“Davidson” submits:

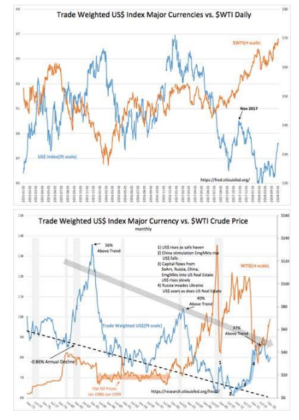

Capital shifts globally everyday seeking the highest returns which sometimes means avoiding a perceived higher level of risk. Just as in equity and fixed income markets, capital flows always occur after events become well known. Prominent capital shifts have occurred recently in the Trade Weighted US$ and oil prices($WTI). This is how policy changes/economic trends become translated into market prices as investor market psychology evolves in response. Depending on how far and for how long a particular price shift is extended it can result in an economic impact. The strong US$ 2014-2016 produced an industrial recession in the US. Today we have 2 shifts which may or may not produce economic impact which are based in part on recent policy shifts.

The US is shifting policy with respect to the Mid-East. It has been in the process of doing this since Jan 2017. While the US$ has been in decline since early 2017 indicating global investors have reversed earlier concerns, global investors have again shifted capital in response to today’s pending decision regarding Iran’s nuclear deal. The US$ has risen recently as they seek safety till the outcome is better known. The same type of shift occurred summer 2017 as verbal threats built regarding No. Korea. Then, the US$ rose to a near-term peak November 2017 before settling lower. The US$/$WTI levels have generally been inversely correlated since 2003 due to computer algorithms which correlate a stronger US$ with economic recession and lower $WTI(lower commodity demand/prices in recession). When these levels suddenly correlate, a shift in market psychology has occurred. Such shifts tend to be short-term and leave little lasting economic impact, but we can never be sure. The 2014-2016 shift was long and high enough to result in an industrial/commodity sector recession while we were in the middle of a broad economic expansion.

As investors, deciding on portfolio adjustments using near-term shifts in market price trends has always missed the larger and more important relationships. It matters to long-term portfolio performance what one selects for investment perspective. Long-term the US$ has been trending lower as US$ global trading relationships have grown and raised the currency values of trading partners. The gradual decline in the US$ since 1973 represents the spread of Democratic principles as well as standard of living improvements globally. The US$ decline has largely been brought about through technology exports by US companies, which are manufactured overseas and reimported. US consumers maintain access to older but still useful technology which has become too expensive for native manufacture such as air conditioners and Emerging Markets gain employment and access to technology which raises their standard of living. Those who call this ‘Capital Exploitation’ miss the societal benefits which occur in the process. Human thinking has a spectrum with some only seeing the big picture ‘Top Down’ themes at one end and miss the vital detail. At the other end are those who see the details. They are the ‘Bottom Up’ thinkers, but they miss the broader themes. If you can combine both perspectives, then one can see that near-term unpredictable shifts in prices which may or may not evolve into an economic impact are likely to give way to the larger and stronger economic driver of individuals seeking to raise their standard of living. The basis of ‘Capitalism’ is Democracy with a capital ‘D’.

The Investment Thesis:

The current strength in the US$ is likely to be short-lived. The current rise in $WTI likely has some short-lived aspect. Longer-term, global economic forces are likely to see the US$ lower and $WTI higher. Current trends in multiple economic indicators (covered in recent notes) speak to continued global economic expansion. The pace of this expansion is likely to surprise many by its strength. Recent earnings reports and forecasts for the next few years by well known and respected CEOs in multiple sectors remain very positive. The current gloom should dissipate fairly quickly.