“Davidson” submits:

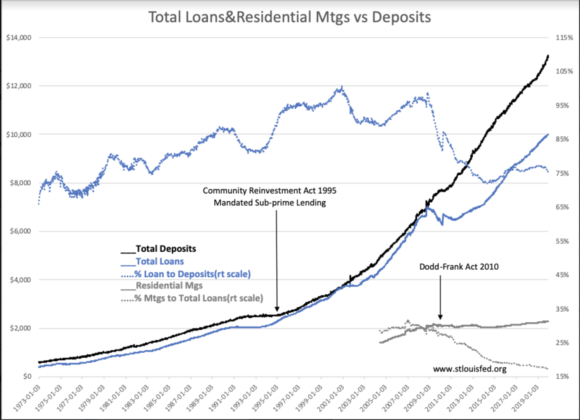

The history of bank lending vs deposits shows a gradual increase from under 70%(bank reserves 30%+) to a 1990 peak of 89% which then pulled back to ~80% with the scare of the financial crash in 1987. As the next cycle began, Congress passed the Community Reinvestment Act 1995 to force banks to lend to Sub-prime borrowers. The goal was to reduce poverty through advancing the percentage of home ownership to those with poor credit histories. The underwriting rules were eased several times resulting in more than 98% loan/deposit ratio coinciding with the peak of the ‘Internet Bubble’ in 2000 and then revisited this level in 2008 in what is now called the peak of the ‘Sub-prime Housing Bubble’. A 98% loan/deposit ratio leaves almost no daylight for underwriting errors even if there is a 0.0% default rate. This social engineering effort failed and the rest is history.

In response to correct but not admit their earlier errors, Congress proceeded to blame financial institutions and enact Dodd-Frank in 2010 which demanded higher reserve requirements and onerous mortgage lending rules. The next economic expansion began in 2009, but loans as a percentage of deposits fell below 75% or to levels in last seen in the late 1980s. Mortgage lending for Single-Family homes which had represented ~30% of Total Loans in 2004 have fallen to ~15% today, or half what is deemed normal(without sub-prime speculation) for a cycle.

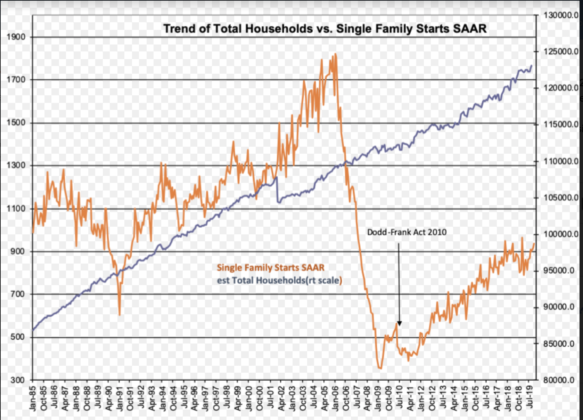

This is a history of one bad policy, the Community Reinvestment Act 1995, being followed by another bad policy, Dodd-Frank 2010, in an overcorrection leaving the US with a well know Single-Family housing shortage. From 1985 till 2005, Single-Family housing starts tended to keep pace with Household formation. After Dodd-Frank, starts fell sharply and have widely underperformed household formation trends.

The current administration has stated that Dodd-Frank reform is in process. As yet there is no sign things have changed.