“Davidson” submits:

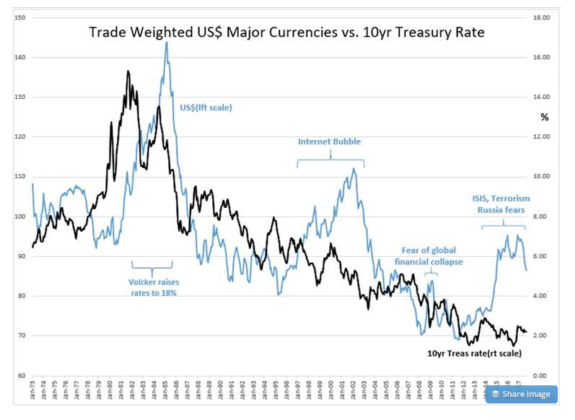

History shows that the rises in US$ occur with capital seeking better/safer returns. The early 1980s saw Volcker raise rates to quash inflation and capital shifted to the US. The late 1990s saw an Internet Bubble and capital sifted to the US. The 2008-2009 market collapse drew capital to US seeking a safety as did Russia’s 2014 invasion of Ukraine and the rise of ISIS and terrorism.

What we have seen is a rise in debt globally and a fall in 10yr Treasury rates to levels deemed ‘lowest in 5,000yrs’. Every event on this chart pushed capital to the US and drove 10yr Treasury rates ever lower. Emerging market investors have borrowed locally and transferred capital to Western nations espcially the US. Much of this has been a safety trade. It has overwhelmed the historical cultural expectations for investment returns. If the current administration’s actions improve safety for global capital, then we will see some of this flow reverse. But, it is likely that Western rates will be unusually low for an extended and upredictable period.

One needs to read the historical record and make the connections between policy decisions and investor responses over the long-term to understand trends such as these. The majority of investors are short-term and the media’s self-interest in promotion of short-term analysis reinforces misperceptions to cause and effect. If your perspective is long-term, then you can see how long-term policies impact markets even though you cannot predict them. Fortunately, long-term shifts are not only significant but they develop slowly which provides the perceptive investor to take advantage well before markets become aware.