“Davidson” submits:

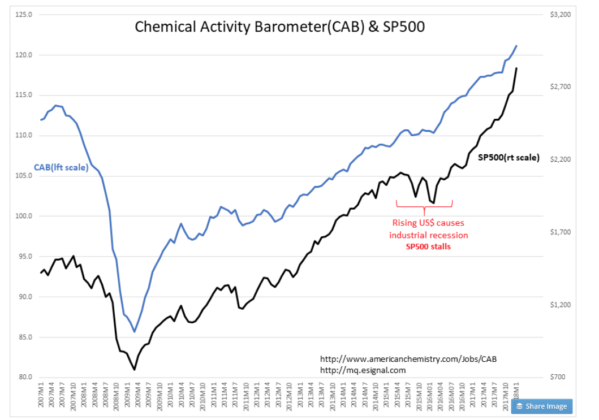

CAB reported at a new record of 121.13 with past few months revised higher. Economic activity is accelerating and equities should follow as they have done historically. Likely a 3yr-5yr period of higher equity markets based on recent reduction of regulations, tax reductions, US reemerging as protector of Democracy globally and a falling US$.

Contrary to accepted wisdom, a weaker US$ represents repatriation of capital back to Intl markets which in recent years had pooled in the US as a safe haven from predations of Iran, ISIS, Russia and etc. Fear of capital losses drove the US$ higher 2014-2016 by ~40% resulting in a US Industrial recession and collapsing commodity prices. Exiting this period, we are seeing a very strong recovery which spurs global economic expansion. The US$ still has ~25% fall to return to its long-term trend.

A falling US$ is positive for global economic expansion and rising global equity markets.

Upside should continue to surprise, markets should respond.