“Davidson” submits:

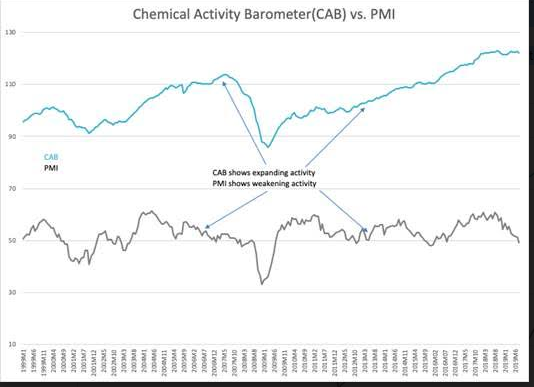

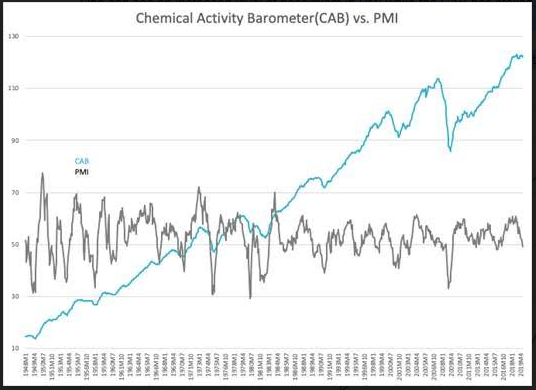

Many take the PMI as a measure of manufacturing activity when it is in fact a survey of manufacturer psychology. The CAB is mostly hard data measures of economic activity but does include chemical producer equity prices which shift with market psychology. If one looks carefully, the PMI calls for slowing activity when the CAB indicates rising activity. Mind-over-matter!

Many use the PMI because they do not know how to use economic data. They believe ‘how people feel’ is more important to predicting future economic activity than trends in economic activity. The PMI often misinforms investors and often responds after the hard data has turned.

One can see an increased level of pessimism in PMI while the CAB has stalled. Other measures like the Trucking Tonnage recently reported a new high as has employment, retail sales, personal income and etc.

Hard data trends are the only way to judge economic activity but we keep substituting stuff which is based on market psychology such as oil prices, copper prices (Dr. Copper), equity prices and etc.