This is why the “rig count” data matters less every day.

“Davidson” submits:

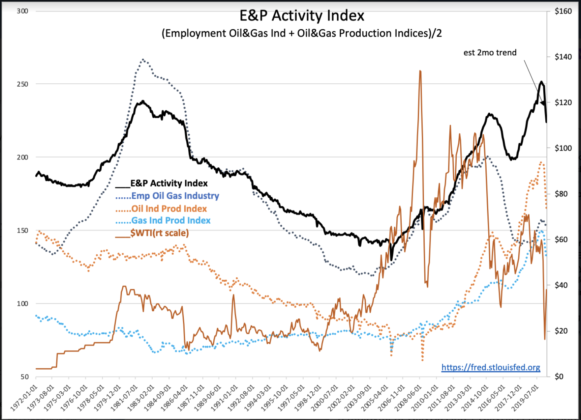

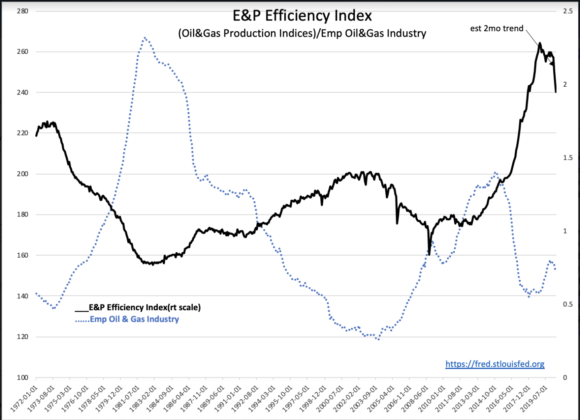

The updated E&P(Oil and Gas Exploration&Production) Indices lag conditions in the industry by 2mos. As expected both reflect the downturn due to the imposition of a nationwide shutdown in response to COVID-19. The level of activity follows $WTI prices which is the basis of Cash Flows but dependent on consumption. Both, consumption and $WTI pricing has recovered significantly in May/June. $WTI, sensitive to market psychology, has recovered to levels still 1/3 below Dec 2019 levels near $60/BBL. Consumption levels for oil remain ~15% below and for gas ~11% below Dec levels (2mo delay in data). Consumption levels are uncorrected for seasonality or weather related issues.

Market psychology has a significant price impact to fossil fuel pricing beyond production/consumption. In the past, fear of rising global demand vs declining supply drove $WTI to $140+/BBL without any actual declines in production or shortages. There have been price shifts as market psychology sought to counter perceived impacts of inflation, economic activity or exchange rate shifts vs global currencies. More recently ESG(Environmental, Social, Governance) thematic investing has shifted investors away from fossil fuels and towards perceived to be less ‘carbon-based’ energy sources. Investors desire to be politically correct have ignored the significant decline in CO2 emissions which has occurred as natural gas has replaced coal for electric generation. Also, ignored has been the efficiencies attained by transportation sector whose fuel use (Motor Gasoline and Distillate Fuel) has barely increased with a 400%+ growth in Real US GDP. The US is the only country with declining CO2 emissions with current levels last seen 1990, 30yrs ago. Little recognition has been given to the significant US technological innovation and the rise in ‘Lean Business Processes’ which are responsible for US maintaining global competitiveness even with globally uneven tariff structures as barriers to export, non-existant labor protections dramatically undercutting US labor costs, protections to private property and patents and lower costs from far fewer environmental protections.