“Davidson” submits:

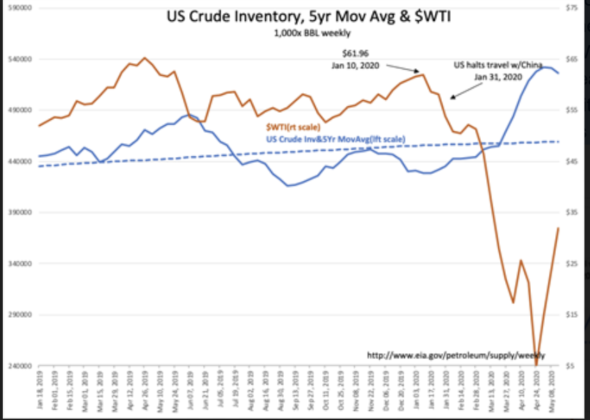

Looking at the details, the higher $WTI pricing becomes evident.

- US Crude Production has fallen to 11.5mil BBL/Day

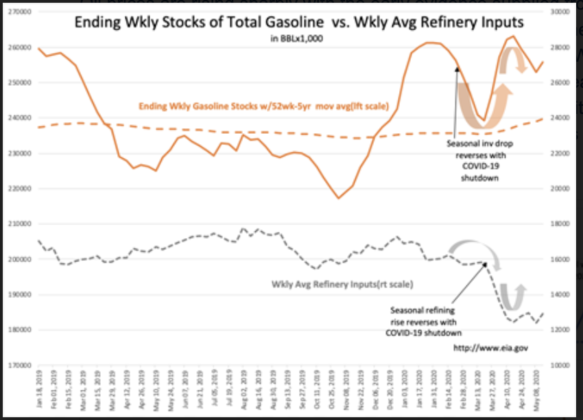

- Exxon restart refinery-Refinery Inputs rise

- Gasoline Inv rise a little but US Crude Inv falls ~5mil BBL

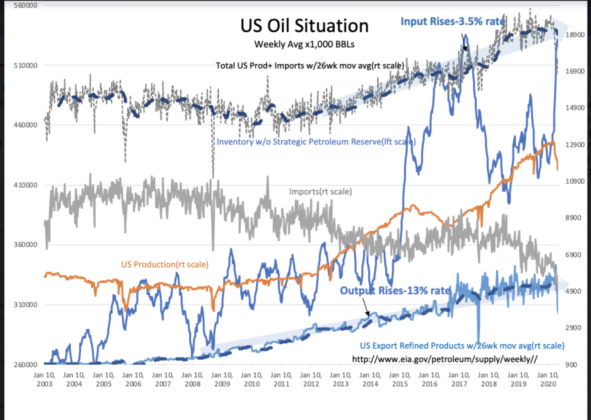

Oil prices are rising sharply with the early evidence supplied from Initial Unemployment Claims falling rapidly below peak levels. Market psychology improved quickly. Following this Apple released the Apple Mobility Trend data showing an uptrend which soared in the last release. Market psychology improved yet again and pushed $WTI higher more on surprises in improved economic activity and travel than on US Crude Inv levels. Last week revealed US Crude Inv had peaked with a 0.75 mil decline-a very small drop with 526mil BBL Crude Inventory. This week the drop is just under 5mil BBL and definitely revealing a trend when viewed in conjunction of US Crude daily production 1.6mil BBL/Day below peak. US Net Crude Imports have risen a little to 1.96mil BBL/Day but still more than 50% lower than the pre-COVID-19 41mil BBL/Day