“Davidson” submits:

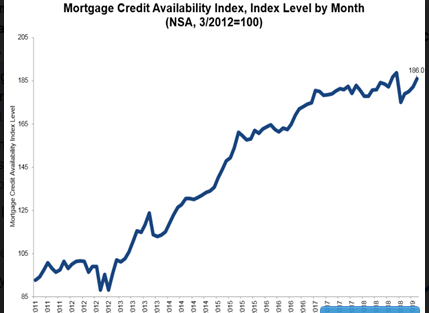

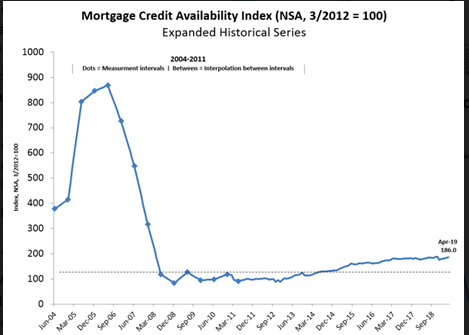

The MCAI is telling us that the current administration’s policy which began last summer to reduce onerous regs from Dodd Frank has begun to increase the credit flows to Single Family mtgs. We had a sharp drop in Dec when the HARP ended. The new FDIC Chairperson Jelena McWilliams sworn in last summer has acted to ease regs such that credit availability is now increasing at a decent pace nearly eliminating the drop due the end of HARP.

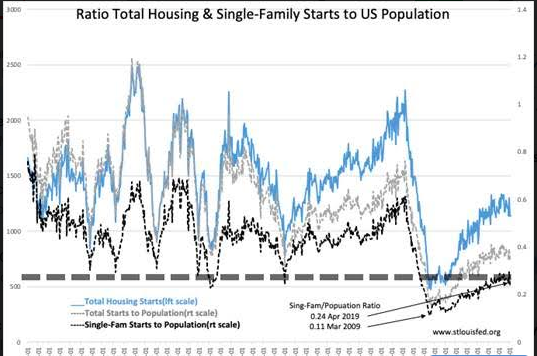

The current rise in MCAI is significant and should spur home building which has been well under ½ what one would have expected in a normal recovery. The MCAI should be closer to 400. It is currently 186 and rising. Even so, the ratio of Single-Family Starts to the Population ratio remains near the lowest levels of previous recessions having more than doubled from March 2009 lows 0.11 to 0.26 April 2019. The US has a significant Single-Family Housing shortage.

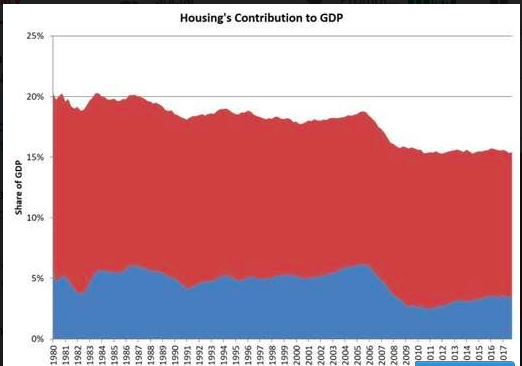

Just easing Dodd Frank a little can provide significant economic stimulus without adding traditional financial risks to our economy. Looks like this is occurring and the current economic cycle appears it may last another 5yrs. Housing activity represents 15.4% GDP currently historically averaging closer to 20%.

To access premium content, please follow this link