“Boring” can be so profitable…..

“Davidson” submits:

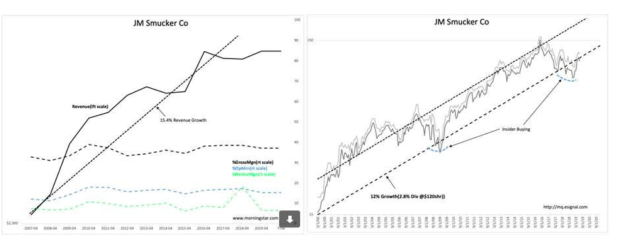

JM Smucker(SJM) is reiterated as a portfolio suggestion. Every suggestion is always a work in progress. SJM is no exception with investors confused about the current transition. SJM has a long history of successfully managing consumer food Brands and recently expanded in the pet food arena. In the past 10yrs Revenue has compounded more than 15% annually while Gross, Op Inc and Net Income margins have been rising steadily. Recent price correction is due to the sale of SJM’s lower margin bakery business and the acquisition of the pet food business makes it appear that revenues have stalled. Typically, business transitions create uncertainty and depress investor interest. Newer product offerings reflect higher growth opportunities. Newly introduced products required a faster ramp in capacity than anticipated which temporarily lowered margins. A problem every company would like to have to deal with.

From the 4QFY18 Earnings Press Release:

Mark Smucker, Chief Executive Officer said, “While fourth quarter adjusted earnings per share was below our projections due to industry-wide headwinds and certain discrete items, the actions we are taking to align our portfolio for growth set up our business to win. In the past few months, we brought 1850™ premium coffee and Jif® PowerUps™ snacks to market, innovations created in response to changing consumer preferences. We acquired Ainsworth, thereby strengthening our pet food portfolio with the addition of the high-growth, on-trend Rachael Ray® Nutrish® premium pet food brand.”

From the 4QFY19 Earnings Transcript:

“Fiscal 2019 was another successful year for the company, as we executed against our three growth imperatives, leading in the best categories, building brands consumers love and being everywhere, and continued to undergo significant transformation aimed at better aligning our portfolio and products towards consumer trends and preferences, while positioning our company for sustainable long-term growth.

This was done in several ways over the past year. First, we continued to reshape our portfolio including the successful acquisition and integration of Ainsworth Pet Nutrition, which achieved year-over-year sales growth of 20% and the divestiture of our U.S. baking business, allowing us to increase our focus and resources on higher growth categories.

Second, our strengthened approach to innovation delivered $420 million of net sales from products launched in the last three years, including contributions from 1850 coffee and Jif Power Ups, as both platforms ranked in the top quartile of all food product launches this past year.

Third, we improved our organization’s operating model by consolidating our geographic footprint, unlocking cost savings and significant capability enhancement as our teams are now more agile.

Fourth, we implemented our Power of One marketing model, which aims to improve the quality of our consumer engagement and increase productivity, while yielding cost reductions that will fund new investments and future growth.

Fifth, we achieved our cost management goals, including the first full year of our right spend program, which delivered $30 million of savings.

And finally, we continued to take intentional steps in developing our people and culture, and are committed to fostering a unique environment where our employees can thrive and grow. It is through this execution against our strategy that we have laid the foundation for our long-term success.

The desired results began coming to fruition in fiscal 2019, particularly through increased momentum in the back half of the year, as our financial results included, net sales growth of 7% to over $7.8 billion, adjusted EPS of $8.29, well exceeding our guidance range of $8 to $8.20, and free cash flow of $781 million, also above our most recent expectations of $700 million to $750 million, we increased our dividend by 8% and repaid over $800 million of debt during the fiscal year, while reinvesting in the business.

Turning to our fourth quarter results, we continue to position our business for growth and execute on key priorities during the quarter and are pleased that we are beginning to see results from the initiatives and the investments we have made over the past few years.

Net sales increased 7% compared to the prior year driven by the acquisition of Ainsworth. Excluding the acquisition, divestiture of the U.S. baking business and foreign exchange, net sales were in line with the prior year.

Our growth brands grew 16% in the quarter led by Nutrish, Dunkin’ and Cafe Bustelo. Our leading and core brand sales declined slightly, primarily due to planned lower pricing for the Folgers brand corresponding with coffee commodity prices.

Adjusted gross profit increased 7%, which provided fuel to reinvest in our brands through increased marketing. Total marketing spend was up $35 million compared to the fourth quarter of last year, reflecting the addition of Ainsworth and approximately $15 million of incremental support behind our coffee and snacking innovation.

Adjusted earnings per share outperformed our expectations growing 8% driven by a lower tax rate. In addition, our earnings performance reflects contribution from the Ainsworth acquisition, achievement of acquisition synergies and cost reduction goals, including expense management through our right spend program, while continuing our commitment to increase investments in our brands.”

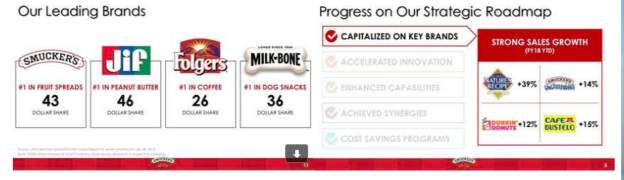

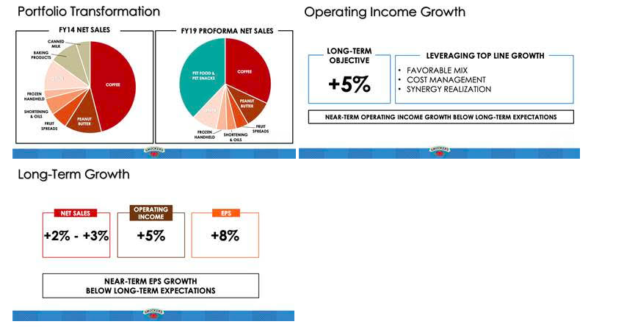

SJM’s 2018 Analyst Presentation outlined growth initiatives and additional cost savings of $450million which imply Gross Margins currently at 38.5% could rise to 45% by 2020.

http://www.jmsmucker.com/investor-relations/company-calendar/details/5267951

From the Feb 20, 2019 Consumer Analyst Group of NY Presentation:

https://jmsmucker.gcs-web.com/static-files/415e28d6-fc21-4cbd-aa7b-d3cdb70640ca

SJM’s 12yr Morningstar Revenue and Margin growth have produced an attractive share performance which appears much more attractive with the recent correction.

The Investment Thesis:

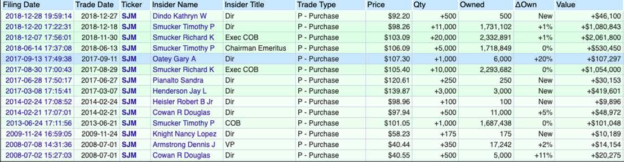

SJM has recently sold a lower margin bakery business (Aug 2018), launched new products and entered new markets. Investors should expect that there will be a resumption of historical financial performance. A positive investor response is likely to follow. The potential for investors is a share price which is currently $120shr could be repriced over $200shr in a few years.

Every investment requires an assessment of management’s abilities to achieve their stated goals. The underlying question which must be answered is “Do I believe them?” An affirmative analysis makes SJM an equal position recommendation in a portfolio of 50 similar positions. Each recommendation is always a work in progress.