“Davidson” submits:

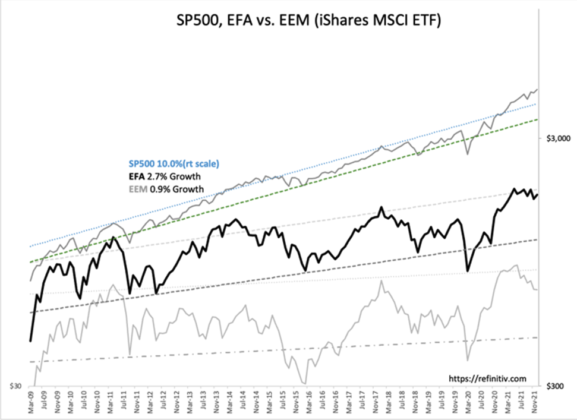

In 2014 the data emerged which supported the recommendation that investors focus solely on US based companies. The basis for this was the monthly chart SP500, EFA vs EEM. With the SP500 performance vastly better than EFA and EMM since then, the same recommendation is renewed today.

Consensus opinion today recommends 40% of portfolios should be placed in EEM(Emerging Markets). It is worth examining why the asset class is viewed as undervalued and offering higher than average growth when the historical data does not support this perception. One needs to do some digging and have enough experience to puzzle-out this bit of cognitive dissonance. It is a similar narrative that has been repeated multiple times by the many pundits in the media. They accepted an earlier view that seemed reasonable at the time and developed products to take advantage of new-found opportunity, it seems no one applied hindsight to reassess the initial point of view as the data emerged to reveal that the outcome has failed to meet expectation. It is worth asking the question, “Why continue to recommend International investing when the US has such outperformance?”

The financial industry (it is an industry) like any industry seeks to maximize returns and minimize risks. The emergence of Modern Portfolio Theory(MPT) in 1952, a purely mathematical approach based on statistical analysis of prices, sought to eliminate faulty human judgement in the investment process. With the growth of employee retirement plans emerging post-WWII, the corporate responsibility to produce acceptable results grew significantly as did the risk of failure and subsequent liabilities. The business, social and political risks were rising sharply as faulty investment judgement paved the path towards financial self-immolation. MPT coming out of academia with Harry Markowitz and others eventually receiving the 1990 Nobel Prize in Economics gradually became the basis for all business education programs. As a mathematical construct, it could be defined and taught in graduate programs and became a significant offering for universities. Applying MPT to investment management mostly eliminated human judgement which in turn lowered liability exposure. When markets corrected, the ensuing investor lawsuits experienced lower success rates with MPT’s academic and Nobel Prize backing. As investment fees became more competitive, firms lower overall cost of business implementing MPT. Financial Planning now a ubiquitous product is based on MPT with many firms assuring investors they will have successful outcomes, something they would have never contemplated advertising 20yrs ago. Human judgement has been replaced by computer analysis.

So…“Why continue to recommend International investing when the US has such outperformance?” The basis for this recommendation lays in a simple belief long held and embedded in MPT’s mathematical model: Smaller = Higher Growth It is the consensus view that smaller companies grow faster than larger companies. That view, based on experience in the US, has been translated globally without any other consideration. In general smaller companies do grow faster than significantly larger companies. It is easier to double revenue when a company is very small just beginning to offer its products vs a long-established company with an existing and successful market position. The issue occurs when making broad top-down assumptions and not reassessing one’s position after one has expanded into unfamiliar markets believing the rules are universal. MPT basically recommends EMG on market capitalization. EMG companies are proportionately smaller and should have higher growth. The recommendation is further supported by EEM companies having lower P/Es and lower Pr/Cash Flow ratios vs US companies. What is not considered is the risk to private property which is considerably higher in countries like China, Venezuela, Turkey, Russia and etc. Investors take this into consideration and have favored the US over EFA(developed but leaning socialistic) and EMM(often non-democratic authoritarian) at risk of unexpected government confiscation. The belief that mathematics and computer analysis reveal investment opportunities better than human judgement is one of those perceptions that fails the test of reality.

When investing one must always, always review initial assumptions and expectations. New data emerges daily that either supports one’s original thought process or looks very different in light of hindsight. The perception behind the consensus recommendation of 40% portfolio exposure to EEM is not supported by the data. The SP500 has a growth rate of 10x+ that of EEM and ~4x that the EFA. The recommendation has been and continues to be, avoid International investing as the risk/return is unfavorable relative to the US.