“Davidson” submits;

Recession talk abounds. The media feeds fears that current conditions are leading to the next Great Depression. While some of this talk has abated, predictions of imminent recession continue to fly about at a fast and furious pace. Fundamental Investors have to question what is it advisors use to make these predictions. The conditions which preceded previous recessions are not present today. Most forecasts for recession are based on single economic reports and very much out of context with recent financial history.

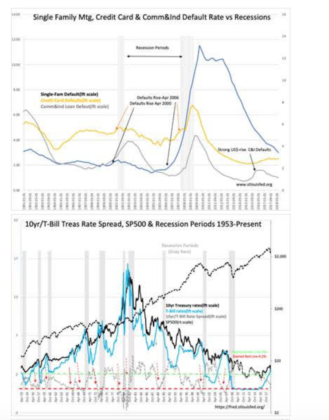

The data on Single-Family Mortgage, Credit Card and Commercial & Industrial(C&I) defaults is plotted from Jan 1991. The pattern this data presents is that Credit Cards are first to see a rise in defaults followed by Single-Family Mtgs and finally C&I. Intimately tied to this pattern is the T-Bill/10yr Treasury rate spread which acts as a proxy for lending by financial institutions. Credit Card defaults correlate to this rate spread falling below 0.20%. Lending margins drop and lenders become less inclined to roll-over outstanding credit card debt, which carries the highest risk of default, and defaults of those churning credit card accounts rises as lenders slow further credit extension. Eventually, the decline in credit extension impacts Single-Family mortgages and C&I as default fears continue to rise.

Note that Single-Family Mtg defaults today remain in sharp decline. The rise in C&I in 2015 and the follow-on rise in Credit Card defaults is the result of the strong US$ in 2014-2016. This created a period of low energy prices, weak exports sparking energy-related and manufacturing cos defaults. Employees in those industries were then furloughed and defaults rose in credit card payments. As corporations adjusted to this latest period of strong US$, C&I defaults have declined and continue in a downward trend. Credit Card defaults have flattened and very likely could follow C&I lower. Conditions never caused a rise in Single-Family Mtg defaults.

Recent global recession fears and tariff disputes lowered the 10yr Treasury rates which triggered some to panic as the T-Bill/10yr Treasury rate spread fell to 0.20%. Key to interpretation of this signal rests on the fact that this was a period of fear not one of market euphoria. Previous market peaks leading to recessions have always occurred after a period sustained investor euphoria. In addition, the SP500 Value Investor Index(not shown) was strongly positive this time as was Insider Buying activity(not shown). The T-Bill/10yr Treasury rate spread has since widened to 0.40% and likely to widen further as market optimism improves.

Net/Net: Economic conditions favor continued economic expansion and significantly higher equity markets from current levels. The recession potential for the next several years is quite low.