“Davidson” submits:

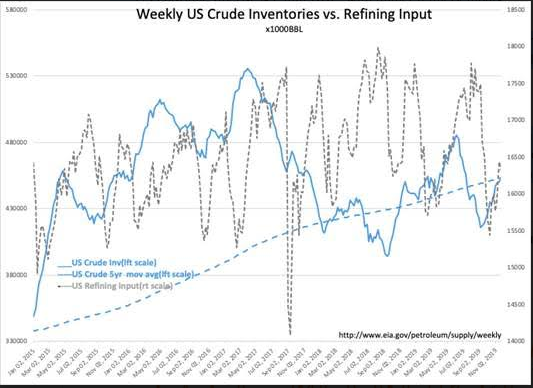

- US Crude Production remains at record 12.9mil BBL/Day but US Crude Inv fall 4.9mil BBL(~6.4mil BBL below 5yr mov avg)

- US Refinery Inputs rise to ~16.8 mil BBL/Day, but remain near lower trend level

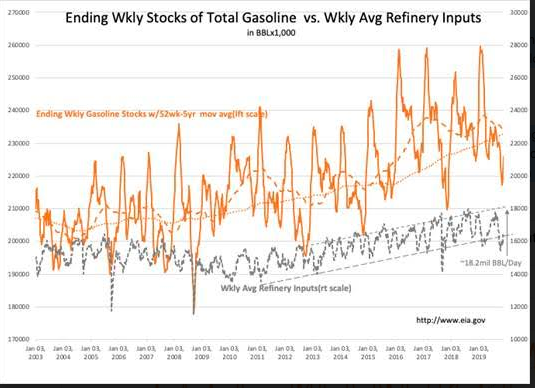

- US Gasoline Inv rise ~3.5mil BBL with higher refinery inputs

It appears we are exiting the fall shut-down period and refining inputs are rising which in turn cause a rise in gasoline inputs. US continues to produce crude at record levels, but draws bring inventories to a net 4.8mil BBL below the 5yr mov avg for US Crude Inventories.

$WTI prices have fully recovered from Friday’s 4% decline to $58.20/BBL.

This could be the start of a sustained decline in US Crude Inventories till the Spring shutdown period. Traders typically trade $WTI higher with US Crude Inv levels below the 5yr mov avg. It will take several more reports before a clear trend is observed. If a $WTI uptrend occurs with accompanying improved perception of the US and global economic activity (which appears to be developing), then a sizable rise in $WTI is to be expected.