an investment/business cycle, we have to think long-term and at the same time view the markets and the economy as a human story being written in real time without any trend having a predictable outcome. We must watch each trend develop slowly and make investment decisions based on past experience.

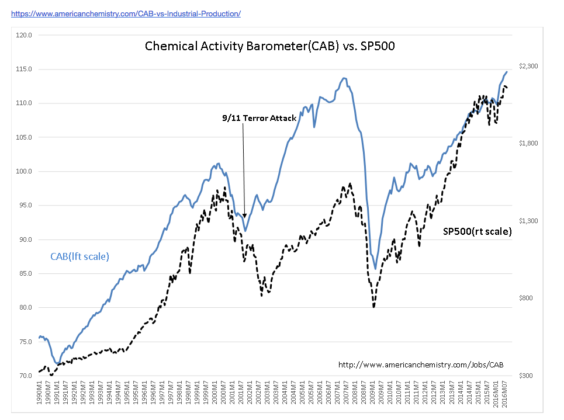

The CAB

Our economy remains mixed with many investors fearful. Overall, the Chemical Activity Barometer(CAB) is hitting a new cycle high. This index, first introduced in 2012 by the American Chemical Council, has shown itself to track economic and predict stock market activity back to 1919. Chemical demand as a useful economic measure is based on the fact that nearly everything we consume on a daily basis is tied to chemicals. Chemicals are intimately part of our clothing, housing, transportation, health, food and entertainment demand. The CAB is more often than not a leading indicator of equity markets. The reason for this is based on the fact that most investors wait till the news is better than expected before buying stocks. Trends in the CAB continue to register a stronger economy than most believe we have today. The latest level comes in at 104.61. This reflects a much more robust economy than many believe. The CAB explains why we have record Real Retail Sales, Real Personal Income and Employment. Nonetheless, economic activity is not uniform.

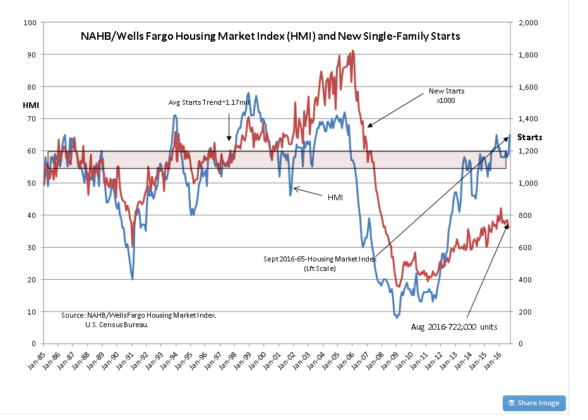

The Housing Sector

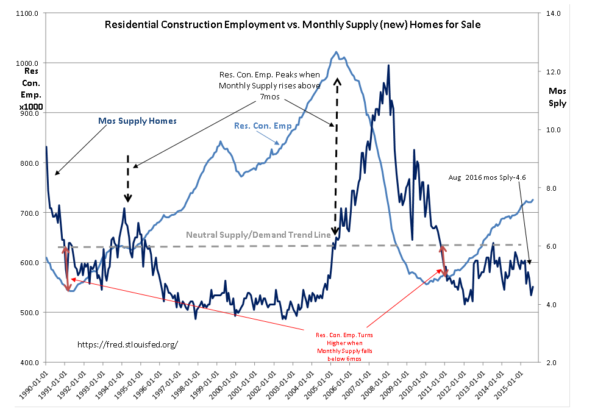

Housing reflects a less robust situation. The National Assoc of Home Builders Housing Market Index(HMI) at 64and the Monthly Supply of New Homes at 4.6mos have been reported by many as excellent signs of strength in the housing sector. Not so robust have been Single-Family Starts and the Residential Construction Employment which remain well below historical levels. Single-Family Starts continue to struggle at 1990 recession levels.

The HMI and Monthly Supply reports reflect builder expectations, i.e. their market psychology. Builders in response to tight lending standards have kept new home inventories low and focused on the more expensive and more profitable sector of housing. Most housing being built is done so with a sale and financing in hand. These are often homes with some customization. There is little speculative building and inventories have been kept low and in line with actual market demand. Residential Construction Employment is estimated to be 500,000 less today than what would be justified by our long-term housing demand. The input normally seen historically from housing is missing in today’s economy. While market psychology measures are good, the economics of housing are not robust by any measure.

Fall 2015, as regulators discussed additional banking restrictions, I recommended the avoidance of housing and banking related issues. The Fed Dec 2015 Fed Funds 25bps rise resulted in 100bps contraction in credit spreads, i.e. Credit Tightening . It is too early to tell, but the surprise fall in Single-Family Starts to 722,000 for Aug 2016 may be a result of this additional credit tightening. My recommendation is to avoid these sectors till there is evidence that credit spreads are widening.

Natural Resources

The rise in the US$ 2014-2016 has had wide ranging impact on energy and infrastructure companies. Quite a few companies are weathering the storm with lower earnings yet still solid businesses. After all, supplying energy to our expanding economy remains a sizable part of our economic activity.

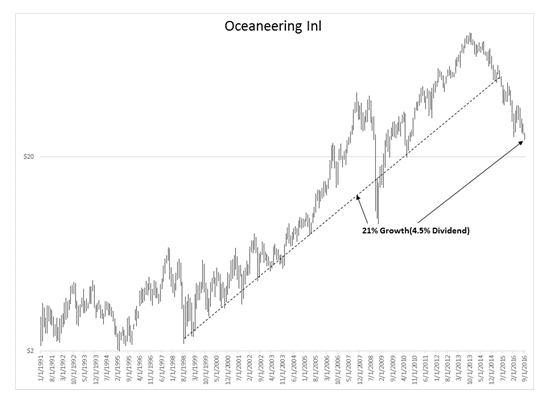

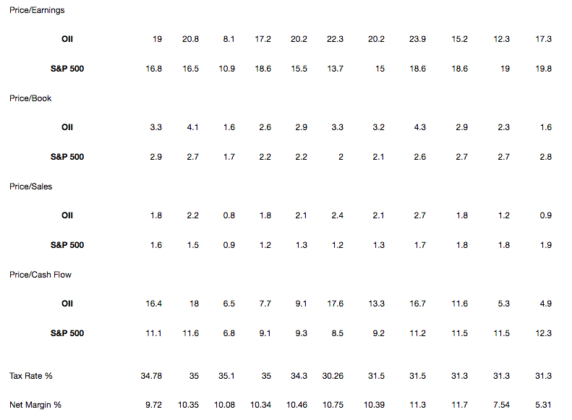

To recommend this asset class with some confidence one needs to perform enough individual company analysis to support an overall asset class approach. If one cannot justify buying a number of individual issues, then one should not be buying into an asset class. If fundamentals support buying individual issues, they in turn support owning the asset class. Oceaneering Intl(OII) is a good example. OII’s long-term return as shown in the price history has been well above the long-term 6.1% return of the SP500. That current levels are attractive to value buyers requires comparison to other well-known and well-managed companies(XOM) as well as to the sector index(XOI). OII has recent insider buying above the current range.

OII’s price history reflects its financials and the sector’s general response to oil’s rise above $100BBL during the 2008-2014 period. The price correction correlates to oil’s fall to below $30BBL in 2016.

Corporate insiders are historically ‘value buyers’. Buying activity is always much more important than selling activity. There has been considerable buying activity in Natural Resources and infrastructure issues and the same is present in OII.

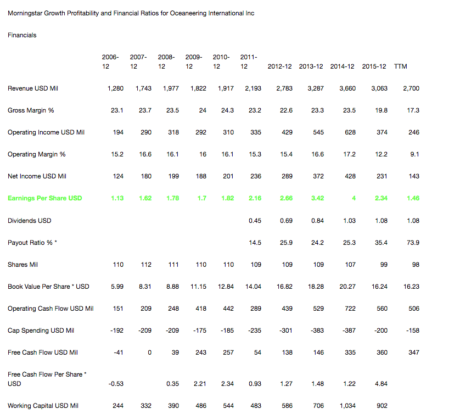

OII’s Sept 22, 2016 Presentation combined with its financials reveals a well-run business working successfully through a down turn.

Johnson Rice Energy Conf Presentation: http://www.oceaneering.com/wp-content/uploads/2016/09/2016-JRCO-Presentation.pdf

Financials reveal a strong operating history with Earnings Per Share more than tripling as oil rose over $100BBL but fell as US$ rose and oil prices fell. Earnings remain positive with a TTM(Trailing Twelve Month) level of $1.46. Oil and US$ have a long history of being inversely correlated and the US$ in turn has a long history correlated to global trade. The US$ returning to its historical trend should cause the price of oil to rise carrying XOI and its constituent companies higher.

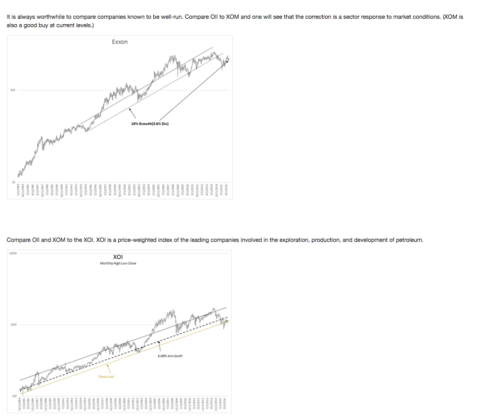

It is the long-term performance of the XOI which combines economic fundamentals, global politics, currency shifts(previous US$ strength) and multiple corporate management outcomes. It may be useful to think of the XOI as a ‘dumpster’ of all inputs to pricing the fundamentals of oil producers. The XOI provides part of the basis for the analysis that current levels represent a buying opportunity similar to those in the past when we had the ‘end-of-the-world’ and the ‘end-of-the-oil-industry’ thinking that we have today. Prices represent the market psychology of expectations. Value investors have already come forth buying this industry followed by statements that it represents a good long-term value. XOM is part of the XOI. OII is not part of XOI, but has global business with all major oil producers.

Natural Resources as an asset class offers an interesting investment opportunity at current ‘panic-low’ levels reflected in the XOI in my opinion. Low commodity pricing is correlated to unusual strength in the US$. Low prices in the Natural Resource sector are not due to weak economic activity which, as can be seen in the CAB, continues to expand. Global trade and Free Market activity has always brought the US$ back to its long-term trend. Unusually low prices in a long-term trend reflect pessimism. The more than 30yr trend of the XOI provides fundamental guidance in my work.

The long-term historical trends reveals current economic activity and pricing deviations. It is left to investors to understand the underlying reasons for discrepancies all other things being equal. The discrepancies today exist in housing, the US$ and historically low interest rates at a time of reasonably good economic expansion. If one can get one’s arms around the reasons underlying the disparities, then one can judge if they provide investment opportunities.

Housing, banking and related issues do not appear to offer opportunities at the moment due to potential for increasing regulation. Natural Resources, on the other hand, appear to be an opportune investment in a period of continuing economic expansion.

Economic activity is better than many believe. The better values are those sectors and issues which can benefit from knowledge of fundamentals.