We here have long maintained oil was going higher….not lower.

“Davidson” submits:

- US Crude Production steady 12.8Mil BBL/Day

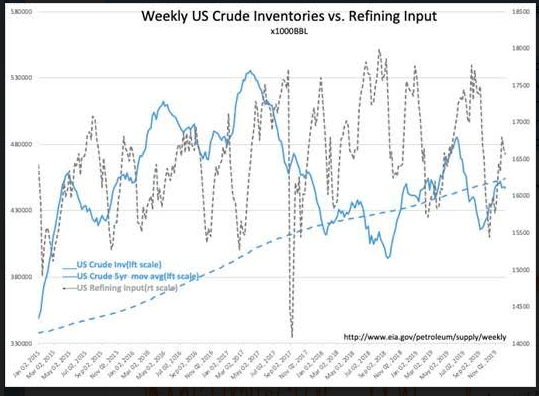

- US Crude Inv fall ~1mil BBL leaving inventories 7.4mil BBL below the 5yr mov avg

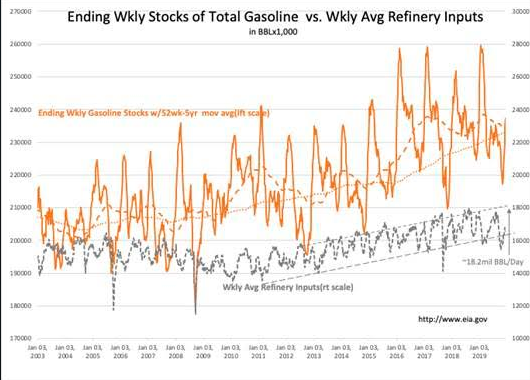

- US Refinery Inputs drop 140,000 BBL/Day on an outage, but Gasoline Inv continue to rise towards seasonal Spring levels

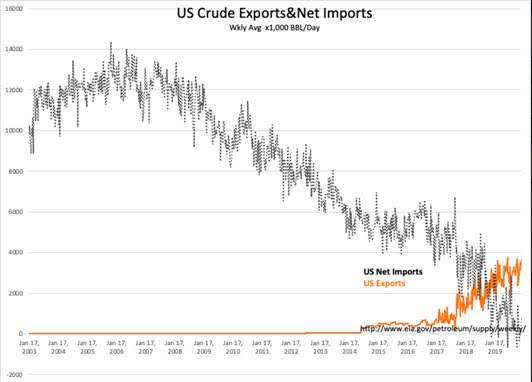

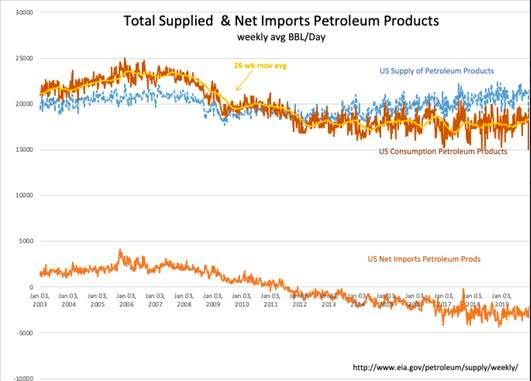

US Crude Inv remain higher than one would expect at this point in the year as Refinery Inputs remains near the lows of the historical trend. The industry is dynamic with imports of crude and refined products at certain ports and exports at other ports the balance dependent on many variables. It appears that US Crude and Refined Products Exports have held steady the past 12mos. Volatility in the weekly reports has made this emerging change in trend difficult to visualize till enough data is in hand. The condition remains that on balance the US is a slight net exporter of crude oil in 2019 and has been a net exporter of refined products since 2011.

EIA global data reported monthly indicate 2019 has shown no change of production/consumption growth at 1.74% annually. If one looks carefully, there is a down-trend in US Refining Input since Aug 2018 which is somewhat reflected in gasoline inventories. This shift can be attributed to higher than expected crude inventories on which many traders focus for oil price direction. Meanwhile, even with crude inventories not falling as much as anticipated, oil prices continue to drift higher as investors come to realize economic activity is far better than perceived even 3mos ago when recession fears were rampant.