This is about the time of the cycle people start looking to the market to provide guidance on the economy. The assumption of market participants that it predicts the economy, nothing could be further from the truth. I am not as optimistic as “Davidson” is on the economy as I see too much steering of it by the government. If they steer right, things are great but I think history is ripe with missteps, and that leads to downturns…fast and hard ones. No, I am not calling for one but my concern is that the economy is very susceptible here given moratoriums are ending, aid packages are running out and businesses even being open is at the weekly or even daily whims of politicians. That makes for a nervous time for me

“Davidson” submits:

Forecasts for a disastrous market and economic outcome are piling up. The media’s multiple headlines of the same forecasts make it appear that every major investor believes the same. Headlines reflect market psychology. The way this works is simple. If a headline receives greater views and higher advertising revenue, then repeating it or similar stories become the media focus. The media follows. It does not lead. They put out fearful headlines daily, even hourly thru electronic delivery, and receive constant feedback thru how many ‘clicks’ a particular story receives. This is used to direct the next round of headlines. Higher advertising fees accrues to the one who consistently trolls the market successfully. CNBC’s stories, while claiming often the first to report breaking news, has already evaluated the market response to something already in the news stream and surfaces those expected to be most impactful. 2 headlines are worth noting for their ‘the sky is falling’ basis.

The shelves are bare — Goldman’s Currie flags shortages across commodities

Goldman’s Jeff Currie appeared on Bloomberg TV this morning — markets are “incredibly tight from a physical perspective” … “we are out of everything, I don’t care if its oil, gas, coal, copper, aluminum, you name it we’re out of it.”

‘Begin to Fail’: Billionaire Investor Jeremy Grantham’s Chilling Prediction

The Wealth AdvisorContributor

February 4, 2022 https://www.thewealthadvisor.com/article/begin-fail-billionaire-investor-jeremy-granthams-chilling-prediction

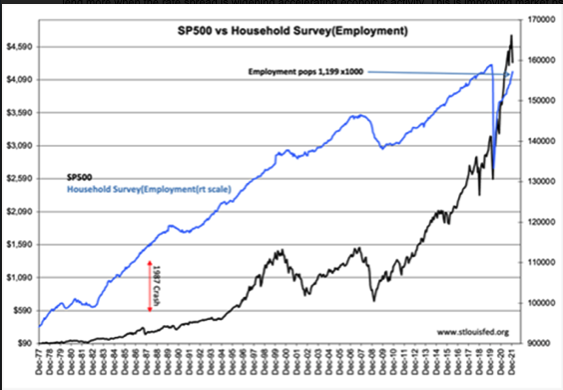

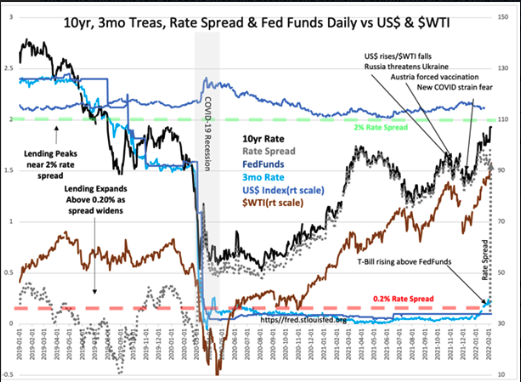

The Household Survey added 1,199,000 employed on its annual correction(Friday’s chart is repeated here). It boggled my imagination that the media said this was really a loss of -240,000+ not a gain. Huh? Good news does not sell advertising. At many points in every economic cycle, the media highlights the fearful story. This occurs after markets have already reflected some concern. One can see this in SP500 vs Household… that a down turn began weeks before dire forecasts were issued. The better handle on markets is the …Rate Spread… pattern. Severe speculation of the type that becomes a recession and major market correction has a history from 1953. Rising rates reflect capital leaving fixed income to favor equity. It is when the T-Bill rate rises to narrow the spread between it and 10yr Treasuries to 0.2% or less that signals excess speculation that leads to 40%-50% corrections and recessions. One also sees employment and other hard count economic indicators have stalled as confirmation.

The simple perspective is that a rising employment level signals economic expansion as we see today. Financial recessions are not possible during sharply rising employment, unless of course govt policy locks-down businesses for other reasons. The deeper argument comes from viewing rates as reflecting market psychology as the measure to which investors are over-committed and severely exposed to financial risk. Current conditions reflect a rising rate spread, i.e. improving liquidity. Lenders lend more when the rate spread is widening accelerating economic activity. This is improving market psychology and oil price are tracking higher as a result. Dire forecasts by Momentum Investors, who are caught up in the Momentum issues in correction, do not reflect the remaining 80% of businesses that benefit from continued economic expansion. It is that potion of the 80% mostly ignored by those chasing the 20% of ‘high-fliers’ of the past 2yrs, that is likely to form the next leg higher for indices.

How high is impossible to predict. How high will oil go or oil and related issues which having been starved of investment capital for 7yrs suddenly become society saviors to energy needs as Green Energy has proved unreliable? Major pensions and endowments have abandoned this sector to fulfill ESG mandates. What happens when this sector proves the be the best area for returns? I expect to see capital flood to this area chasing returns in an effort to catch up. Expect this to occur in a significant way once a sufficient uptrend is visible. Cash flows from energy companies drive a host of related industries. Everything is connected to such a degree that higher oil prices drive the entire industrial economy. Can the 80% of ignored companies double in price the next few years? This remains to be seen but the current rate spread suggests that potential. Market psychology is impossible to predict with precision. One can make a good guess on direction but price and timing have always proven elusive.

Conditions remain very, very positive for industrial equities.