“Davidson” submits:

- US Crude Production remains 12.9mill BBL/Day(Crude Imports rose 0.6mill BBL/Day)

- Refinery Input falls 0.4mill BBL/Day

- US Gasoline Inv rose ~9mill BBL(US Exports fell by 0.5mill BBL/Day)

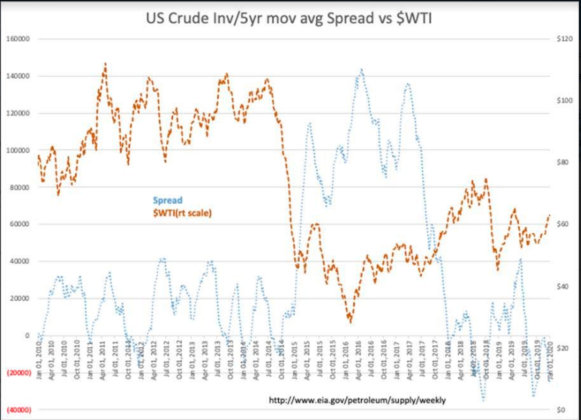

- Crude Inv rise ~1mill BBL, remains ~24.1mill BBL below the 5yr mov avg

Within the EIA data, this week’s report is unchanged. Always part of these reports is an ‘Unaccounted BBL’ measure which one should read as a statistical error factor. The crude inventory levels for the US carry an error factor of =/- 4mill-5mill BBL or about 1% of the 430mil BBL US Crude Inventory(the Strategic Petroleum Reserve excluded) reported this week.

Every market cycle has its own unique non-repeatable market psychology. In the 2010-early-2014 period, a 12mill BBL negative spread to the 5yr mov avg was sufficient to keep oil prices elevated in the $100/BBL range. Today, a 24mil BBL deficit when traders still think an ‘oil glut’ exists, does not have the same immediate impact. As the data reported demonstrates, US Production and Refining and imports/exports are in constant flux. In any week, a capacity outage may be offset by higher imports or a reduction of inventories from the previous period depending on a combination of short-term and long-term considerations. Trader reactions to a million BBL change in either direction when the error factor is several times this level demonstrates little real comprehension of the significance of this data.

In my opinion, traders more likely than not should gravitate towards thinking we have less supply vs consumption if US Crude Inv continue the current discount to the 5yr mov avg. Current market psychology carries a decent level of economic pessimism which colors oil price expectations. This will improve should economic reports continue to be more positive than expected. Economic trends remain quite positive and higher oil prices should follow as should higher equity prices. In particular, energy related and industrial issues have been depressed since 2014. Any market psychology shift towards optimism will lift these long out of favor sectors