“Davidson” submits:

Morningstar data comparing the top 10 issues of VOOV(SP500 Value issues) vs VOOG(SP500 Growth issues) as of Feb 28, 2021 help to explain the widely differing market forecasts. While it may sound like there are two types of investors, Value vs Momentum, the fact is when one examines the many perspectives more closely one finds a wide spectrum of opinion. In my experience, no two investor perspectives are identical. Each carries a unique mix of Value and Momentum providing specific advice as if their own view is the only correct course of action. It is a Tower of Babel which investors must work to decide their own course of action.

Many inexperienced investors simply throw up their hands and invest in what is most popular and touted by the media. It rapidly devolves into everyone chasing popular price momentum issues which become over-crowded carrying much higher valuations than the rest of the market. After all, the name of the game is to buy lower/sell higher before other investors panic. Right?

Momentum price trends can continue for some time especially when supporting themes dominate investor thinking. Driving valuations to extreme levels is justified by many who believe that market pricing works on ‘hidden information’ and in some fashion the marketplace thought of as an efficient pricing mechanism of value not recognized by most. On this topic Eugene Fama wrote “Efficient Capital Markets: A Review of Theory and Empirical Work”, 1970, and was awarded the 2013 Nobel Price for bringing “…science to finance”. If the world were only that simple.

If one does the individual analysis, requiring individual assessment of all SP500 issues, one finds that at no point in time has mathematical analysis ever revealed sensible pricing to financial metrics. There will always be periods during which the growth theme dominates investor interest and other times value issues will dominate. The valuations of accepted growth issues will always exceed the sensibilities of those sensitive to valuation. Predicting when investors switch between these themes is impossible. The best one can do is to monitor valuations and media context. The final analysis lays with what the media touts loudest. This is the primary information source for most inexperienced investors. The media begins to tout a social/market trend well after the trend has begun. The media if it wants to maintain its advertising revenue needs to present daily commentary where investors are, not where investor interest is going, otherwise they lose viewership.

What begins a theme in any particular direction is a shift higher in earnings where it was not expected. It requires several quarters of surprise earnings reports, even perhaps 18mos of reports, from multiple and related companies and requires Momentum Investors to connect the dots. Value Investors have for the most part already invested even before prices of favored companies reached their lows as they invest with low valuations more than price trends. Value Investors typically buy before prices bottom which slows the Momentum driven decline but does not end it. There are historically many more Momentum Investors than Value Investors. Perhaps the ratio is 10 to 1 but this is a guestimate from experience as we are on a spectrum with one style blending into the other. Value Investors also have a strong tendency to sell well before shares peak based on excess value metrics.

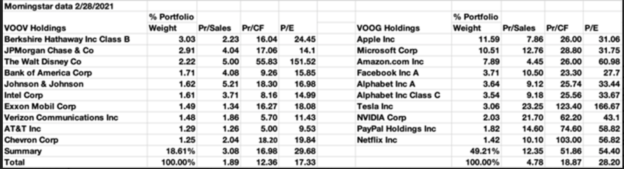

The many calls for markets being over-priced come from the dominance currently of issues in the VOOG ETF. The table reflects this dominance. The top 10 issues in the VOOG ETF represent ~50% of the entire ETF and trades at an outrageous 51x Cash Flow and ~12x Sales. The price momentum of these 10 issues is responsible for most of the price movement in VOOG and represents the COVID related ‘stay at home’ investor growth theme of the past 12mos. The performance since the 2020 March lows for VOOG is ~96% vs VOOV of ~75%.

People are returning to work at a rapid pace. At what point do investors suddenly realize that the ‘stay at home’ driver for much of the VOOG pricing is no longer valid? That is the question. There have already been two bouts of the VOOG stalling with VOOV moving forward, Nov-Dec 2020 and Feb-Mar 2021. VOOG has since jumped ahead. Will it continue to outperform? In my opinion, it will suddenly begin to under-perform as Momentum Investors coupled to the media recognition that VOOV issues have strung together several back-to-back positive quarterly surprises. Then, capital shifts to the new dynamic.

Note that the top 10 issues in VOOV represent only ~19% of this ETF. The remaining issues have lower valuations and represent industrial issues. Standard and Poors splits the SP500 in large part on share price and revenue momentum. 250 of the SP500 issues with price and revenue momentum become VOOG members with the remainder members of VOOV. Momentum Investors focus on these metrics while Value Investors want to see Revenue falling down to Cash Flows, Free Cash Flows and Net Income. The skewing of investor psychology is represented with capital commitments into VOOG vs VOOV of $5.5Bil vs $2.1Bil(as of Feb 28, 2021).

What drives pricing is market psychology based on market themes of the moment. The longer any particular theme is reinforced by financial reports the greater the financial metric valuation till another theme takes its place. Themes can run to extremes even in the face of obvious changes in underlying fundamentals. Once market psychology begins to abandon the current theme, capital can shift suddenly. ‘On a dime’ is the term applied. It can be so sudden as to leave those unaware of fundamentals puzzling for comprehension. One needs to be aware and be prepared even though one cannot predict such shifts.

There remains plenty of opportunity with continued economic expansion ahead. In my opinion, it will not prove to be in the leaders of the last 12mos. If investors get the economic picture correct and select well operated companies at decently low valuation metrics, late coming investors responding to subsequent positive earnings surprises will provide attractive returns.

Be a Value Investor but be sensitive to Momentum as well.