“Davidson” submits:

Job Openings data from the Bureau of Labor rose as companies scrambled to add employees to deal with the impact of the coronavirus. Demand for individuals to improve service, sanitize surfaces, deliver needed goods, restock heavily in demand items has to some degree offset the drop of nearly 3mil employed in the Household Survey.

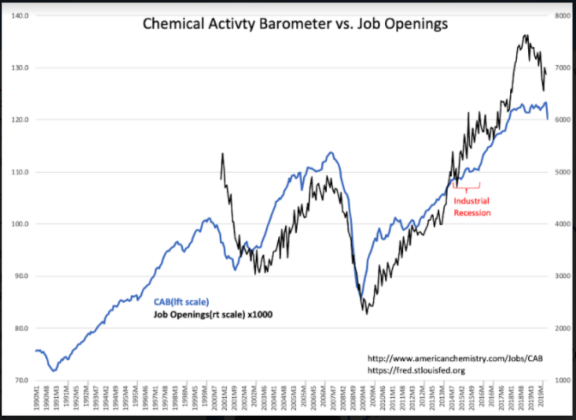

Job Openings data is more a measure of market psychology, i.e. business intentions to hire, not on the same level an actual economic activity measure of individuals employed fulltime or as Temporary Help. It is useful in assessing economic direction when other measures have a trend. With the current employment trend in a sharp decline, Job Openings data are more descriptive of the current disruptions than implying future economic activity.

What is more significant regarding the coronavirus has been the significant reductions in expected illness as we gain experience. The global Covid-19 data link: https://google.com/covid19-map The initial fears of 80% infection rates widely accepted have been replaced with numbers of cases below 1% per million. Multiple countries have seen new illnesses peak and globally multiple treatments have emerged as healthcare systems have been energized. The statistics while still unfinished with Covid-19 spell-out an illness which is much less threatening than earlier thought. The has been considerable misinformation which continues to be repeated in the media. Separating facts from speculation does take some time, but doing so with wide distribution of factual information and commons sense action to protect the more vulnerable should let us reopen the US economy fairly quickly.

In this environment of misinformation, equities are grossly underpriced in my opinion.