“Davidson” submits:

Economic data and equity markets are highly correlated over time. The correlation is not day-to-day or even month-to-month as the media attempts to connect the dots on a daily basis, but over several years the connections become apparent. Along the way, there are many using market trends to predict the trend of the economy and the next few months, even days, of market prices.

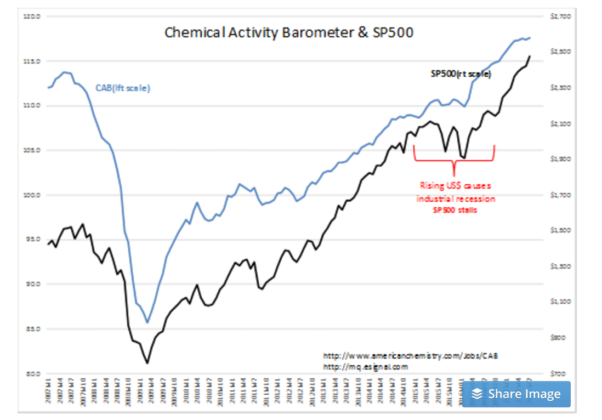

While it makes great media fare, it is markets which follow economics over time. If one monitors the economic trends, then one can anticipate markets 12mos-to-24mos ahead. The data is quite clearly displayed in the series of charts presented.

The Chemical Activity Barometer(CAB) which measures the production, transport and use of chemicals we consume in plastics, paints, medicines and etc is a good forecasting tool for economic expansion. Economic expansion leads to higher equity markets as corporate earnings surprise investors with news which is better than expected.

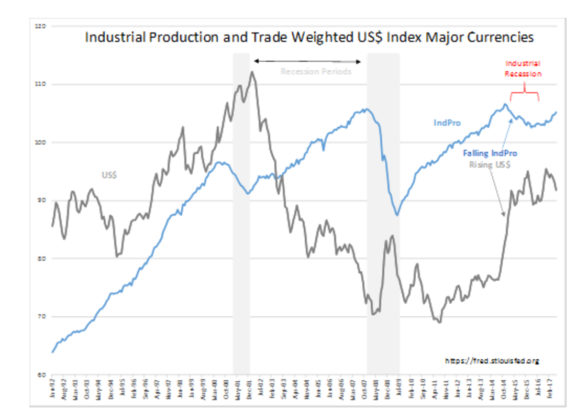

Along the way one can even see some of the details of economic activity as the strong US$ 2014-2016 created an industrial recession while the rest of the US economy chugged along. Weakening in the US$ has helped US exporters to exit recession and boost Industrial Production. The US economy is getting a 2nd wind.

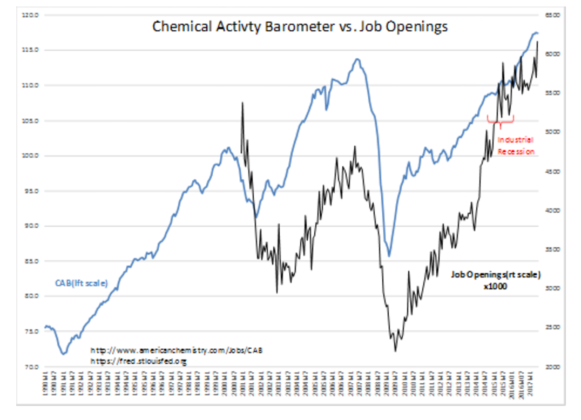

It can be seen that US Job Openings have picked up with the improvement in US Industrial Production.

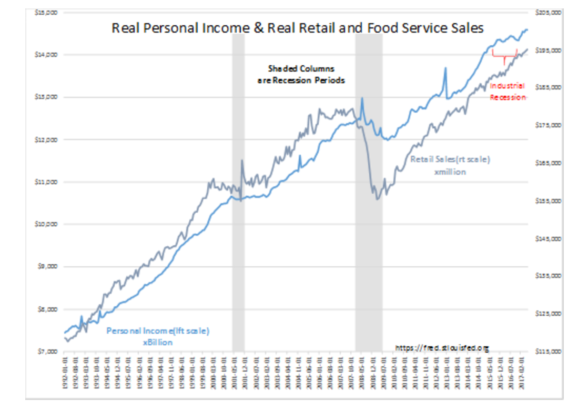

Rising employment has produced record Real Personal Income and Real Retail and Food Svc Sales. One never has a single economic measure shifting in an opposite direction to others. If there is an economic trend, then all indicators participate over the cycle.

Equity markets remain in an uptrend precisely because economic activity remains in expansion. The long-term trends not only reflect this relationship, but recent rises in employment related data tell us that equity markets should continue to rise the next few years.