I still maintain that the risk to oil price is significantly higher, not lower in the coming year. Drillers have “found Jesus” so to speak and are focusing on cash flow and cap-ex has collapsed. This means those under the opinion Shale drillers can simply turn on a spigot when oil prices rise, are sorely mistaken. First, due to the cap-ex collapse, they will not be able to and second, with the renewed focus on cash flows, they may not WANT to.

Here is a great video on the oil situation looking out a year or two.

“Davidson” submits:

- US Crude Production 12.8mil BBL/Day

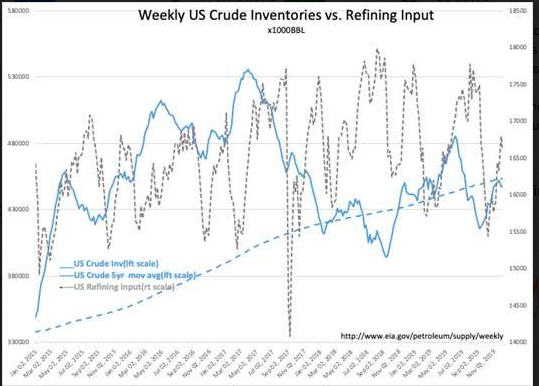

- US Crude Inventories rise 0.822mil BBL-~6mil BBL less than the 5yr mov avg

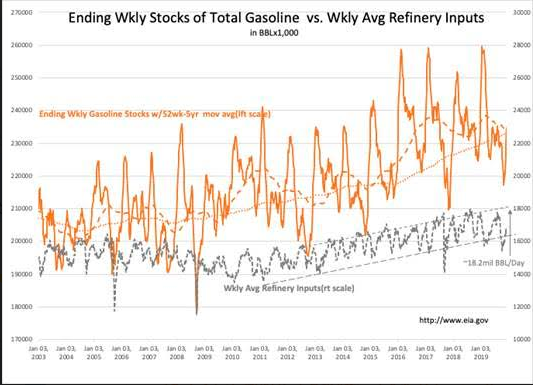

- Refining Inputs fall 0.1mil BBL/Day, but Gasoline Inv rose ~5mil BBL

Investors have been pricing $WTI in the high-$50s/BBL as market psychology becomes more positive. This morning’s report dropped $WTI by $0.50-$1 with some having expected inventories to be less than reported. The data-errors in gathering information for this report make the accuracy of Crude Inventory changes of even 2-3mil BBL on a base of 450mil BBL suspect. What is important are the larger trends over several years despite the high variability of seasonal fuel-blend changes which make the weekly data so confusing to short-term traders.

Key economic trends of Employment, Personal Income, Retail Sales and etc continue to describe continued economic expansion in the face of many forecasting recession. As investors gradually come to accept that the US economy remains in its uptrend, $WTI is likely to price higher.