“Davidson” submits:

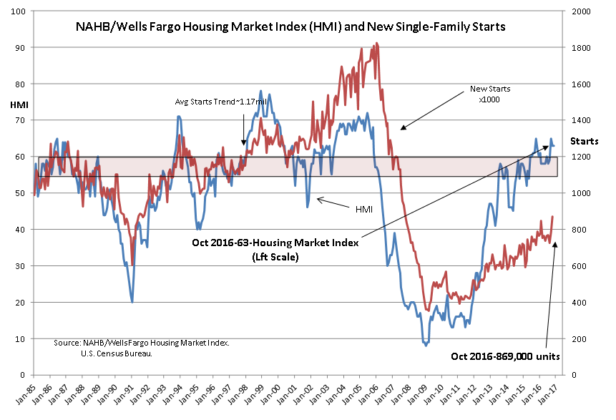

Single-Family Housing activity drives employment, commodity prices, retail sales and professional services. When it corrects this sector’s impact is significant. When it expands, it impacts the entire country positively. The past 7yrs has seen many restrictions on this sector. One of the most restrictive has been the narrow spread of rates between T-Bills/10yr Treas on which bank mtg lending is based. With a narrow spread, mtg cannot be extended beyond Prime Borrowers and new home buyers/first time buyers even if relatively good credit risks cannot get a mtg. Once the spread widens, even at higher rates, mtg become easier to obtain. Single-Family Housing benefits. A full recovery in this sector would double current level of starts. The US economy should experience acceleration.

Housing Starts and financing go hand-in-hand. The T-Bill/10yr Treas spread used by banks in mtg lending decisions narrowed to 1.2% in July 2016 indicating a potential slowing in housing which this data reflects. This morning this spread has widened rapidly since the election to 1.8% and the trend looks higher. 10yr rates should continue to rise faster than T-Bills and this will confound many forecasters.

The election of Trump has not yet been factored into housing. I would buy TOL and LEN at current levels with their excellent CEOs. Single-Family Housing starts should be higher by June 2017 after Trump strips away some of the impediments to mtg lending.

The bump in T-Bill rates brought them to just over the Effective Fed Funds rate which I use in my studies. Yellen will be forced to hike FFunds. FFunds should be at least 25bps higher than T-Bill rates. Today’s levels suggest FFunds should be 0.75%. I do not thing the Fed will do this in the current political environment.

The current economic environment is improving. US LgCap issues should benefit especially the infrastructure issues. I do not recommend hedging any positions. Long-term economics support a potential shift in market psychology well into the optimistic side of the spectrum.