“Davidson” submits:

Understanding where market prices are likely to be months and years ahead can only be anticipated by analysis of economic/business fundamentals. Market prices reflect investor psychology, i.e. market psychology. Investing requires anticipating shifts in market psychology. Most investors, especially those called ‘Momentum Investors, make their decisions well after positive or negative news is reported. Momentum Investors are ‘after-the-fact investors’. The economic trends which produce the news are typically 12mos or more in the making before they become news items.. Those who focus only on fundamentals are referred to as ‘Value Investors’. Value Investors tend to be ‘early-buyers and early-sellers’ capturing the early part of the cycle, but missing out on the period of excessive pricing which may represent the latter 1/3-1/2 of the full cycle. To invest through the entire investment cycle, one needs to be cognizant of the drivers of market prices for the full cycle.

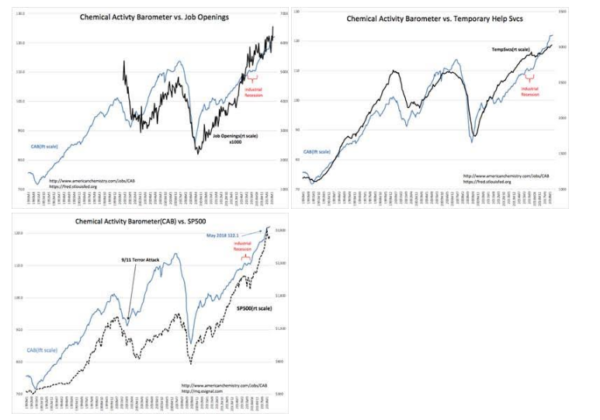

Today, market prices are mildly over-priced if one looks at the indices, but the Chemical Activity Barometer(CAB), Job Openings, Temp Help are at record highs and show no signs of stalling. We can anticipate that the financial news is likely to be more positive than most are currently expecting and that this should result in higher market prices the next 3yrs-5yrs. The current correction in the SP500, if you can call it that, is likely to be short-lived. (Retail Sales and Real Personal Income are also at records and rising)

The Investment Thesis:

Market prices are driven by market psychology which in turn is driven by economic/business fundamentals. Most investors are ‘consensus investors’ who buy on good news and sell on bad news. A focus on fundamentals alerts savvy investors well ahead to changes in market psychology and therefore market prices. Equity markets should continue to rise the next few years.

Policy is important for economic activity even though one cannot predict the precise outcome. The Job Opening data spiked to record highs likely on the new tax law. The regulation reduction begun last year is likely to provide benefits for many years. The adjustment to Dodd-Frank is likely to be only the first step in easing an overly tight lending climate. On the International front, messy progress is being made to make the world safer for Democracy. Should No. Korea and Iran policy initiatives result in a safer climate for Democracy, we can expect the current strength in the US$(US Dollar) to weaken. Should this occur, it would be more favorable for US exports and further extend the current economic expansion.

Much is working well for higher equity prices ahead. Best we can do is to watch closely.