Davidson and I disagree here on some points. I print both opinions because I think Davidson is brilliant (but nobody is perfect) so I am obliged, given the constant pin point accurate analysis he has provided us over the years to print this even if I disagree to some point (and I very well may end up being wrong). I also feel obliged to place my two cents here because I feel differently. Readers my read both and decide.

I do not see RE as being in a “bubble”. The principle reason is that the current run up in pricing is due virtually solely to supply or lack of it. Nationally we are at the lowest supply of home for sale in a decade. Regarding mall, there has not been a Class A regional mall built in the US (that I have been able to find) since the great recession’s onset. So, yes, prices of existing assets have risen but that is a function of there being less of them available. We have roughly 15MM more American’s in the US since 2008 and fewer shopping centers. At the onset of the great recession in Q3 2008, we had 130,500,000 homes in the US housing stock. As of Q3 2016 (latest data available) there were 135,600,000. So, 15MM more people and only 5MM more homes for them…..prices must go up.

Now, this dearth of single family home building has lead to an explosion in multi family units (people need a place to live). Over the same timeframe we’ve seen over 7MM multi family units built. So, I am of the opinion “if” there is a bubble in RE, it is in the multi-family sector. Should we see conditions for normalized lending for SF purchases, the multi-family sector could be in for a rough few years with falling rents and increased vacancies.

Is sovereign debt in a bubble? Probably yes. It has been the “safe haven” for the past 9 years and as global conditions turn to growth, and interest rates rise, its allure will wane and that will cause price declines to existing debt…it could get very ugly for large holders of it

“Davidson” submits:

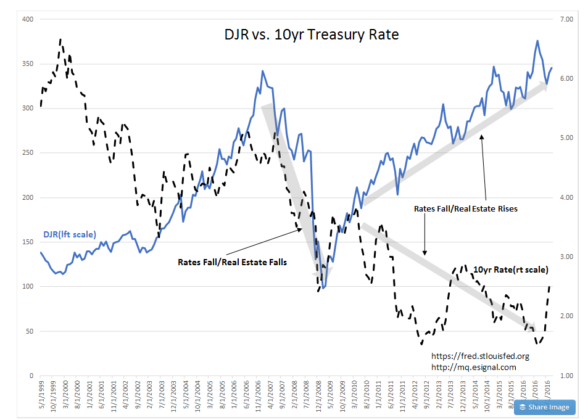

Real estate is a fascinating mirror of changes in global geopolitics and investor perceptions. Comparing the DJR(Dow Jones Equity REIT Index) and the 10yr Treasury Rate helps to explain that while markets appear to repeat, markets never have the same conditions from cycle to cycle. The drivers of the real estate cycle prior to Jan 2010 transitioned to entirely different drivers today and will likely transition again the next several years. Investment fundamentals changed and caused investor behavior to change.

Prior to Jan 2010 there is a pattern dominated by the government’s agenda since 1995 to provide homeownership to those ‘left out of society’ because of their poor credit history. The history of attempts at social engineering by forcing behavioral change on parts of society to reduce poverty can be traced to the early days of Democratic institutions. In the US, since 1900, there have been three such attempts. Each ended in a significant financial correction. The first was Pres. Wilson’s attempt to bring rural farmers, the poor at the time, into society by setting up the Federal Reserve Bank to foster lending to this group. There is not enough space here to present all the history which led to the 1929 Crash, but it began with Pres. Wilson’s programs. The second was Pres. Johnson’s ‘Great Society’. This program provided extensive housing and living expenses founded on excessive government spending. This led to the ‘Great Inflation’ of the 1970s which ended with Paul Volcker’s action to quash inflation-based consumption by raising lending rates to ~18%. Two back-to-back recessions were necessary to change the dire behavior which had become prevalent and return the US to conservative financial behavior. The last attempt at social engineering is in the DJR vs. 10yr Treasury Rate chart and had its start in the Community Reinvestment Act 1995. The financial system was forced to lend to Sub-Prime borrowers to eradicate poverty. The belief by some is that human behavior is malleable. If one provides the right conditions, then one can engineer better human beings. Steven Pinker wrote, “The Blank Slate”, 2002, to counter this widely accepted belief. This recent social engineering attempt ended with the subprime mortgage crisis. Tis is shown by the DJR peaking Jan 2007. A significant financial correction occurred shortly afterwards. The patterns in the DJR vs. 10yr Treasury Rate chart reflect that of higher rates and higher real estate prices. This is so because capital left the safety of 10yr Treasuries to buy real estate and, when real estate sold off, capital returned back to the safety of 10yr Treasuries. Once it was apparent that the correction was over and recovery had begun, capital again left 10yr Treasuries as real estate prices recovered. But, then global dynamics changed.

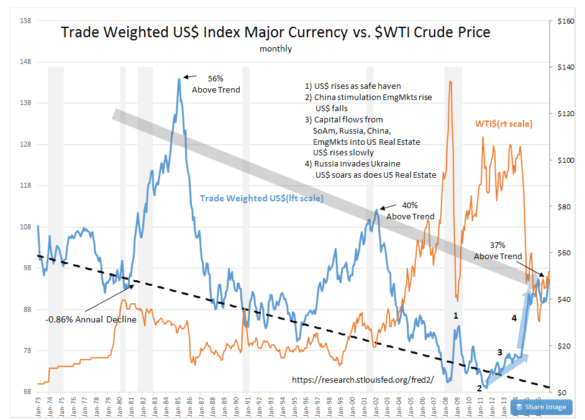

In 2009, the US changed its foreign policy and began to withdraw its global initiatives for support of Democratic institutions. Individuals began to feel that the support they had experienced for protection to individual property rights began to diminish. It was apparent enough to cause some to begin the shift of capital to Western nations. The charts DJR vs. 10yr Treasury Rate and Trade Weighted US$ Index Major Currency vs. $WTI Crude Price show this shift. We can see that the prior pattern of rates and real estate moving in tandem shifted to the reverse roughly Jan 2010. The US$ after multiple gyrations began a steady rise vs. Major Currencies in 2011. Russia invading Ukraine accelerated this move. Both of these shifts reflect a rise in investor fears and a need to preserve capital by shifting it to Western nations and in particular into real estate and Sovereign Debt assets. This caused the DJR to rise while the 10yr Treasury Rate fell.

Key to understanding why such a shift occurred lies in understanding investment dynamics vs. cultural perception. Prior to 2010, rising 10yr Treasury rates reflected investors seeking higher returns, i.e. Fixed Assets were sold to buy Growth Assets. As 2010 began, the need for capital safe havens globally favored the investors shifting capital to those nations with higher protections to property rights. Culturally this favored Real Estate and the Sovereign Debt of strong currency nations. Foreign investors were seeking safety not investment returns. So fearful were they that they drove rates to the lowest levels in 5,000yrs.

This leaves us today with REITS(Real Estate Investment Trusts) at the lowest dividend levels ever witnessed ~3.5% compared to a long period from 1970s ~7% and lowered 10yr Treasuries rates to ~1.50% (~2.5% today) when the “Natural Rate” (Knut Wicksell’s Natural Rate) indicates rates should be closer to ~5%. Where we go from here depends on the current administration’s foreign policy. If the US resumes its global defense and promotion of individual property rights and Democratic institutions, then capital will return to developing/emerging nations and the US$ will fall as a result with the 10yr Treasury rate rising.

My view is that Real Estate and Sovereign Debt are in “Bubbles”. I expect both to return to levels closer to historical returns over time. Just as it took time for the current condition to develop, it will take time to normalize. As normalization occurs, equities should benefit. My expectation is for significantly higher global equity markets the next several years. I favor Domestic and Intl LgCap exposure. For portfolios using individual issues, I expect US$ sensitive industrials and energy producing related issues to benefit.

No two markets are ever alike. Certainly, we can see this is so since 1995. One needs to pay close attention to policies which drive investor perspectives. What has worked for investors in the past is always modified in the present circumstance. Investors must always be students of markets as geopolitics evolve.

One other very important investment point:

In every investment and every investment cycle, there is always a mix of Momentum Investing and Value Investing. Value Investors get lost when market valuations exceed financial reason and as a result they tend to sell too early. Momentum Investors follow price-trends with valuation not being a factor. When so much inexperienced capital has been placed in Sovereign Debt and Real Estate finally decides to seek returns in equities, the shift to excessive valuations is likely.

The growing optimism in the financial markets (Dow Jones just peaked over 20,000) has not yet entered capital lending. Once it does, it continues with rising rates till the T-Bill/10yr Treasury rate spread narrows to 0.0%. At this point, markets are highly speculative and lending slows dramatically when the rate spread is 0.0%. Markets, then enter correction. We are several years away from this condition.

Equities continue to appear quite attractive for investor returns. How high equity markets could rise is impossible to forecast. They could see silly valuations 5yrs out.