“Davidson” submits:

Every market has multiple events deemed a ‘pending crisis’ which results in panics some longer and some shorter. One rule has held over many cycles and that has been, ‘Buy on every ‘crisis’ if the market reflects strong liquidity.”

Buy on every ‘crisis’ if the market reflects strong liquidity.

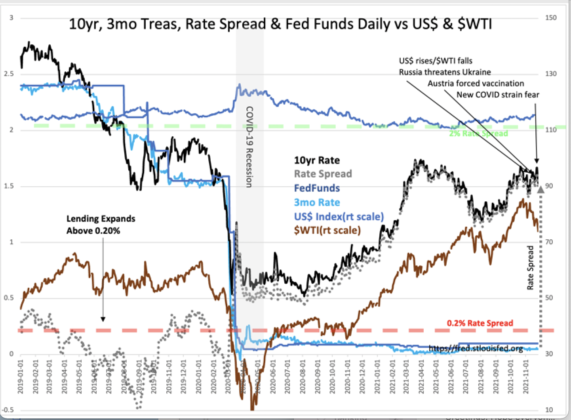

Liquidity and market psychology are highly correlated. If investors have adequate liquidity, then they do not panic when an earthshaking event hits the headlines as the new COVID strain has done today. The T-Bill 10yr Treasury rate spread is a combined proxy for liquidity and market psychology. It provides a measure for how far investors have ‘gotten over their skis’ in Wall Street parlance. Investors always panic on unexpected negative news and reassess market exposures vs the newly defined risk. Some will pare back positions on the first headline, while others will wait to be better informed as more detailed information emerges. Investor responses are dependent on how much one feels exposed to price declines. If one has adequate liquidity and market experience, one tends to ride out every new negative as something that can be worked through if a general economic expansion appears unthreatened. Those with the least experience tend to panic and sell positions precisely because they have been the least cautious at being prepared for unexpected negatives that more experienced investors have built into their strategies. It is the same every cycle.

The current T-Bill 10yr Treas rate spread is ~1.5-1.6% and has been widening since we exited the COVIS lockdown. Every important economic indicator, retail sales, employment and so on across every economic parameter reflects economic expansion. While a new COVID strain is to be expected, we have already had some 3,000 variants which is typical for a virus, it only becomes a “Black Swan” if investors are unable to deal with short term liquidity that arises from being overly committed to longer-term strategies with borrowed funds i.e., margin. This all-in investment position is reflected when the rate spread falls to 0.2% on rising T-Bill rates as investors commit all their capital including rainy day capital for higher returns. The history of this measure indicates ample liquidity exists to deal with today’s negative headline.

Today is a buying opportunity in my opinion within a strong economic expansion period.