There are a ton of stocks at obscene levels as people were thinking “work at home” was going to be the new normal. It isn’t and it just can’t be for a host of reasons. Americans will not stay locked down forever and those companies who have spent and built-out as if we are seeing a fundamental permanent change in the way people work I think got out over their skis so to speak.

Just look at the insider selling at places like Zoom, I’d say even they realize this.

‘Davidson” submits:

With Pfizer’s vaccine announcement of 90% effective (a level which has wiped out smallpox) and multiple other vaccines on the verge of reporting investor perceptions are in the process of changing rapidly. The investments over-favored by the COVID-19 have begun to decline while equities mostly ignored since April 2020 have begun to receive investor attention. Some like Cooper-Standard(CPS) rose 100%+ in recent days.

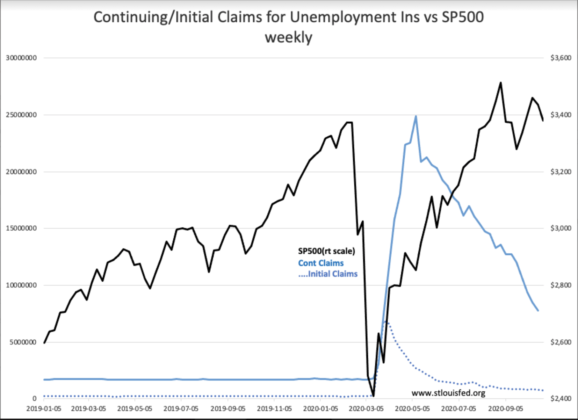

Getting the US population back to normal work activity has in fact been occurring rapidly since May 2020 Continuing Claims for Unemployment Insurance peaked just shy of 25mil. Today’s 7.75mil range represents close to 70% return to work. The evidence of recovery has been evident weekly since May but market themes have been severely one-sided in the media, favoring a select few issues believed to be ‘high growth’ and singly favored by the COVID19 lockdown. The evidence to the contrary has been mostly ignored till Pfizer’s announcement.

Some have discounted Pfizer’s “90% effective” as ill-defined. These opinions have been heavily featured in the media. This type of discussion casts severe doubt on what exactly Pfizer means. Commonsense dictates that Pfizer reporting a high level of illness prevention with a strong safety profile (94 illnesses out of 44,000 individuals in the study) is subject to severe reputational risk should claims be unfounded. Some continue to express skepticism but the market has spoken and COVID-19 issues are falling while industrial issues, the core manufacturing, services and transport issues in the US, are beginning to rise sharply. As US employment continues to normalize to pre-COVID-19 levels, this shift should accelerate. Importantly, oil prices, which have been used as a hedge to counter a fall in the industrial economy, rose sharply by 10% as FAANG issues fell.

The signs are present that a significant market psychology shift is underway from a lockdown mania. Rates are rising as capital shifts to industrial issues and commodities. More to come in my opinion.

The NYTimes story provides a good summary of Pfizer results and other vaccine programs:

https://www.nytimes.com/2020/11/09/health/covid-vaccine-pfizer.html