“Davidson” submits:

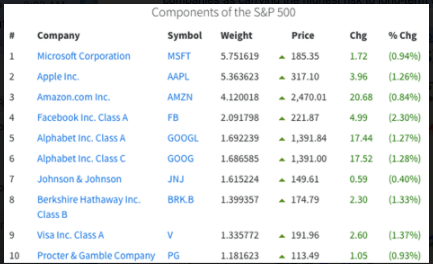

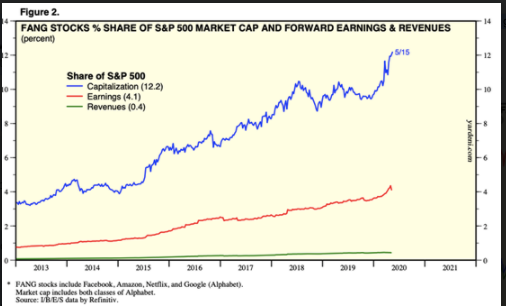

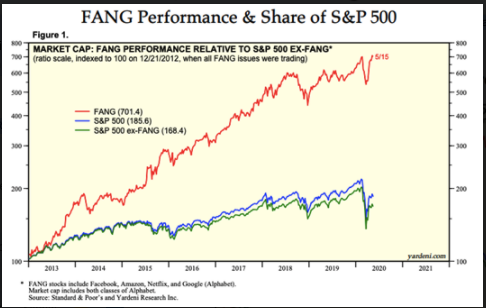

Ed Yardeni routinely posts the disparities of pricing in the SP500. Most analysts speak of the SP500 as representing ‘The Market’ and compare individual share performance relative to this index as the measure of how well a company is performing financially. This is the ultimate in price-trend following and highly deceptive misinformation comprising the bulk of daily media commentary. The latest data shows that FANG stocks, representing Facebook, Amazon, Netflix and Google(traded as 2 separate companies, have returned to pre-COVID-19 levels. The SP500 w/o FANG performance stands well below pre-COVID-19 levels. The examination of market capitalization with earnings and revenue shows FANG representing ~21%+ of the SP500 but 4% of the earnings and 0.4% of the revenue. This is not to say that FANG issues do not have earnings and revenue, but that the over-pricing relative to other SP500 issues is extreme. Such mispricing is typical of the Momentum Investing price-trend following approach which justifies itself by saying they promote these issues because “the market action tells us that these are the shares to own”. The daily ranking of market capitalization for the top 10 issues is available at the slickcharts link.

Ed Yardeni routinely posts the disparities of pricing in the SP500. Most analysts speak of the SP500 as representing ‘The Market’ and compare individual share performance relative to this index as the measure of how well a company is performing financially. This is the ultimate in price-trend following and highly deceptive misinformation comprising the bulk of daily media commentary. The latest data shows that FANG stocks, representing Facebook, Amazon, Netflix and Google(traded as 2 separate companies, have returned to pre-COVID-19 levels. The SP500 w/o FANG performance stands well below pre-COVID-19 levels. The examination of market capitalization with earnings and revenue shows FANG representing ~21%+ of the SP500 but 4% of the earnings and 0.4% of the revenue. This is not to say that FANG issues do not have earnings and revenue, but that the over-pricing relative to other SP500 issues is extreme. Such mispricing is typical of the Momentum Investing price-trend following approach which justifies itself by saying they promote these issues because “the market action tells us that these are the shares to own”. The daily ranking of market capitalization for the top 10 issues is available at the slickcharts link.

The argument made by Value Investors against the Momentum Investor approach is that they are operating through circular reasoning. To buy shares because they are in a rising price trend causes the price trend itself to rise which justifies buying more shares. Huh? Momentum Investor reasoning does not include their own investing behavior as causing the price trend. Price trends continue till market psychology deteriorates enough that they are no longer supported.

Compare what FANG issues represent to Wabtec(WAB) which has a far longer price history (20%+ compounded) representing rising Gross, Operating and Net Income Margins and more than 12+ years of 17% revenue growth coupled with a sizable increase in insider buying. WAB has yet to rebound much at all. When analyzing SP500 performance long term, it is the 21% performance of companies like WAB which drive this index through multiple cycles vs. the SP500’s long-term 6.1%. This means that the FANG issues do not hold up from cycle to cycle as they never produce real value creation in terms of shareholder equity growth per share as do companies like WAB. FANG issues this cycle are literally spending all their cash flows (and then some) to build revenue on which most judge investment viability.

It is through comparison of the market’s divergence in share pricing vs. fundamentals that we identify Momentum Investing and the issues favored by this form of investment judgement vs. Value Investing and the basis of fundamental analysis. Long-term Value Investing performs well but most investors miss this perspective when markets are in a frenzy driven by Momentum Investors. Assuming that market performance vs. individual issue performance, called Relative Performance, is how one achieves the better outcomes is what drives more and more investors and portfolio managers into the same few issues driving the SP500. The term is FOMO (Fear Of Missing Out). Value Investors are more concerned with long-term risk to investment capital than chasing short-term performance.

The recommendation remains to buy equities. Many issues like WAB are unusually discounted vs. fundamentals and represent exceptional investment opportunities. Avoid indexing and favored Relative Strength issues such as FANG-type companies as carrying the highest risk to long-term capital growth.

https://www.yardeni.com/pub/yardenifangoverview.pdf

The argument made by Value Investors against the Momentum Investor approach is that they are operating through circular reasoning. To buy shares because they are in a rising price trend causes the price trend itself to rise which justifies buying more shares. Huh? Momentum Investor reasoning does not include their own investing behavior as causing the price trend. Price trends continue till market psychology deteriorates enough that they are no longer supported.

Compare what FANG issues represent to Wabtec(WAB) which has a far longer price history (20%+ compounded) representing rising Gross, Operating and Net Income Margins and more than 12+ years of 17% revenue growth coupled with a sizable increase in insider buying. WAB has yet to rebound much at all. When analyzing SP500 performance long term, it is the 21% performance of companies like WAB which drive this index through multiple cycles vs. the SP500’s long-term 6.1%. This means that the FANG issues do not hold up from cycle to cycle as they never produce real value creation in terms of shareholder equity growth per share as do companies like WAB. FANG issues this cycle are literally spending all their cash flows (and then some) to build revenue on which most judge investment viability.

It is through comparison of the market’s divergence in share pricing vs. fundamentals that we identify Momentum Investing and the issues favored by this form of investment judgement vs. Value Investing and the basis of fundamental analysis. Long-term Value Investing performs well but most investors miss this perspective when markets are in a frenzy driven by Momentum Investors. Assuming that market performance vs. individual issue performance, called Relative Performance, is how one achieves the better outcomes is what drives more and more investors and portfolio managers into the same few issues driving the SP500. The term is FOMO (Fear Of Missing Out). Value Investors are more concerned with long-term risk to investment capital than chasing short-term performance.

The recommendation remains to buy equities. Many issues like WAB are unusually discounted vs. fundamentals and represent exceptional investment opportunities. Avoid indexing and favored Relative Strength issues such as FANG-type companies as carrying the highest risk to long-term capital growth.