When people talk of “market euphoria”, it just isn’t really true…. there are dozens of examples like this out there.

“Davidson” submits:

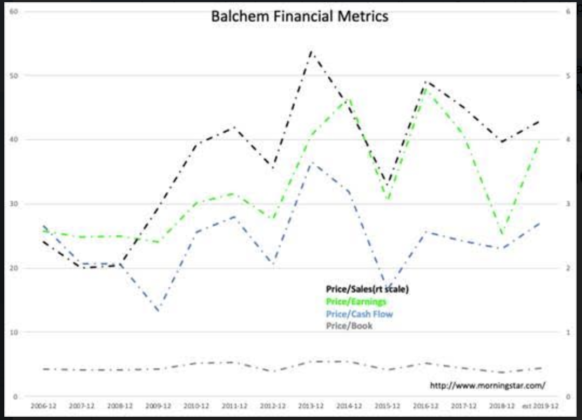

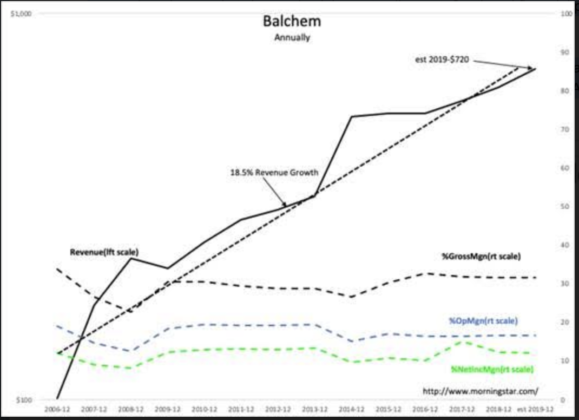

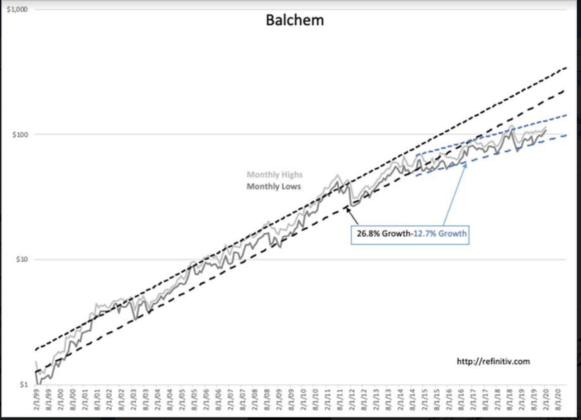

This market has been different than markets in the past. Balchem(BCPC), a portfolio suggestion, is a good example of what has occurred. BCPC’s share price has severely underperformed its previous history since 2015. Yet, there has been no material change in its Revenue growth or business margins which remain at high levels. What has occurred is a repricing of past financial metrics to lower Pr/Sales, lower Pr/Cash Flow and etc because of a change in market perception.

BCPC is a chemical manufacturer supplying human and animal nutrition products which they often encapsulate designed to improve bioavailability at specific areas of the digestive system. A portion of their business supplies ‘fracking’ chemicals. It appears that the oil price decline in 2014-2016 has changed the market perception of BCBC resulting in lower pricing of its growth metrics. BCPC is not alone with changed perceptions. There are many companies with good records with similar repricing discounts.

The power of market psychology on pricing corporate performance is unpredictable even if one is able to identify well-operated companies. Just the same, the investment process which makes the most sense in my opinion (because it is based on identifying sound mgmt performances) is to invest in the BCPC-type companies when markets have priced them at a discount. Continued financial performance should result in repricing eventually back towards former pricing metrics.

Many chase the price-trends of TSLA, NFLX and FAANG-type issues which may not produce Net Income for a decade or more. These issues are often priced at extreme multiples of revenue which lack common-sense economic returns. All market pricing is through market psychology. Eventually, companies such as BCPC return to historical pricing if the financial performance continues.