“Davidson” submits:

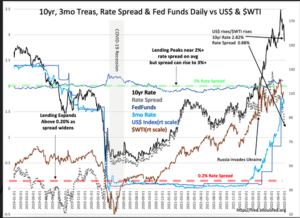

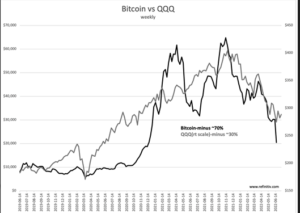

The T-Bill/10yr Treasury Rate Spread has suddenly narrowed below 1% as T-Bill rates rise while 10yr rates collapse. This is occurring with an economy in an uptrend and well under full employment with up to 5mil individuals unemployed from what could be expected in a full recovery from the COVID Recession. It is an environment being roiled by speculators using leverage in positions without economic support. The WSJ story speaks to the risks in the multi-$Trillion Cryptocurrency speculation. Cryptocurrencies have not lived-up to the heavy promotion as a global currency replacement, a “storehouse of value” or protection against inflation.

“Crypto’s Domino Effect Is Widening, Threatening More Pain”

Losses are blowing holes in balance sheets and pushing firms in the industry to near bankruptcy

https://www.wsj.com/articles/cryptos-domino-effect-is-widening-threatening-more-pain-11656754202

There appear to be both a panic in Advanced economies pushing capital into US$ assets driving 10yr rates lower and simultaneously a shift in reserve capital to assets offering inflation protection out of T-Bills driving these rates higher. The shift has been so exaggerated in recent days that it suggests we could see a short equity selloff near term. The best advice is to not make any changes to existing portfolios.

Predicting investor behavior near term has always proven problematic. In my experience, the economy will support equities long-term even if there is a selloff the next few weeks. Trading to take advantage of anticipated market shifts has a history of missteps resulting in poorer long-term performance. Investors should be aware of current conditions but recognize that cryptocurrencies are a speculation without long-term economic value.

We may see additional correction near term but the economic value remains for higher equities the next 3yrs-5yrs.