UPDATE

“Davidson”

If banks raise mtg lending to 1.4mil Single-Fam starts from current levels, we could see $160Bil economic stimulus each year for a long as 5yrs.

The math is current Sing-Fam starts 850,000/yr rising to 1.25mil/yr is 400,000 units x $500,000 = $200Bill/yr.

There is a multiplier in the economy as capital flows through housing into vehicles, furnishings and on into recreation and retail sales of every type. Current levels of housing of Real Private GDP is 15.4% with 1.235mil total starts(multi-fam and single-fam) . Let’s say we move housing back to 20% of Real Priv GDP, then the current 0.45 fraction of GDP could move to ~0.6 and a 3% GDP measure could rise to 3.15%. This is just on housing moving towards historical demand.

As an economic driver, this would be substantial.

ORIGINAL POST

“Davidson” submits:

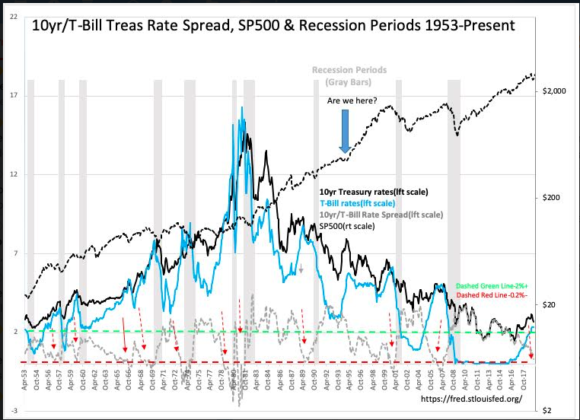

We could be in the same conditions as 1995 just before the Internet Bubble. The Internet Bubble began with capital flows generated by the Community Reinvestment Act 1995 leading to the subprime crisis 14yrs later. This time Dodd-Frank has constricted mtg lending so much that we have been at half-pace the historical rate of 1.4mil Single-Family Starts.

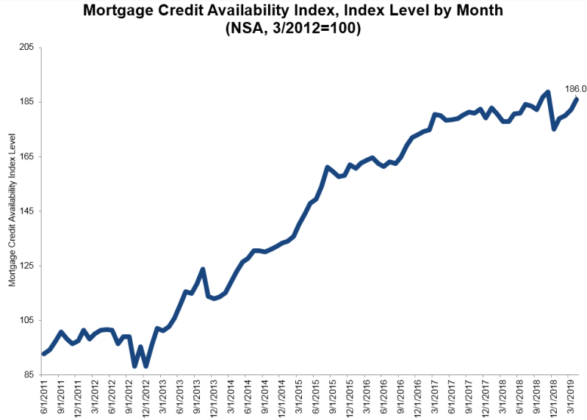

Should we see regulation relief and the MCAI begin to hit a series of new cycle highs (currently 186), the shift to higher bank mtg lending could prove similar to the beginnings of 1995.

This could prove a huge rise to the SP500 and this time Value Stocks would be propelled to all time highs.

We need to watch the MCAI next several months to confirm.

To access member-only content FREE for 5 days, follow this link